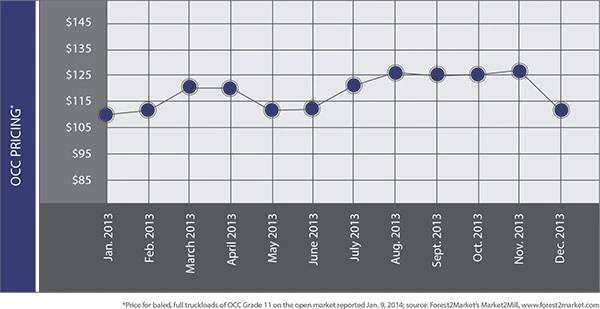

Whether it was better-than-expected orders or difficult weather throughout much of the United States that cut into the supply of old corrugated containers (OCC) in early January, OCC markets have started 2014 with a fairly heady run in terms of demand, driven primarily by buying from domestic mills.

Although OCC pricing remains stable as of mid-January, it could soon reflect this growth in demand, as offshore mills could be re-entering the North American market in the near term.

One West Coast broker describes OCC demand as good as of mid-January, with more domestic mills looking to buy available tonnage. “Domestic mills are being very aggressive right now,” the broker adds.

While OCC prices for January purchases haven’t really moved up, sources say they expect a push for higher prices in February, especially if Chinese mills come into the market more aggressively after the Lunar New Year Jan. 31.

The Chinese New Year always plays a factor in paper stock markets early in the year, and some recycled board mills in China have been taking downtime recently in anticipation of the holiday. However, the market looks promising in the near future once the holiday celebrations have concluded.

One possible area of concern for companies that export paper stock to China is the potential requirement to provide video of their loading processes to customs officials. Two exporters, one on the East Coast and one on the West Coast, say China’s central government is discussing this policy right now, which could create more problems for paper stock exporters (as well as many other shippers of recyclables).

Several other brokers say they have not yet heard that Chinese customs officials will require such video. However, these sources add that more pictures are being requested by officials, which ultimately slows down the overall shipping process.

Even with this potential change to container loading requirements for export orders, the outlook for OCC remains favorable. A combination of better domestic markets and a pickup in offshore orders could push OCC prices higher by $5 to $10 per ton in the early part of the year, according to sources.

New domestic capacity additions in the eastern U.S. should positively affect OCC demand in that region as well. Cascades Greenpac recycled paperboard mill in Niagara Falls, N.Y., which opened last summer, as well as Atlantic Packaging’s recently reopened Whitby, Ontario, mill should be seeking material to feed their paperboard machines.

The Atlantic Packaging mill in Niagara Falls closed last year in light of soft newsprint demand. However, following a technology upgrade enabling the plant to produce recycled paperboard products such as linerboard, the mill reopened in the fall of 2013 and has begun ramping up production.

SP Fiber Technologies also is in the process of converting a newsprint machine at its Newberg, Ore., paper mill to produce packaging paper. The company says it closed its PM5 newsprint machine Jan. 15 and expects to start producing packaging material in the first half of this year.

According to one source, domestic paperboard mills “are taking everything they can find. We are seeing a $5 per ton increase for OCC.”

According to one source, domestic paperboard mills “are taking everything they can find. We are seeing a $5 per ton increase for OCC.”

Another broker says he sees positive indicators for OCC in the Southwest, as well, with prices possibly climbing by as much as $20 per ton over the next several months. He adds that pricing may soften in February, though it should be short-lived. He speculates that perhaps as soon as this spring there will be a wholesale improvement in the paper stock market. “All grades (of recovered paper) will be stronger this year,” he says.

While domestic markets for OCC have been better, domestic markets for mixed paper and old newspapers (ONP) have been static recently, with one source saying this holding pattern has been in play for several months.

One of the issues has been the practice of blending ONP with mixed paper, which is exacerbating an overall decline in the generation of ONP, according to some sources. Many sources add that No. 8 deinked ONP has become harder to source. This is leaving some consumers of ONP No. 8 in a difficult situation.

Looking at high-grades of paper stock, markets for pulp substitutes remain in good shape. Prices are holding firm for the material, and paper stock dealers say the printer market has strengthened recently. This newfound strength should offer a boost to many deinking grades, such as coated book stock and manifold white ledger, sources say.

An improvement in the printing sector would be positive news for these paper stock grades, as a growing number of printing companies have gone out of business recently.

Explore the February 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Greenville, Mississippi, launches aluminum can recycling program

- Cotton Lives On kicks off 2025 recycling activities

- Georgia-Pacific names president of corrugated business

- Sev.en Global Investments completes acquisitions of Celsa Steel UK, Celsa Nordic

- Wisconsin Aluminum Foundry is a finalist for US manufacturing leadership award

- MetalX announces leadership appointments

- Sofidel agrees to purchase Royal Paper assets

- US Plastics Pact report charts expansion path for recycled content in packaging