Nonferrous metals markets ended 2013 on a down note, and these softer markets likely will continue in 2014, according to sources.

One scrap dealer says markets for copper, aluminum and other nonferrous scrap metals historically have perked up during the first part of the year. Other than that, he says, he sees minimal upside for most nonferrous metals in the first half of 2014.

A scrap metal dealer who specializes in aluminum scrap says he feels 2014 will be a carbon copy of the last two years, with decent demand but also tight margins and minimal generation.

Primary aluminum pricing was not faring well as 2013 came to a close. According to Bloomberg News, in early December primary aluminum pricing fell to its lowest level since 2009 as stockpiles grew to 5.47 million metric tons, their highest in four months.

The article cites a report by Societe Generale SA, France’s second-largest bank by market value, which notes that despite a sluggish global economy, global aluminum output will increase by 6.2 percent in 2013, resulting in supply exceeding demand by roughly 500,000 tons.

A turnaround in aluminum markets likely is not going to happen until much later in 2014. Overcapacity continues to put downward pressure on aluminum markets. Additional closures of pot lines are indicative of the problem with oversupply.

Despite this oversupply of aluminum, prices for scrap material have held up fairly well and demand from consumers has been decent, according to sources. However, lack of scrap generation continues to elicit bearishness.

With less scrap being generated, dealers are competing more aggressively for fewer tons, which further compresses their profit margins.

A Midwest-based recycler says, “Competition has definitely intensified.”

He adds that he foresees an industry shakeout, with some marginal scrap dealers closing down their operations.

Another source says consolidation won’t be limited to small operations. He says many large companies, especially those that grew through acquisition and consolidation, are saddled with significant debt and may close some facilities and streamline operations to lessen their debt.

One large East Coast processor says generation of nonferrous scrap has “fallen off the face of the earth” since mid-November. This likely will create problems for secondary consumers, who might have to look for alternatives.

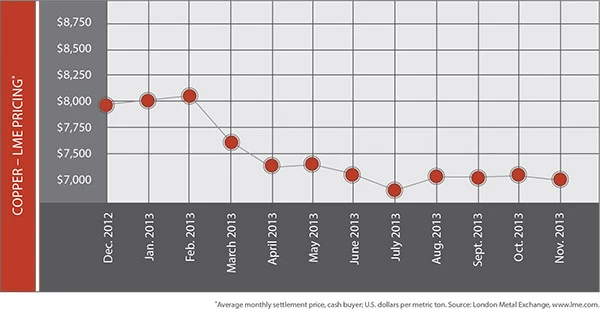

Copper scrap markets remained fairly steady to strong moving into the end of 2013. One dealer says his firm is getting calls from consumers who are looking to lock in supply for 2014 and are having a difficult time getting enough material. If the current situation continues, he adds, “There will be a lack of copper scrap available. If [consumers] need metal, they will have to go into the copper cathode market.”

Stainless steel scrap also has been under continued pressure, though several sources say the market may bounce modestly in 2014. One source says a number of stainless scrap consumers are going to be looking for material in the year ahead. However, as of mid-December, “Stainless is flake like everything else,” the scrap dealer adds.

Explore the January 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Orion ramping up Rocky Mountain Steel rail line

- Proposed bill would provide ‘regulatory clarity’ for chemical recycling

- Alberta Ag-Plastic pilot program continues, expands with renewed funding

- ReMA urges open intra-North American scrap trade

- Axium awarded by regional organization

- Update: China to introduce steel export quotas

- Thyssenkrupp idles capacity in Europe

- Phoenix Technologies closes Ohio rPET facility