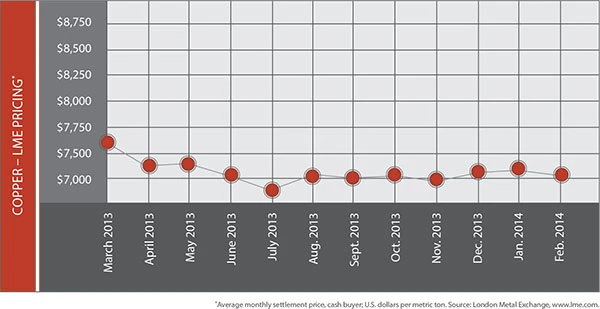

Nonferrous metals, which have been under pressure over the past several months, are now nearly in a distress situation. The economic improvements taking hold in many world regions have not been able to offset macroeconomic issues that are driving down prices for many metals.

Copper is in a spot right now. The growing concerns over China’s weakening economy have helped push copper prices to multiyear lows.

As the largest consumer of copper scrap, China has led the way in copper’s surge during the past 10 years, with prices cresting to record highs several years ago. Now, with reports that the Chinese government is attempting to rein in its “shadow” banking sector, copper demand from has virtually dried up. Chinese companies have used copper as collateral for low interest loans, which they use to purchase bonds.

However, China recently experienced its first domestic bond default. The default “has shaken the foundations of the copper market, stoking investor worries about the possible unravelling of financing deals that have locked up vast quantities of copper,” Reuters reports.

“At least one U.S. scrap copper trader has suffered ‘large’ losses after the Chinese default, one of the first signs that sinking prices and tightening credit are taking a toll on the physical market,” Reuters adds.

According to the article, some analysts and traders say 60 percent to 80 percent of China’s copper imports in recent years may have been used as collateral, though they were less certain about how much copper is now tied up in deals.

With the growing concern that further economic declines in China will curb demand for copper scrap, a number of scrap metal exporters are looking for alternative homes for their material. During the recent Middle East Metals Recycling Conference, hosted by the Recycling Today Media Group and Media Fusion in Dubai, United Arab Emirates, several exporters from the Middle East said they were looking to redirect copper scrap to other countries, such as India.

Copper is not the only nonferrous metal feeling the drag of China’s economy; aluminum and nickel also are seeing downward pressure because supply and demand are out of balance.

On the positive side, sources note that global demand for aluminum is growing at a strong clip. During the Middle East Metals Recycling Conference, Will Adams, head of research with FastMarkets, based in the United Kingdom, noted that “aluminum demand outlook is second to none. It is a metal with a great present and future.”

Despite aluminum’s bullish outlook, problems with overcapacity continue and the effects of the London Metal Exchange (LME) program to address issues at its warehouses continues to be implemented.

Despite these challenges, some market observers say that with the steady growth of aluminum demand, much of the oversupply could be absorbed, resulting in a deficit by 2015. This situation will be more likely if China aggressively reduces aluminum production.

Regarding nickel, the Indonesian government’s decision to ban nickel ore exports has created a difficult situation, especially for China, a large consumer of the material. If the ban continues, China could end up working off its inventory and have to scramble for more material.

Explore the April 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Sofidel agrees to purchase Royal Paper assets

- US Plastics Pact report charts expansion path for recycled content in packaging

- USTR announces phased measures designed to address China’s shipbuilding dominance

- APR, RecyClass release partnership progress report

- Clearpoint Recycling, Enviroo sign PET supply contract

- Invista expanding ISCC Plus certification program

- Redwood partnership targets recycling of medium-format batteries

- Enfinite forms Hazardous & Specialty Waste Management Council