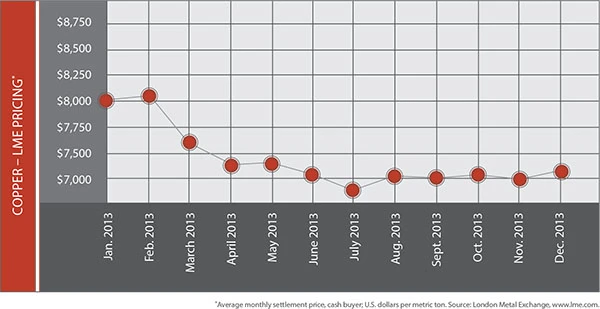

Pain before gain may be the operative words in markets for many nonferrous metals as the first quarter of 2014 advances. More pain may lay ahead for copper as concerns about China’s role in the market continue to muddy the picture for scrap dealers who supply this material. The consensus seems to be that while the economies of North America and Europe are gradually improving, China’s is feeling downward pressure.

The growing optimism about the United States, however, hasn’t been enough to boost the mood of copper scrap dealers in light of the well-publicized problems with China’s economy. Also creating a stir in the market is the Chinese government’s move to crack down on some financial tools that use copper as collateral.

After seeing sluggish growth through the early part of 2013, signs indicated that the country’s economy was picking up. However, toward the end of 2013 and into early into 2014, concerns about the health of China’s economy flared again. Prices for copper scrap have softened as a result. With China consuming roughly 40 percent of the world’s copper, the economic uncertainty will keep scrap metal dealers on edge.

Within the U.S., the big concern for many nonferrous scrap dealers continues to be the lack of copper scrap generation. One broker says that as of early January the lack of generation corresponds with a decline in orders, making it a difficult time for copper markets. With more scrap dealers chasing less material, margin compression continues to be the issue for the industry.

Looking beyond the first few months of the year, one can see some positive signs. Sydney-based financial firm Macquarie says the global consumption of refined copper will increase by 4.5 percent in 2014 compared with 2013’s consumption level, which increased 3.6 percent from the previous year.

Despite this projected growth in demand, new copper capacity coming online in early 2014 could flood the market in the short term, keeping copper prices somewhat muted, sources say.

The picture is somewhat better for aluminum, as the steadily improving U.S. economy, along with U.S. auto sales, has resulted in more robust aluminum shipments. According to recent figures from the Aluminum Association, Washington, D.C., U.S. and Canadian producers shipped 24.5 million pounds of aluminum forgings in November 2013, which is nearly 20 percent more than what was shipped in November 2012.

Despite the year-over-year improvement, concerns remain. Shipments in November 2013 declined 7.4 percent from the previous month, while shipments in the first 11 months of 2013 totaled 268.5 million pounds, a 2 percent drop from the prior year’s 11-month total.

The Aluminum Association notes that the domestic aluminum industry purchased more aluminum scrap during the first nine months of 2013. Supporting this information, estimates from the U.S. Geological Survey (USGS) find that the recovery of aluminum and aluminum alloys increased by 5.3 percent through the first nine months of 2013 compared with the same time in 2012.

Meanwhile, U.S. exports of aluminum scrap, not included in the government’s consumption statistics, totaled 3 billion through September 2013, down 11.9 percent from the same period in 2012, according to the USGS.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Explore the February 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Georgia-Pacific names president of corrugated business

- Sev.en Global Investments completes acquisitions of Celsa Steel UK, Celsa Nordic

- Wisconsin Aluminum Foundry is a finalist for US manufacturing leadership award

- MetalX announces leadership appointments

- Sofidel agrees to purchase Royal Paper assets

- US Plastics Pact report charts expansion path for recycled content in packaging

- USTR announces phased measures designed to address China’s shipbuilding dominance

- APR, RecyClass release partnership progress report