Reliable demand from domestic steel mills, coupled with winter weather supply disruptions, helped keep ferrous scrap prices stable in the January buying period despite continued disinterest from overseas buyers.

The ferrous scrap export indices prepared by American Metal Market (AMM) for January were calculated using very few transactions, the publication reported, as buyers in Turkey and South Korea stayed out of the market. Reasons cited for the lack of overseas interest included political and energy market turmoil in Turkey and unfavorable currency exchange rates in South Korea.

Fortunately for scrap processors, steel mill buyers in the U.S.—especially those in colder regions—continued to make purchases to ensure their mills have suitable inventory to keep running through the winter months.

AMM cited a dwindling supply of obsolete scrap in the cold Midwest and Northeast as the reason shredded and heavy melting steel (HMS) grades made greater gains in January compared with prime grades.

For the second month in a row, auto shredding plant operators suffered from a lack of supply but benefitted from higher bids to purchase what they produced, with the result that shredded scrap closed to within $6 per ton in value of prime grades.

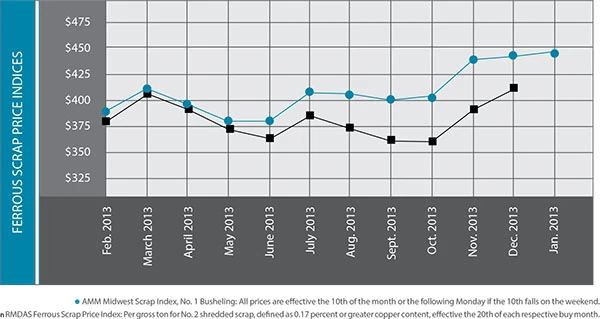

While the mill buying price for shredded scrap on the AMM Midwest Index rose by nearly 6 percent in January to slightly less than $439 per ton, No. 1 busheling rose just 1.9 percent in value to slightly less than $445 per ton.

Bitterly cold weather in early January kept peddlers home, slowed the pace of construction to a crawl and significantly reduced scrap flows and processing output at outdoor scrap yards throughout the Northeast and Midwest.

The decline in obsolete scrap and the narrowing of the price spread between obsolete grades and prime grades is creating anticipation that mills will shift their sights to the purchase of prime grades in February.

On the domestic demand side, 2014 is starting out as a mirror image of the previous year, according to the American Iron and Steel Institute (AISI), Washington, D.C. The group reports that in the week ending Jan. 11, 2014, domestic raw steel production was 1.830 million tons, almost exactly in line with the 1.832 million tons produced the week ending Jan. 11, 2013.

In the first part of January 2014, U.S. mills operated at a 76.3 percent capacity rate, also roughly in line with the 76.5 percent rate from early 2013.

Longer term, for domestic steel and ferrous scrap demand to improve, automotive sales will have to continue apace while activity levels in the construction sector will have to show greater improvement.

National construction figures for the final few months of 2013 seemed to be pointing to favorable news for the sector. “Total construction spending increased between October and November [2013] and for the year amid growing private sector demand,” the Associated General Contractors of America (AGC), based in Arlington, Va., reported in early January, citing an analysis of recent U.S. Census Bureau data.

National construction figures for the final few months of 2013 seemed to be pointing to favorable news for the sector. “Total construction spending increased between October and November [2013] and for the year amid growing private sector demand,” the Associated General Contractors of America (AGC), based in Arlington, Va., reported in early January, citing an analysis of recent U.S. Census Bureau data.

Tight spending controls in most U.S. states, however, continue to lead to declining public sector expenditures, notes the AGC.

“The nonresidential construction spending figures are more positive than they appear, with most categories now positive year-over year,” says Ken Simonson, AGC chief economist. “The outlook appears favorable for many types of private nonresidential and multifamily construction but remains flat or negative for public spending.”

Highway and street construction, the largest public construction spending category, increased 4.6 percent during the 12-month time frame ending Nov. 30, 2013, Simonson noted.

Ferrous scrap processors and brokers have their eyes on several parts of the world to try to determine when or if the export market will rebound.

According to the World Steel Association (Worldsteel), Brussels, as of November 2013 America’s leading export destinations were posting mixed steel output numbers. Through the first 11 months of 2013, Turkey’s output was up more than 3 percent compared with the year before. However, both Taiwan (-2.9 percent) and South Korea (-3.6 percent) were on pace to produce less steel in 2013 than the year before.

Worldsteel’s statistics show that China, the fourth-largest non-NAFTA (North American Free Trade Agreement) overseas buyer of U.S. ferrous scrap in 2012, continues to produce as much steel as ever, though the financial press in that country consistently writes about overcapacity and threatened shutdowns of older, polluting mills.

If the statistics are accurate, China’s major steel companies are continuing to produce more than enough steel to make up for any shortfall created by the shuttering of older, high-emissions-level plants in cities or provinces striving for cleaner air.

Additional RMDAS (Raw Material Data Aggregation Service) pricing from Pittsburgh-based Management Science Associates (MSA) is available on the Recycling Today website at www.RecyclingToday.com/RMDAS/Default.aspx.

The American Metal Market (AMM) Midwest Ferrous Scrap Index is calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The AMM Scrap Index includes material that will be delivered within 30 days to the mill. Spot business included after the 10th of the month will not be included. The detailed methodology is available at www.amm.com/pricing/methodology.html. The AMM Ferrous Scrap Export Indices are calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The detailed methodology is available at www.amm.com/pricing/methodology.html.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Explore the February 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- PCA reports profitable Q1

- British Steel mill subject of UK government intervention

- NRC seeks speakers for October event

- LME identifies Hong Kong warehouses

- Greenville, Mississippi, launches aluminum can recycling program

- Cotton Lives On kicks off 2025 recycling activities

- Georgia-Pacific names president of corrugated business

- Sev.en Global Investments completes acquisitions of Celsa Steel UK, Celsa Nordic