Paper stock markets have been moving up during the first month of 2013. Many dealers are asking whether the uptick in demand and pricing for most paper stock grades has staying power or if the market will give back many of these gains with commensurate declines later in the first quarter of the year.

Regardless, as of mid-January bulk grades, such as old corrugated containers (OCC), and high grades, such as sorted office paper, coated book stock and manifold and sorted white ledger, all have seen price increases. Also seeing modest improvement in pricing in early 2013 is a range of pulp substitute grades.

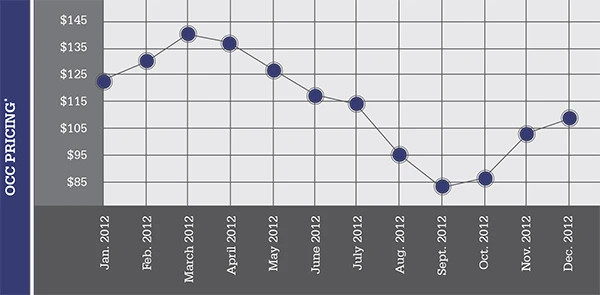

While it is still early in 2013, several sources say paper stock markets are shaping up to be a repeat of 2012, when markets during the first half of the year stoked optimism. However last year, gains made in the first half of the year were given back in the second.

“We had a fantastic first six months of last year, so I am optimistic,” one Midwestern paper stock dealer says. However, he adds, “Right now it feels like 2013 will be like 2012.”

One broker on the East Coast says demand for all paper stock grades is healthy presently. Strong demand for OCC from domestic consumers is keeping the supply of recovered fiber at packing plants to a minimum. Other bulk grades also are moving well, though they currently are not displaying the same robust nature as OCC, he adds.

Another source, also located in the East, describes the market as “false,” despite the improvements in demand and pricing. He adds, “Markets are moving up, but I don’t know why.”

He says markets for some high grades could start to soften as early as February if tissue and towel mills don’t see a significant increase in orders for finished products. Currently, he says, many of the mills he supplies are looking to rebuild depleted inventories.

OCC is seeing stronger demand from domestic and offshore sources alike. Several paper stock dealers say orders to domestic mills are improving. Their recovered fiber inventories had declined through the end of 2012. These mills are now rebuilding these stocks, which is keeping demand for OCC strong.

One source says markets are so healthy that one recycled board mill in the Midwest is paying export-comparable prices for OCC to guarantee its supply.

Along with the improvement in orders from recycled board mills, several sources say gypsum and wallboard producers are starting to increase their production and are buying more bulk grades. If this continues, this sector, often tethered to the overall housing sector, could help strengthen some of the bulk grades during the first few months of 2013.

Although export markets have improved, one East Coast broker says there is less activity on the West Coast than on the East Coast. A contributing factor could be concern regarding the threatened strike at more than a dozen ports on the East and Gulf coasts. Negotiations between the United States Maritime Alliance and the International Longshoremen’s Association held promise and were ongoing as of press time.

Another source says demand for ONP (old newspaper) isn’t strong currently, though orders from the Northwest have been a bright spot.

The supplier adds that sorted office paper (SOP) seems to be in strong demand throughout the country.

Sources who are marketing recovered fiber to paper mills in Mexico also appear to be enjoying healthier orders. The improvement is reported to be strongest for deinking and office grades.

A supplier in the Midwest and a paper stock dealer in the Southwest say Mexican mills let their recovered fiber inventories decline toward the end of 2012. Now, these same mills are re-entering the market aggressively to rebuild these inventories.

Paper stock grades that are the chief beneficiaries of this buying pattern are office pack, coated book stock, sorted white ledger and a handful of pulp substitutes.

A large dealer of bulk grades who is based in the Southwest says these Mexican mills depleted their recovered fiber inventories at the end of the year for tax reduction purposes. However, while these mills are actively purchasing recovered fiber currently, they are not necessarily seeing stronger demand for their finished products.

Explore the February 2013 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Orion ramping up Rocky Mountain Steel rail line

- Proposed bill would provide ‘regulatory clarity’ for chemical recycling

- Alberta Ag-Plastic pilot program continues, expands with renewed funding

- ReMA urges open intra-North American scrap trade

- Axium awarded by regional organization

- Update: China to introduce steel export quotas

- Thyssenkrupp idles capacity in Europe

- Phoenix Technologies closes Ohio rPET facility