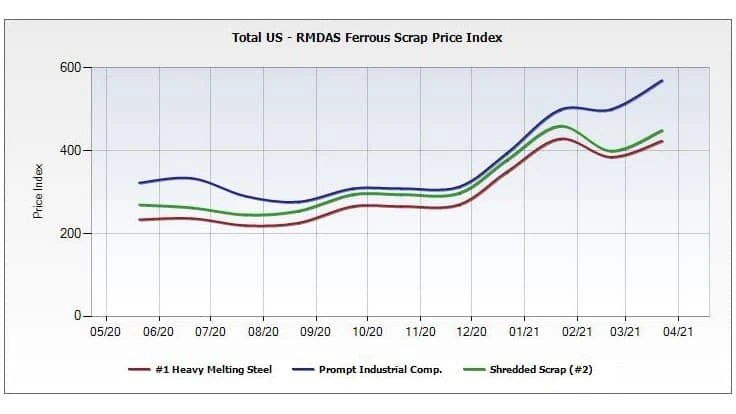

Prompt ferrous scrap continues to widen its price margin compared with the benchmark obsolete scrap grades tracked by the Raw Material Data Aggregation Service (RMDAS) of Pittsburgh-based MSA Inc.

Although the reluctance of some overseas buyers to purchase at a perceived pricing peak is acting as a brake on the value of shredded and heavy melting steel (HMS) scrap, prompt grades have soared in value in the first quarter of 2021.

The situation at the end of March, as measured by aggregated RMDAS mill purchase prices, shows a widening gap between the lines representing the Prompt Industrial Composite figure and those for No. 2 Shredded Scrap and No. 1 HMS.

In a 30-day window that included late February and the first 19 days of March, mills in the United States paid an average of $120 per ton more for prompt scrap compared with shredded scrap. There was a $146 per ton difference between the value of prompt scrap and No. 1 HMS.

In the RMDAS South region, where prompt scrap is considered to be at a consistent deficit and where the HMS export grade can be the farthest from major ports, the gap was $185 per ton. (Prompt scrap was worth $572 per ton in the region while No. 1 HMS checked in at $387 per ton.)

At least one processor Recycling Today contacted in mid-March is unconvinced prompt grades will retain their lofty status heading into April, saying he “had a hard time placing some final tons of busheling” in the second week of March.

Steel mill output in the U.S. has been on a rising trend in 2021, with the Washington-based American Iron and Steel Institute (AISI) reporting some 1.753 million tons of steel output the week ending March 20. That total surpassed by 0.7 percent output in the comparable week in 2020—just as COVID-19 restrictions began curtailing industrial output in the U.S.

As far as prompt scrap generation, a still quiet aerospace sector is creating less scrap, and a global shortage of semiconductor chips has slowed down or even idled some automotive assembly plants.

The latter condition was not helped in the third week of March, when an automotive chip plant in Japan operated by Renesas Electronics was damaged by a fire. According to Reuters, the plant will be out of commission for at least one month.

Latest from Recycling Today

- BMW Group, Encory launch 'direct recycling’ of batteries

- Loom Carbon, RTI International partner to scale textile recycling technology

- Goodwill Industries of West Michigan, American Glass Mosaics partner to divert glass from landfill

- CARI forms federal advocacy partnership

- Monthly packaging papers shipments down in November

- STEEL Act aims to enhance trade enforcement to prevent dumping of steel in the US

- San Francisco schools introduce compostable lunch trays

- Aduro graduates from Shell GameChanger program