February brought with it a chill in ferrous scrap prices as well as some bouts of nasty weather in the southern U.S. that may ultimately play a role in warming prices back up.

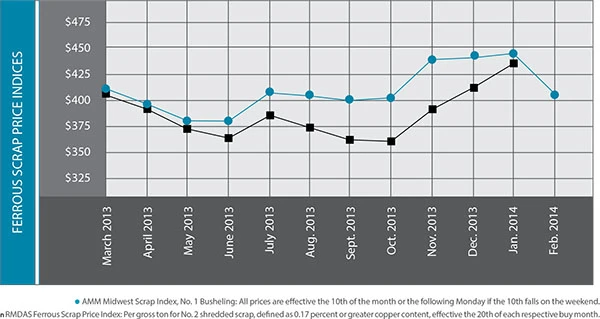

Transactions tracked in early February in the Midwest by American Metal Market (AMM) gauged declines of more than $35 per ton for prime grades (No. 1 busheling) and more than $30 per ton for shredded scrap.

Disinterest from export buyers in late January and early February was cited as one reason for the price decline, as a smaller pool of buyers bid down prices in the early February buying period.

By mid-February, brokers and processors on the Atlantic Coast were reporting renewed interest from Turkish buyers at the new, lower prices, one of two factors that scrap processors say may point to higher prices in the March buying period.

The other factor has been a harsh winter, particularly in the Southeast, where two snow and ice storms within 10 days caused power outages and curtailed traffic.

In the northern U.S., low temperatures and snow may not have affected traffic as much for drivers with winter weather experience, but the frozen ground and tough conditions have contributed to keeping construction activity in check.

As of mid-February, mills were not making earlier or higher bids to procure scrap in case it becomes scarce later in the month, though processors are likely to point to reduced scrap flows when the next round of buying begins.

Export buyers, meanwhile, were more active in February, but many have recently shown a willingness to sit out during months when prices rise. Thus, any late February decrease in scrap supply may be balanced out by a decrease in demand.

As scrap processors and generators navigate the winter weather, as of mid-February it was still difficult to tell if economic conditions (and demolition and construction activity in particular) could lead to increased scrap generation later in 2014.

Ferrous scrap transaction figures from AMM and the Raw Material Data Aggregation Service (RMDAS) of MSA Inc., Pittsburgh, seem to indicate that industrial scrap generation is relatively healthier than the yields coming from the construction, demolition and peddler sectors.

AMM’s February Midwest price averages showed just a $3 per ton spread between the No. 1 busheling prime grade and shredded scrap. While prime scrap flowed in a stable pattern from auto stamping plants and other sources, shredder operators struggled through difficult weather and reluctant sellers to procure feedstock to produce adequate volumes of shredded grades.

The January RMDAS figures showed a similar pattern, with just a $13 spread between the RMDAS prompt industrial composite grade and its No. 2 shredded scrap grade as of late January. That spread had narrowed by some $10 per ton compared with December 2013.

Domestic demand for all grades of ferrous scrap has not reflected a healthier start to the new year in the first quarter. According to the American Iron and Steel Institute (AISI), Washington, domestic raw steel production was 1.84 million tons in the week ending Feb. 8, 2014, with mills running at a 76.8 percent capacity rate.

That compares with output of 1.88 million tons in the comparable week in February 2013, when mills were running at 78.3 percent capacity. The better news is that output increased 1.9 percent in the first full week of February compared with the previous week ending Feb. 1, 2014.

Year-to-date in 2014 total steel output of 10.17 million tons in the U.S. is down 0.7 percent compared with the first five weeks of 2013, according to AISI. Mills have been running at 76.2 percent capacity during that time compared with 77.3 percent in the first five weeks of 2013.

Year-to-date in 2014 total steel output of 10.17 million tons in the U.S. is down 0.7 percent compared with the first five weeks of 2013, according to AISI. Mills have been running at 76.2 percent capacity during that time compared with 77.3 percent in the first five weeks of 2013.

The winter weather, as well as impeding ferrous scrap flows, appears to be hurting auto sales.

Auto and light vehicle sales declined 3.1 percent in January 2014 compared with January 2013, according to figures maintained by WardsAuto (www.wardsauto.com) and reported by the New York Times. The 3.1 percent decline to sales of slightly more than 1 million vehicles was blamed on “a harsh freeze and winter storms [that] thwarted purchases across much of the country.”

Sponsored Content

Labor that Works

With 25 years of experience, Leadpoint delivers cost-effective workforce solutions tailored to your needs. We handle the recruiting, hiring, training, and onboarding to deliver stable, productive, and safety-focused teams. Our commitment to safety and quality ensures peace of mind with a reliable workforce that helps you achieve your goals.

Sponsored Content

Labor that Works

With 25 years of experience, Leadpoint delivers cost-effective workforce solutions tailored to your needs. We handle the recruiting, hiring, training, and onboarding to deliver stable, productive, and safety-focused teams. Our commitment to safety and quality ensures peace of mind with a reliable workforce that helps you achieve your goals.

Sponsored Content

Labor that Works

With 25 years of experience, Leadpoint delivers cost-effective workforce solutions tailored to your needs. We handle the recruiting, hiring, training, and onboarding to deliver stable, productive, and safety-focused teams. Our commitment to safety and quality ensures peace of mind with a reliable workforce that helps you achieve your goals.

Sponsored Content

Labor that Works

With 25 years of experience, Leadpoint delivers cost-effective workforce solutions tailored to your needs. We handle the recruiting, hiring, training, and onboarding to deliver stable, productive, and safety-focused teams. Our commitment to safety and quality ensures peace of mind with a reliable workforce that helps you achieve your goals.

Sponsored Content

Labor that Works

With 25 years of experience, Leadpoint delivers cost-effective workforce solutions tailored to your needs. We handle the recruiting, hiring, training, and onboarding to deliver stable, productive, and safety-focused teams. Our commitment to safety and quality ensures peace of mind with a reliable workforce that helps you achieve your goals.

Sponsored Content

Labor that Works

With 25 years of experience, Leadpoint delivers cost-effective workforce solutions tailored to your needs. We handle the recruiting, hiring, training, and onboarding to deliver stable, productive, and safety-focused teams. Our commitment to safety and quality ensures peace of mind with a reliable workforce that helps you achieve your goals.

Sponsored Content

Labor that Works

With 25 years of experience, Leadpoint delivers cost-effective workforce solutions tailored to your needs. We handle the recruiting, hiring, training, and onboarding to deliver stable, productive, and safety-focused teams. Our commitment to safety and quality ensures peace of mind with a reliable workforce that helps you achieve your goals.

Not all manufacturers suffered equally, however. Sales of General Motors products fell 12 percent compared with January 2013, while Ford’s unit sales also dropped 7 percent.

Chrysler, meanwhile, sold 8 percent more vehicles in January 2014 compared with January 2013. Its sales were bolstered by a 35 percent gain for Jeep and a 22 percent rise in Ram truck sales.

Toyota’s vehicle sales declined 7.2 percent in January, while Honda’s sales dropped 2.1 percent, and sales of Nissan models rose 11.8 percent. Volkswagen of America’s sales fell 19 percent.

As the winter weather dissipates, scrap processors and mill buyers will have their eyes on automotive sales figures and construction and demolition activity to try to determine supply and demand scenarios in the second quarter of 2014.

Additional RMDAS (Raw Material Data Aggregation Service) pricing from Pittsburgh-based Management Science Associates (MSA) is available on the Recycling Today website at www.RecyclingToday.com/RMDAS/default.aspx.

The American Metal Market (AMM) Midwest Ferrous Scrap Index is calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The AMM Scrap Index includes material that will be delivered within 30 days to the mill. Spot business included after the 10th of the month will not be included. The AMM Ferrous Scrap Export Indices are calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The detailed methodology is available at www.amm.com/pricing/methodology. *FOB New York, in metric tons; **FOB Los Angeles, in metric tons.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Explore the March 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Green Cubes unveils forklift battery line

- Rebar association points to trade turmoil

- LumiCup offers single-use plastic alternative

- European project yields recycled-content ABS

- ICM to host colocated events in Shanghai

- Astera runs into NIMBY concerns in Colorado

- ReMA opposes European efforts seeking export restrictions for recyclables

- Fresh Perspective: Raj Bagaria