After ferrous scrap prices took a considerable upward turn in November, sellers were able not only to hold on to those gains in December but also to fetch several more dollars per ton from domestic consumers.

Sellers of ferrous scrap are benefiting from steady-to-strong purchases by domestic mills, though in some regions they are confronted with winter weather disruptions to supply. Blasts of winter weather moved through the Northeast in particular in December, causing the types of driving and outdoor working conditions that keep some peddlers indoors and smaller yards from seeing much traffic.

Some of the same collectors and small dealers made less active by the weather also have shown an inclination to hold on to material in a rising market, opting to see if there may be a few more dollars per ton to be had in the new year.

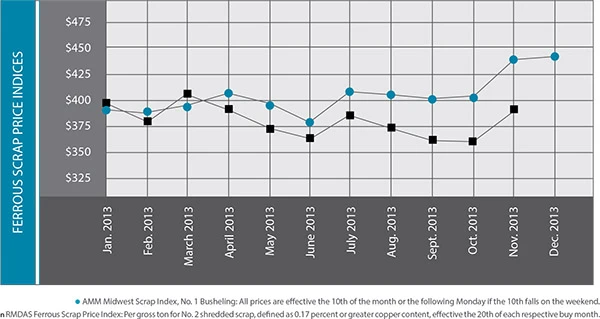

This combination of factors helped the American Metal Market (AMM) Midwest Index No. 1 heavy melting steel (HMS) grade receive a healthy boost of more than $23 per ton in December.

Auto shredding plant operators also must have been pleased with December mill purchases, as AMM’s research indicated mills paid an average of nearly $415 per ton for shred, up $25 dollars compared with November.

No. 1 busheling rose the least in the AMM Midwest index in December, but it not only held on to its $30-per-ton November gain but added another $5 per ton to its selling price. At $436 per ton in December, No. 1 busheling finished the year with its highest value in all of 2013.

Heading into 2014 the per-ton price gains are not guaranteed to be long-lived. On the supply side, higher scale prices could draw out more scrap, and there are no guarantees that heavy snowfall will provide numerous disruptions in January or February.

December’s snowfalls were not especially wide ranging, with a recycler based in the center of the country west of the Mississippi River saying his yard had received “just a dusting.” He described activity at his facility in mid-December as “steady—good but not great.”

On the demand side, overseas buyers of U.S. ferrous scrap are still buying sporadically rather than in volumes that would spur additional price gains or even provide a quick floor on pricing.

AMM’s export pricing figures show that buyers off of the East Coast have been particularly reluctant to match domestic prices, with No. 1 HMS selling for just $357 per metric ton in December—well below the price fetched from domestic mills.

As it has for the past few years, the state of the U.S. economy and the steelmaking sector in particular remains difficult to gauge. According to the American Iron and Steel Institute (AISI), Washington, D.C., in the week ending Dec. 14, 2013, domestic raw steel production was 1.82 million net tons, down slightly from the 1.83 million tons produced the week before.

But the week’s output total and capability utilization rate of 75.9 percent were both improvements over the identical week in 2012. Twelve months earlier, weekly production was 1.79 million tons at a capacity rate of 71.7 percent.

But the week’s output total and capability utilization rate of 75.9 percent were both improvements over the identical week in 2012. Twelve months earlier, weekly production was 1.79 million tons at a capacity rate of 71.7 percent.

With figures now in for all but the last two of the year’s 52 full weeks, it is clear the U.S. will not match its 2012 steelmaking output in 2013. Through mid-December 2013 U.S. mills had churned out 92.35 million tons of steel, down 1.4 percent from the 93.69 million tons produced in the same timeframe in 2012.

Recyclers enter 2014 with many of the same concerns they have had the past few years—fierce competition for material, excess processing capacity in many regions, narrow-to-nonexistent profit margins and a construction sector that is not producing the volume of scrap it was before 2008.

At the end of 2013, new auto shredder plants were being announced and commissioned in Albany, N.Y., and Fremont, Neb., at the same time that Sims Metal Management has reportedly idled shredders in Mobile, Ala., and North Haven, Conn., and OmniSource Corp. has temporarily shut down a shredder in Wilmington, N.C.

The moves seem to indicate some processors have invested for a future rebound while others are trying to line up their operating capacity with the current scrap flows they are experiencing.

Whether scrap flows will change depends in part on construction and demolition activity, as the property development and building industries have continued to lag most other economic sectors in the past three years.

Mike Taylor, executive director of the National Demolition Association (NDA), Doylestown, Pa., says his demo contractor members are seeing gradual improvement. “There is definitely an upswing in the amount of demolition activity,” he says. “Most of our members have some work, and their backlogs are beginning to grow. We still have a ways to go before we reach pre-Great Recession numbers, but things are definitely looking up for the demolition industry in both the U.S. and Canada.”

Additional RMDAS (Raw Material Data Aggregation Service) pricing from Pittsburgh-based Management Science Associates (MSA) is available on the Recycling Today website at www.RecyclingToday.com/RMDAS/Default.aspx.

The American Metal Market (AMM) Midwest Ferrous Scrap Index is calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The AMM Scrap Index includes material that will be delivered within 30 days to the mill. Spot business included after the 10th of the month will not be included. The detailed methodology is available at www.amm.com/pricing/methodology.html. The AMM Ferrous Scrap Export Indices are calculated based on transaction data received that are then tonnage-weighted and normalized to produce a final index value. The detailed methodology is available at www.amm.com/pricing/methodology.html.

Explore the January 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Orion ramping up Rocky Mountain Steel rail line

- Proposed bill would provide ‘regulatory clarity’ for chemical recycling

- Alberta Ag-Plastic pilot program continues, expands with renewed funding

- ReMA urges open intra-North American scrap trade

- Axium awarded by regional organization

- Update: China to introduce steel export quotas

- Thyssenkrupp idles capacity in Europe

- Phoenix Technologies closes Ohio rPET facility