2013 started with great enthusiasm about a sustained economic recovery, which promised good things for paper stock markets. However, as the year unfolded, paper stock markets ground downward, and the mood grew bearish.

As domestic mills pulled back on their paper stock orders in late 2013, the bearish outlook became more intense.

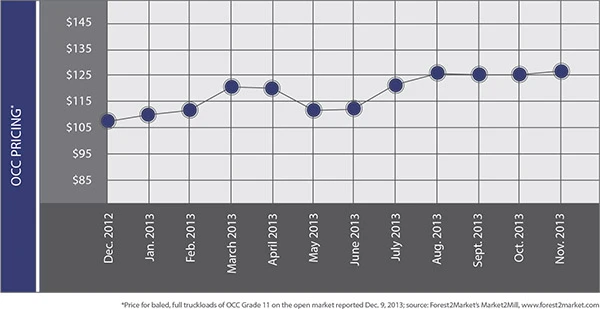

The bellwether old corrugated containers (OCC) grade set the mood for recovered paper markets as a slew of paperboard producers scheduled downtime in December for maintenance as well as in response to slowing demand.

RockTenn, Norcross, Ga., is among the companies that have felt the pinch in paperboard demand. The company has announced plans to reduce production at several of its plants to meet current customer demand. RockTenn says it expects to increase production to normal levels once customer demand has improved. The company also has scheduled major maintenance downtime at several of its recycled board mills in the eastern half of the country in December.

A number of other domestic paperboard mills also are taking capacity offline in light of slowing export demand for paperboard products, according to sources.

As low-cost producers, domestic paperboard mills have been successful in exporting finished paperboard, which kept OCC markets strong throughout much of 2013. This strength allowed many paperboard mills to run at fairly healthy operating rates through much of the year.

Several sources report that OCC prices dipped by $10 per ton for shipments to China in early December, though other vendors say movement remains decent.

China’s papermaking overcapacity has been a concern for some U.S. sources as it has been weighing on markets. With so much new capacity coming onto the market in China, there doesn’t appear to be much of an incentive to push through higher prices on the export side.

However, recycled containerboard production in Russia is outpacing virgin production despite a limited supply of recovered paper in that nation, according to a new report from the Brussels office of RISI, headquartered in Boston.

Recycled containerboard production in Russia has grown by an average of 11.3 percent per year during each of the past three years, while production of virgin containerboard has grown just 3.7 percent annually, RISI reports.

“Double-digit production growth has resulted in Russian domestic Testliner 2 prices reaching 1.7 times their variable costs in the 2010-2012 period,” says Orifjon Abidov, senior economist for packaging papers at RISI. “This is much higher than the 1.25 ratio experienced by the Western European recycled containerboard industry.”

Details of the Russian containerboard market as observed by RISI are available in its new report “The Outlook for Russian Paper Packaging Markets,” available through RISI’s website at www.risi.com/russianpackaging.

According to RISI, the report “includes coverage of containerboard, cartonboard, wrapping and specialty papers from 2002-2012 with forecasts through 2018.”

According to RISI, the report “includes coverage of containerboard, cartonboard, wrapping and specialty papers from 2002-2012 with forecasts through 2018.”

Mixed paper and old newspapers (ONP) continue to present challenges for U.S. paper stock dealers. One trend that is working against mixed paper is the higher cost associated with processing the material to meet consumers’ quality standards. With processing costs increasing by perhaps $10 or more per ton, mixed paper offers little in the way of profit opportunity currently.

Demand from offshore buyers of mixed paper and ONP, which have helped to keep these grades afloat through most of 2013, also has declined. China, as the large buyer of ONP, has greatly reduced its demand for the material as its domestic newsprint mills were running much lighter schedules toward the close of 2013.

High grades of recovered fiber, including pulp substitutes and deinking grades, also have experienced fairly significant downward pressure. Domestic tissue mills appear to have fairly large inventories as of the end of December and, therefore, have exited the market.

This trend also is occurring outside of the United States. For instance, Mexican mills, which are key buyers of office grades and coated book stock (CBS), also dropped out of the market toward the close of 2013 as they attempted to avoid taxes related to carrying inventory.

CBS is trending downward recently. Some North American tissue mills, which historically have been large consumers of CBS, are finding it more economical to consume sorted office paper (SOP) instead of CBS, which ultimately results in a significant yield loss in light of its clay coating.

Although the short-term outlook for most paper stock grades is pessimistic, several sources say a recovery in the Chinese paper market, along with steady improvements in the U.S. paper industry, could result in moderately better markets later in the first quarter of 2014.

Explore the January 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Orion ramping up Rocky Mountain Steel rail line

- Proposed bill would provide ‘regulatory clarity’ for chemical recycling

- Alberta Ag-Plastic pilot program continues, expands with renewed funding

- ReMA urges open intra-North American scrap trade

- Axium awarded by regional organization

- Update: China to introduce steel export quotas

- Thyssenkrupp idles capacity in Europe

- Phoenix Technologies closes Ohio rPET facility