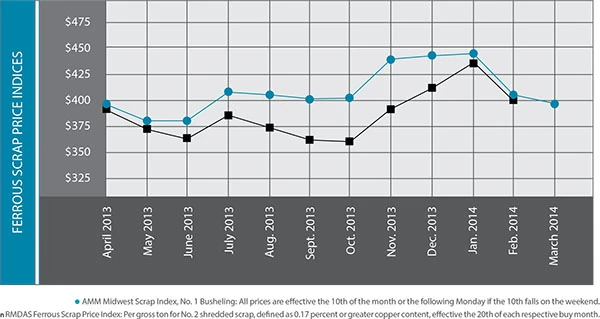

After a January and February marked by falling prices, neither of the two things ferrous scrap processors and traders hoped could lift the market in March appeared to happen: Export buyers did not come into the market aggressively to buy scrap and, partly for that reason, prices did not move up or even stabilize.

As of early March, American Metal Market (AMM) was having difficulty updating its ferrous scrap East Coast and West Coast export indexes because of the lack of overall purchases being reported on both coasts.

The lack of bulk shipping continues a pattern that started in late 2013 and is likely being exacerbated by volatile pricing. While lower prices ultimately may prompt a return in overseas purchasing, overseas mill buyers are reluctant to buy large bulk cargoes that may decline in value while on the water.

A new factor in the export market may be the political turmoil in the Black Sea region, as Turkish mills had reportedly been buying heavily from that region in early 2014.

With Russia effectively having seized control of the Crimean peninsula and Russia’s navy having increased its presence in Ukrainian waters, it remains unclear to what extent Russia’s land grab will affect commercial relationships and shipping activity in the region.

If the dispute is lengthy or, worse yet, intensifies, Turkish mill buyers may need to pivot quickly back to the North American market, where they are likely to find prices lower than last year’s and willing sellers.

Lower across-the-scale prices have done nothing to improve the generation of ferrous scrap. “Prices are weak, flows are off . . . business is just fair,” says a buyer in the lower Midwest.

Also contributing to weak scrap flows have been more bouts of severe winter weather in the northern half of the U.S. and the falling price of copper. Winter Storm Vulcan in mid-March brought yet another wave of snow and blizzard conditions to a winter-weary swath of the country ranging from Montana to Maine.

Copper’s price plunged throughout the first 12 days of March, with the price falling below $3 per pound on the COMEX exchange for the first time in four years. Although uncertainty in China’s banking sector was receiving the blame for the price drop, the effects could be felt in the U.S.—and not just in the nonferrous market.

Another Midwestern recycler says peddlers, contractors and small dealers who hold onto their red metal scrap during a downtrend also likely are holding onto ferrous material that they would typically bring on the same trip, thus contributing to reduced inflows.

The lack of this “odds and ends” ferrous scrap can be seen in the relative strength of No. 1 heavy melting steel (HMS) in AMM and Raw Material Data Aggregation Service (RMDAS) pricing.

RMDAS pricing, calculated by MSA Inc., Pittsburgh, shows the spread between its No. 1 prompt industrial composite grade and No. 1 HMS grade narrowing from nearly $60 per ton in October 2013 to just $33 per ton in February 2014.

AMM’s March Midwest index pricing shows an even narrower gap of less than $18 per ton between No. 1 busheling and No. 1 HMS. The diminishing across-the-scale flows are the likeliest cause of the relative strength of No. 1 HMS, as peddlers hold onto material and the construction and demolition sector continues to struggle with bad weather and a weak business sector.

AMM’s March Midwest index pricing shows an even narrower gap of less than $18 per ton between No. 1 busheling and No. 1 HMS. The diminishing across-the-scale flows are the likeliest cause of the relative strength of No. 1 HMS, as peddlers hold onto material and the construction and demolition sector continues to struggle with bad weather and a weak business sector.

On the demand side, domestic output from steel mills year to date has been nearly on pace with 2013. According to the American Iron and Steel Institute (AISI), Washington, D.C., year-to-date production through March 8, 2014, was 17.55 million tons, a 0.8 percent decrease from the 17.7 million tons produced in the same period in 2013.

The U.S. steel industry’s capacity rate has suffered a similar decline, from 77 percent in the first nine weeks of 2013 compared with 76.5 percent during the same period in 2014.

Globally, despite the lack of overseas buyers in the U.S. market, steelmaking in January 2014 outpaced production from one year earlier. According to the Brussels-based World Steel Association (Worldsteel), its 65 member nations produced 129.78 million metric tons of steel in January 2014, up 4 percent from the 124.80 metric tons of steel made in January 2013.

While China’s government continues to issue stern warnings about overcapacity and pollution control and its intention to shutter steelmaking capacity, the nation’s steel mills continue to churn out more product.

According to Worldsteel, China went from producing 59.3 million metric tons of crude steel in January 2013 to 61.6 million metric tons in January 2014, a 3.8 percent increase.

As reflected in falling copper pricing, investors and financial analysts have become increasingly skeptical of parts of China’s lending industry and, likewise, the nation’s ability to consume growing amounts of steel.

The American Metal Market (AMM) Midwest Ferrous Scrap Index is calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The AMM Scrap Index includes material that will be delivered within 30 days to the mill. Spot business included after the 10th of the month will not be included. The detailed methodology is available at www.amm.com/pricing/methodology.html. The AMM Ferrous Scrap Export Indices are calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The detailed methodology is available at www.amm.com/pricing/methodology.html.

Explore the April 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- British Steel mill subject of UK government intervention

- NRC seeks speakers for October event

- LME identifies Hong Kong warehouses

- Greenville, Mississippi, launches aluminum can recycling program

- Cotton Lives On kicks off 2025 recycling activities

- Georgia-Pacific names president of corrugated business

- Sev.en Global Investments completes acquisitions of Celsa Steel UK, Celsa Nordic

- Wisconsin Aluminum Foundry is a finalist for US manufacturing leadership award