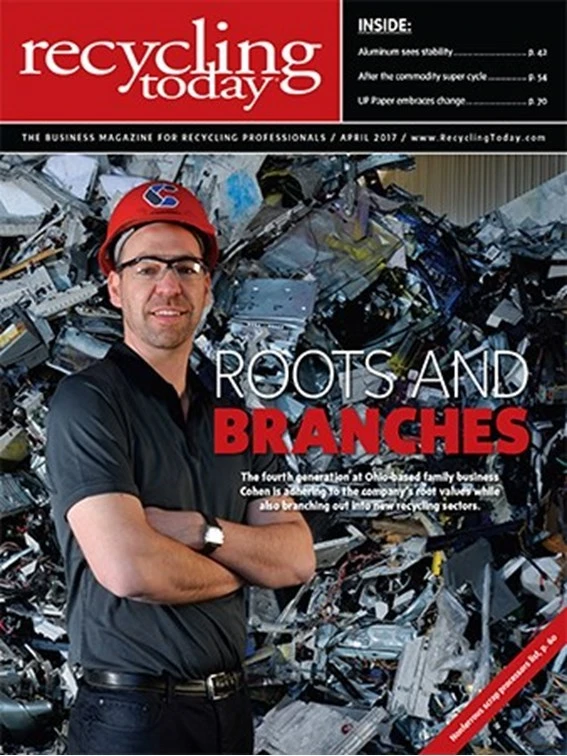

Assuming a leadership role in a multigeneration family business can bring with it inherent pressures pertaining to maintaining the assets and value of the company and protecting the family legacy. Adam Dumes, a vice president with fourth-generation Ohio-based recycling firm Cohen, says he is acutely aware of those pressures.

Dumes, the great-grandson of one of the founders of Cohen (which was known through much of its history as Cohen Bros. Inc.) and nephew of current CEO Kenneth Cohen, is part of the fourth generation of family leadership at the company, along with his cousin Andrew Cohen.

While a person in Dumes’ position could respond to the pressures of “legacy” leadership by avoiding risk and concentrating on maintaining traditional market share, Dumes is charting a different course.

Through considerable investments in the electronics recycling sector and by seeking out a high-profile role in regional sustainability efforts, Dumes and Middletown, Ohio-based Cohen are reshaping a traditional scrap company while also striving to maintain its core business, mission and values.

Independent mindset

Cohen was founded by brothers Mose and Phil Cohen in 1924, who essentially started out as “peddlers with push carts,” according to Dumes. Mose’s son Wilbur Cohen emerged as the next generation’s leader, a role he continues to play today as the 94-year-old chairman of the company. Wilbur maintains a regular presence at the Middletown headquarters.

Under Wilbur’s leadership and then under the guidance of current CEO (and Wilbur’s son) Kenneth, the scrap company has grown in volume and expanded geographically to have facilities throughout not only southwestern Ohio but also in central and southeastern Ohio and Kentucky.

Among Wilbur and Kenneth’s critical accomplishments was remaining independent through previous waves of industry consolidation. As Wilbur told Recycling Today in 2003 regarding selling to potential suitors, “There was a temptation to move into that consolidation direction and cash in, but none of us felt it was worth it.”

In the same interview, Wilbur also commented, “Our customers influenced us to a great extent to stay independent. They wanted to do business with the Cohen family and the Cohen personnel.”

Instead of selling the firm, Cohen has grown through acquisition at a measured pace since 1975, when it acquired a recycling facility in Hamilton, Ohio. Subsequent acquisitions and investments have allowed the firm to enter the auto and metal shredding sector and to expand geographically. The acquisition of Lexington, Kentucky-based Baker Iron & Metal in 2003 has allowed Cohen to establish a solid footprint in the neighboring Bluegrass State.

Through the first three generations of leadership, the company’s core commitment and investments were in the scrap metal sector, with a focus on the purchase of ferrous and nonferrous scrap from industrial, commercial and retail customers and the supply of high-quality scrap grades to mills, foundries, smelters and other buyers.

Scrap metal remains the core sector for Cohen, but an initiative gaining momentum with the fourth generation involves reaching corporate and household scrap generators through some nontraditional channels and creating an obsolete electronics collection, dismantling and processing subsidiary that runs parallel to and separately from the traditional scrap operations.

Good citizenship

In its hometown of Middletown and in cities such as Hamilton, where it has been located for a long time, the Cohen name has long been attached to community improvement and charity efforts, and Cohen officers and personnel have shown considerable and ongoing support to schools, United Way campaigns and other community service efforts.

Kenneth and now Adam have been ramping up that involvement to entail a wider, regional scope, helping attach the Cohen corporate name and logo more prominently to nonprofit efforts throughout the greater Cincinnati region.

“We are very philanthropic,” Dumes says, noting that often this “has been done quietly, sometimes through the Cohen Foundation.”

Through that charity work, he says, “We have become involved in some collaborative efforts with the Cincinnati Reds, the Cincinnati Zoo, Ronald McDonald House, Xavier University, the University of Cincinnati and several of the region’s largest corporate citizens.”

Much of the recent focus has been tied to corporate sustainability and “green” business practices, Dumes says, adding of the region’s largest employers, “We’ve earned their trust and respect, when, in the past, they had no idea of what we did.”

Some of the recent efforts tie into Cohen’s having branched out into the recycling of obsolete electronics in the form of corporate collection programs and collection events open to the wider public. Dumes cites collection events performed in cooperation with the Cincinnati Reds as having been particularly successful in terms of collected volume and informing the public that Cohen is available year-round to collect scrap metal and old computer equipment.

“We get material and new customers also,” Joey Fojtik, a vice president with Cohen with responsibilities on the electronic scrap side, says of these collection events. “We have fliers that show where our recycling centers are in the Cincinnati area. Adam and Andrew and the entire retail recycling group do a great job of maintaining clean facilities that are friendly and welcoming for that ‘mom and pop’ feel. Our goal is to make them aware of the opportunity to make their way into one of our facilities year-round, whether it is to bring electronics or metal.”

Fojtik says the 2016 event carried out in coordination with the Reds brought in “about 250,000 pounds” of material.

The community and corporate connections are raising the Cohen profile so it can be considered the “go-to” company for metal and electronics recycling in the region, Dumes says. “For me I think the culmination was being nominated to be a member of the Greater Cincinnati Green Business Council (www.gcgbc.org). We’re one of only about 20 members,” he comments, noting the others are among the largest companies and institutions in the Cincinnati area, many with globally recognizable brand names.

Rewiring for a new sector

To collect obsolete computers, telecom equipment and consumer electronics items from businesses and households, Cohen had to be convinced it could properly handle such material.

Dumes says that commitment started to take shape in 2010, when the company’s leaders began a strategic planning and branding exercise to help shape its long-term future.

That exercise coincided with the hiring of Fojtik, who says he immediately expressed his interest in taking on additional responsibilities. “I said I wanted to start something new—to build a product line.”

For Dumes and previous-generation company leaders, branching into handling electronic scrap has involved adopting some new ways of thinking. “With electronics, it was a shift for us,” he says. “Normally, as a traditionally trained scrap guy, you go into a place and pay for material. This sector is different, and it drastically shifted when commodity prices dropped.”

Dumes adds, “I couldn’t do it at first. It’s in my DNA to go in and buy scrap. It took me a while to realize that we provide an immense value and have to charge for it.”

The ability to charge for inbound electronic scrap is one of the diversification plusses of the new venture, he comments. “Initially, a lot of us saw electronics as a way to diversify by handling different commodities, such as precious metals. When the economy is down, people do invest in precious metals—but that can quickly shift. We started with that scrap mindset, but it has evolved into knowing that we are a service company that also practices decent commodity management. We realized that what we’re providing is peace of mind and risk mitigation, and that has significant value. Through our plants, what we’re offering is well worth the fee.”

To that end, Dumes and Fojtik say Cohen has pursued several relevant certifications for its Middletown electronics disassembly and processing plant, including R2 (Responsible Recycling), RIOS (Recycling Industry Operating Standard), e-Stewards, OHSAS (Occupational Health and Safety Assessment Series) 18001, ISO (International Organization for Standardization) 14000 and NAID (National Association for Information Destruction) AAA certification.

“As far as scrap companies making this transition, I think we’re leading the way,” Dumes says. His and Fojtik’s description of the company’s current plant and its evolution demonstrates long-term commitment to the sector.

“We started with Joey taking some units apart, and then ramping up for additional dismantling capabilities,” Dumes says. “As the business started to grow, our in-house fabrication division built our dismantling tables. The parent company resources allowed us the capital, leverage and know-how to do this. We went from one to about six to 20 and then 50 work stations at our peak. At that point, we realized the volume justified a shredder and downstream system that could increase our capacity eight-fold overnight.”

The shredding system has by no means replaced dismantling, Dumes says, because, “At the same time we were shopping for the shredder, reuse and refurbishment was becoming the hot topic.”

Fojtik says the electronics shredding plant consists of a “one-of-a-kind” shredding and downstream sorting system designed to identify and separate aluminum, steel, copper, circuit board and mixed plastic fractions.

The dismantling tables, along with a new reuse department that houses a large hard drive wiping system, help the company maximize its refurbished component and working unit resale income. A fleet of more than 10 forklifts, skid-steer loaders and a front-end loader moves material through the plant. Five box trucks pick up material from corporate customers and can offer on-site hard drive destruction.

Looking back and forward

The electronics recycling efforts of Cohen are being fully rolled out in 2017, Dumes says, including an open house and rebranding of the division scheduled for June 1, 2017. He calls it part of the company’s “brand evolution from Cohen Bros. Inc. to Cohen, and now Cohen with descriptors, like Cohen Recycling, Cohen Auto Parts and Cohen Electronics—which will look very similar but very different on June 2, 2017.”

While much of Dumes’ time in the past two years has been spent with Fojtik on the build-out of the company’s electronics division, Dumes is quick to point out that the company has not been standing still on the scrap metal side of the business.

In this area of the business, Cohen has a new copper briquetting operation in Middletown designed to fully upgrade some of the red metal scrap that flows into its 20 facilities, in addition to competitively buying truckloads from other dealers. Dumes says Cohen also has added personnel with expertise to be able to offer “consumer-ready blends” of stainless steel and alloy scrap products.

In its current sectors and potential new ones, “We’re always considering expansion and acquisition opportunities,” he says. On the electronics side, Dumes adds, “We have strategically built this division to be scalable.”

He says the wisdom of the company’s previous generations of leaders remains very much at hand, with 94-year-old Wilbur having reminded him regarding the new venture: “Don’t screw it up.”

Dumes adds, “That message has been loud and clear from Wilbur on down: There are additional exposures and responsibilities [with electronic scrap], and it’s our fourth-generation responsibility to protect the work of the previous generations while doing this. Certifications are great, but in the end they are pieces of paper. Actions dictate values. Three generations have afforded Andy and me the opportunity to add our mark to the Cohen legacy. I’m grateful for that and take it very seriously.”

Regarding Cohen’s overall future, he says, “We’ve got a playbook, but it’s a meticulous, detail-oriented business. We’ve grown strategically at this point, and we’re not going to spread ourselves thin or grow too fast.”

Explore the April 2017 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Fenix Parts acquires Assured Auto Parts

- PTR appoints new VP of independent hauler sales

- Updated: Grede to close Alabama foundry

- Leadpoint VP of recycling retires

- Study looks at potential impact of chemical recycling on global plastic pollution

- Foreign Pollution Fee Act addresses unfair trade practices of nonmarket economies

- GFL opens new MRF in Edmonton, Alberta

- MTM Critical Metals secures supply agreement with Dynamic Lifecycle Innovations