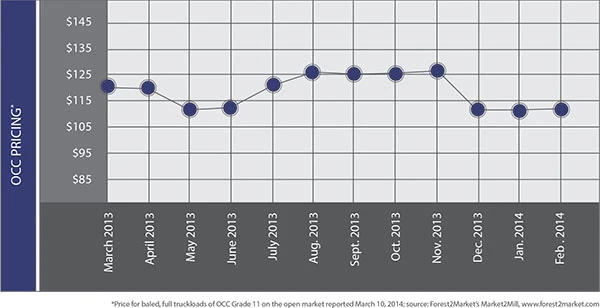

Paper stock markets continue to show signs of improving. Leading the way forward is the old corrugated containers (OCC) grade, which has been solidifying its gains over the past month. Prices have ticked upward for the grade in the eastern half of the U.S., with some sources saying that prices have moved up by as much as $20 per ton or more. At the same time, overseas demand for OCC off the West Coast has been sufficient to keep prices fairly stable.

The upward trend could continue into the spring as domestic board mills in the South, Midwest and Northeast seek to build up inventories that have declined during the winter months. During the first quarter of the year, significant weather-related problems choked off much of the recovered fiber supply to these mills.

Typically, the first quarter of the year is a time of low generation for most paper stock grades. Adding to the challenge, snowstorms that hit a large portion of the country further reduced generation of OCC and other grades of recovered fiber. Exacerbating supply challenges, the trucking industry was confronted with logistical issues and was unable to free up equipment to ship material to consumers, sources say.

The severe weather also affected domestic production. According to figures from the American Forest & Paper Association (AF&PA), Washington, D.C., containerboard production in February decreased 8 percent from January 2014 and was 2 percent higher compared with February 2013.

Despite the slip, AF&PA notes that month-over-month average daily production increased 1.9 percent. Meanwhile, shipments for February reached 151.7 billion square feet. The result was that the containerboard operating rate at domestic paperboard mills for February increased 1.8 points from January, reaching 96.4 percent from 94.6 percent.

However, the news was less encouraging for kraft paper shipments in February. The AF&PA notes that 121,000 tons of kraft paper were shipped in February, more than a 5 percent decline from the prior month. The AF&PA adds that bleached kraft paper shipments for February dropped by 3 percent from the prior month, while unbleached kraft paper shipments declined 5.3 percent. Overall, shipments for the first two months of 2014 were 4.5 percent lower than the same period last year. Total month-end inventories decreased 8.8 percent compared with January.

Reflecting better-than-expected orders, many board mills have opted to boost finished product prices. With several of these price increases slated to go into effect in March, it is still too early to determine whether the increases will hold.

Sonoco is among the producers that recently have announced plans to increase paperboard, tube and core prices by 5 percent to 8 percent, effective with shipments in the U.S. and Canada beginning March 24, 2014.

Other companies that have announced price increases are Caraustar, which says it plans to raise the price on all of its uncoated recycled paper grades by $30 per ton and on all converted paper products by 5 percent, effective April 7, 2014. Newark Recycled Paperboard Solutions, meanwhile, announced a $30 per ton price increase on all uncoated grades of recycled paperboard effective with shipments on or after March 10, 2014.

The OCC market could see the entrance of another consumer in the eastern U.S. The paper mill Fort Orange Office Paper, which operated in Castleton, N.Y., closed nearly 15 years ago. The mill was recently purchased by a firm called Castleton Paperboard LLC, which is looking to reopen the facility as a recycled paperboard mill.

Office pack grades also are enjoying a bit of a renaissance. Orders in many regions of the country have firmed as consumers throughout the United States and Canada are ordering regularly.

During the recently concluded Southeast Recycling Conference & Trade Show, Destin Fla., a number of attendees expressed cautious optimism that paper stock markets will remain strong through the spring months. Demand, according to several attendees, has been holding up fairly well through most parts of the country. Prices, always subject to a myriad of issues, seem to be consolidating at present levels and could start to firm up going forward, according to sources.

During the recently concluded Southeast Recycling Conference & Trade Show, Destin Fla., a number of attendees expressed cautious optimism that paper stock markets will remain strong through the spring months. Demand, according to several attendees, has been holding up fairly well through most parts of the country. Prices, always subject to a myriad of issues, seem to be consolidating at present levels and could start to firm up going forward, according to sources.

Old newspapers (ONP) and mixed paper appear to be stuck in difficult situations. The well-publicized quality issues with mixed paper, especially for offshore orders, have made packing the grade more daunting.

The situation for ONP is even more challenging. The newsprint sector, which has been one of the largest end markets for ONP, continues to shrink. A number of newsprint producers have shifted production away from newsprint toward packaging grades. Additional newsprint mills are looking to shift their production to kraft packaging paper.

Explore the April 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- PCA reports profitable Q1

- British Steel mill subject of UK government intervention

- NRC seeks speakers for October event

- LME identifies Hong Kong warehouses

- Greenville, Mississippi, launches aluminum can recycling program

- Cotton Lives On kicks off 2025 recycling activities

- Georgia-Pacific names president of corrugated business

- Sev.en Global Investments completes acquisitions of Celsa Steel UK, Celsa Nordic