The weather is not the only thing that has turned frigid—paper stock markets also have turned icy over the first few months of the year. A bleak short-term outlook appears to be blanketing most of the country, with only a handful of recovered fiber grades showing signs of stability.

Most grades are trending downward, with old corrugated containers (OCC) showing a significant downward drift in price and demand. A number of paper stock dealers say OCC for February delivery dropped by $10 or more per ton, with signs pointing to additional declines in pricing over the next several months. In fact, some sources say they are unsure what the floor price for OCC will be over the next several months.

The difficulties in the OCC sector have been building for several months and haven’t come as much of a surprise to many paper stock dealers, though the severity of the price dip has been painful, sources say.

One of the biggest factors dragging down OCC is China’s slower economic growth. According to an article posted to Reuters website, www.reuters.com, Feb. 8, “China’s trade performance slumped in January, with exports falling 3.3 percent from year-ago levels, while imports tumbled 19.9 percent, far worse than analysts had expected and highlighting deepening weakness in the Chinese economy.”

Several sources say Chinese paper company Nine Dragons is taking substantial downtime at a number of its recycled paperboard mills over the next several months. This downtime could remove several hundred thousand tons of capacity from the market, resulting in a commensurate drop in OCC, mixed paper and old newspaper (ONP) demand.

One exporter says America Chung Nam (ACN), the procurement arm for Nine Dragons, has been scaling back its OCC purchases from throughout the United States as a result.

Nine Dragons may be the most well-known of Chinese recovered fiber consumers, but other paperboard producers in that country also are cutting production, which is resulting in declining activity at their U.S. purchasing divisions.

In addition to these issues in China, many U.S. recovered fiber exporters have been affected by labor problems at West Coast ports. As terminal operators and longshoremen battle over contract negotiations, the loading and unloading of container vessels has slowed significantly. The slowdown began in November and has gotten worse over the first two months of 2015, according to sources.

The slowdown has created a tremendous backlog of containers that are looking to be loaded or unloaded from container ships. Some exporters say their revenues have declined by 20 percent or more, while others add that they are renting additional warehouse space to store material destined for overseas consumers.

The difficulties associated with shipping off of the West Coast also are affecting recyclers further inland. Several sources say that some of these shipments are being redirected to other areas as railroads seek to reduce the backlog associated with transferring cargo to West Coast ports.

With exports down and paper stock dealers shifting tons to the domestic market, it appears many domestic paperboard mills are in the enviable position of having more recovered fiber available. At the same time, most domestic board mills have fairly significant inventories and are not actively looking for spot purchases of OCC and other bulk grades.

Sponsored Content

Labor that Works

With 25 years of experience, Leadpoint delivers cost-effective workforce solutions tailored to your needs. We handle the recruiting, hiring, training, and onboarding to deliver stable, productive, and safety-focused teams. Our commitment to safety and quality ensures peace of mind with a reliable workforce that helps you achieve your goals.

ONP and mixed paper are seeing modest softening. It looks as if mixed paper may take a $5-per-ton hit in the South and Southwest.

Sorted white ledger and office pack seem to be holding up better than bulk grades. One reason has been the dearth of the two grades right now as more processors are blending these grades with others to create a generic mixed paper grade.

Tissue mills, including in Mexico, appear to be interested in office grades.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

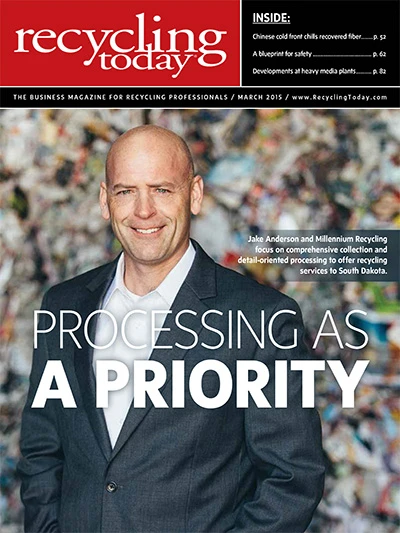

Explore the March 2015 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Recycled steel price crosses $500 per ton threshold

- Smithers report looks at PCR plastic’s near-term prospects

- Plastics association quantifies US-EU trade dispute impacts

- Nucor expects slimmer profits in early 2025

- CP Group announces new senior vice president

- APR publishes Design Guide in French

- AmSty recorded first sales of PolyRenew Styrene in 2024

- PRE says EU’s plastic recycling industry at a breaking point

.jpg)