Paper stock markets could be set for stronger upward movement later in the spring. Several sources say they expect to see an increase in orders for a number of paper stock grades, which likely will help firm up prices for these grades.

Also, reports indicate that domestic paper mills are seeing healthier markets for their finished products, which should translate into better operating rates.

Bulk grades could be one of the first beneficiaries of an improved market, with domestic mills signaling they will buy steadily into the spring. Old corrugated containers (OCC), mixed paper, old newspapers (ONP) and double-lined kraft cuttings (DLK) all could see better markets through the spring season as a result.

Activity on the West Coast seems to be percolating. It looks as if buying from Chinese consumers has picked up quite nicely following the Lunar New Year holiday, though several sources say buyers are carefully managing prices.

“It seems that different Chinese buyers are coming in and out of the market, which has kept prices from really climbing,” one packer/broker comments. Despite the effort on the part of Chinese mill buyers to keep bulk grades from soaring in price, signs of a strengthening Asian export market are visible.

Several brokers and exporters say the flow of material off the East Coast also has been good, with buyers for consumers in China, as well as those in India and other Asian countries, placing orders for material.

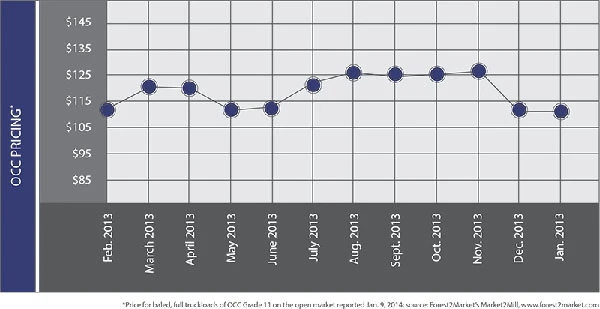

OCC prices appear to be moving up by $5 to $10 per ton with the prospect of further increases, depending on supply, this spring.

The packer/broker says movement is fairly good for OCC as well as for coated book stock, office pack and even sorted white ledger (SWL). Paper stock markets are generally fairly healthy, he adds. Most of his fiber is going offshore, he says, though he has heard that domestic mills have been more aggressive with recent purchases.

In other areas of the U.S., markets are in balance. Domestic mills have been buying steadily, which has kept material flowing.

While domestic mills have not been wildly aggressive in purchasing, they do appear to be ready to lock in tons in anticipation of better markets coming this spring.

Adding to the overall upbeat attitude for recovered fiber has been the uptick in the flow of high grades into Mexico. The region is a large buyer of ledger grades. It appears that tissue mills in Mexico have been more aggressively purchasing fiber from the southwestern U.S., which has helped to boost prices for many office and deinking grades in the Southwest and Midwest regions.

While markets for many paper stock grades are better than expected, inclement weather has created some challenges, which also is a factor helping to firm up prices. The heavy snow and cold weather that swept much of the U.S. in January and February resulted in less recovered fiber being collected from the curb, which has reduced the available supply.

A paper recycler says a good indicator of the weather-related problems in the South is the sharp decline in OCC generated from Wal-Mart. He estimates that the retailer may produce as much as 20 percent of all the OCC generated in the South.

Also, several paper stock dealers say the bad weather has made it more difficult to get transportation for shipments. In the South, ice and snow snarled transportation for a time, cutting off the flow of recovered fiber to consumers throughout the region.

Also, several paper stock dealers say the bad weather has made it more difficult to get transportation for shipments. In the South, ice and snow snarled transportation for a time, cutting off the flow of recovered fiber to consumers throughout the region.

The combination of winter storms and improved demand has pushed prices for many paper stock grades for delivery in February higher by $5 to $10 per ton compared with January.

Several sources say the snowstorm that hammered the Southeast in February could create panic buying through March. “We had to shut down our plants for a couple of days a few weeks ago, which cut into the supply of material we could ship to mills,” one larger scrap paper buyer says. “Once we get back to normal, it will take us as much as a month to catch up with orders.”

While the South has been the focus of many of the weather-related news stories, mills in other parts of the country, notably the Northeast and Midwest, are feeling a supply pinch as well because of weather.

The northeastern quadrant of the U.S. has experienced a steady stream of winter weather that has interrupted supply lines and temporarily reduced flows into packing plants.

Recovered fiber consumers may be feeling the pinch of tighter supply more acutely than in the past because of their raw material inventory practices. Over the past several years, paper mills have carried leaner inventories of recovered fiber, making them scramble somewhat to lock in tons in the current market.

Explore the March 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- LumiCup offers single-use plastic alternative

- European project yields recycled-content ABS

- ICM to host colocated events in Shanghai

- Astera runs into NIMBY concerns in Colorado

- ReMA opposes European efforts seeking export restrictions for recyclables

- Fresh Perspective: Raj Bagaria

- Saica announces plans for second US site

- Update: Novelis produces first aluminum coil made fully from recycled end-of-life automotive scrap