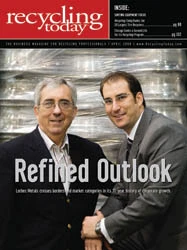

The Goldstein family has helped Lorbec Metals grow in several different directions since the company was created in 1977.

The Saint Hubert, Quebec-based company operates in both Canada and the United States. Lorbec Metals buys, sells and processes a variety of materials and also melts a significant amount of one traded commodity—aluminum scrap.

Operating in geographical climates that can be harsh and in a trading climate that can be extremely competitive, Jay Goldstein, his son Warren and the associates they work with have helped Lorbec Metals not only stay in the game, but also emerge as a healthy competitor.

STAYING TRUEJay Goldstein learned about scrap trading working for his father, who owned and managed a Montreal scrap facility with some of the deepest roots in that city.

The desire to run his own business led Jay to create Lorbec Metals in 1977, establishing his business in a market region that he considers one of the most competitive in North America at a time when Montreal and Quebec were being roiled by cultural and political uncertainty.

"The Montreal area has been extremely competitive—one of the most competitive in North America," says Jay. "We have good competitors that we contend with, and it has been in a market that is not growing."

As in other markets in the northeastern quadrant of North America, considerable manufacturing capacity has moved from Quebec to Mexico and Asia in the past three decades. Additional flight was also created by the on-again, off-again nature of Quebec separatist initiatives and votes, which prompted many Canadian companies to move their operations out of Quebec, usually to neighboring Ontario. "There simply is not as much scrap produced in this area as their used to be," Jay says.

The disappearance of customers has also been a problem on the sell side, as the universe of scrap and ingot buyers in the region has mirrored what has happened with large generators. "In 30 years, I’d estimate about 25 foundries that were buying material from us have closed," says Jay.

Despite the considerable challenges, Jay stayed true to both his scrap industry and his Montreal roots and has led Lorbec Metals to three decades of opportunity and expansion.

The company now operates five facilities in two nations and not only buys and sells scrap commodities, but also melts aluminum scrap to produce 50 million pounds of specification aluminum ingot and de-ox products each year.

Throughout most of the last two decades, Jay has also been able to help his son Warren become an integral part of the company’s management and trading operations.

Like the generations before him, Warren started out working in the plant during his high school and college years, learning the industry from collection and processing on through to the trading aspects.

"I did not grow up in a traditional suburban household," says Warren. "My father traveled 3 to 4 days per week visiting his customers and building up his U.S. clients. He was up at 5:30 a.m. and was off to work. He would return home at 8:30 p.m., sometimes later. By that time he had spent his day on the phone talking up a storm buying and selling metals all day. Jay worked hard building his reputation as being a shrewd, knowledgeable and fair trader," says Warren.

Now working just a few feet apart from one other, daily interaction between Jay and Warren has helped to prepare Warren for the multiple roles he currently plays in managing Lorbec Metals and helping the company realize growth opportunities.

OPPORTUNE TIMESThe instances when Lorbec Metals has taken advantage of growth opportunities have not been uniform, but the logic behind each individual move has created a well-constructed company.

The company that has been created handles multiple materials through several stages and on two sides of a border with fluctuating currencies. The result is a level of protection from sudden changes to any one market segment.

One of the major investments involved Lorbec’s entry into the secondary aluminum production business. "The opportunity arose and we decided to give it a go," states Jay. "It plays into what we’re doing, as we already handled a lot of aluminum scrap; now we melt some of it and we upgrade and ship the other percentage."

The company’s Noral Alloys smelter in Laval, Quebec, produces up to 50 million pounds per year of specification alloy ingot and de-ox aluminum shot used as an additive by steel mills.

While smelters can go through rough stretches of tight profit margins—and, as noted by Jay, melting capacity in North America has been under particular pressure—the market also turns in favor of smelters at times.

But the market can also turn on a dime, and while Jay notes that conditions are good during this mid-February conversation, conditions can change quickly.

The change in fortune between American and Canadian currencies marks one such shift. After years of operating with the premise that the Canadian dollar was trading well below the U.S. dollar, the last three years have seen that pattern end.

Warren says that Lorbec has had to focus on its efficiency to help compensate for the currency exchange difference and lost customers. But

| ABOVE AND BEYOND |

|

Winters in Quebec and in the northern states where Lorbec Metals operates are not for the timid. "Living in the northeast, snow is always an issue, and January and February can be relatively quiet months for scrap generation," says Warren Goldstein of Lorbec. Scrap generation can taper off along with seasonal construction industry slowdowns, but except for the most severe lake-effect snow days, Warren says "the industrial accounts keep going, and we need to serve them." An exception to the "business as usual" rule occurred with the Quebec ice storm of January 1998. In that storm, some 3 to 4 inches of ice fell from the sky, causing traffic pile-ups and bringing down tree limbs and power lines throughout a wide swath of Eastern Canada. Lorbec played a key part, recalls Warren. "We were responsible for hauling and processing 2,000 tons or more of aluminum wire and cable. Some of our employees seemed to be working 24 hours a day, seven days a week for about three months." The volume of downed power lines was so widespread that the Canadian Army played the lead role overseeing the effort, supplementing utility crews that were stretched beyond capacity. "We had the Canadian Army with us out there, cutting with saws," says Warren. "We got a thank you letter from the government for the efficient work we did—and it was a memorable amount of work." |

The company now has three facilities in the United States. Its largest is in Flint, Mich., and it uses two Harris HRB balers fed by Sennebogen material handlers to process a range of ferrous and nonferrous scrap generated by industrial customers.

A smaller facility known as Lafayette Recycling has been set up in central Detroit, and another regional location in Massena, N.Y. (just across the border from Canada), was established in 1995 and also includes an aluminum melting furnace.

The U.S. operations have allowed Lorbec not to be as vulnerable to conditions affecting the market on the Canadian side of the border. "The U.S. plants are not operated to feed the Noral smelter," notes Warren. "They are self-sufficient in their buying and they have not been as affected by the currency situation."

SEPARATE BUT TOGETHERWith operations that buy, process, melt and sell scrap and that are spread over a radius of several hundred miles on two sides of an international border, communication is essential.

"We discuss and talk among Flint, Laval and St. Hubert and discuss sales in particular," says Warren. The company accumulates its nonferrous material into parcels of 1 million or 2 million pounds, ideally. "The scrap industry is one of the few where generally the larger volume you sell, the better price you get—the opposite of most others."

Lorbec’s ability to make large sales has allowed it to act as a wholesaler, buying material from other dealers and from its industrial customers. "We’re buying mostly from dealers now, and even buying from other wholesalers," notes Warren.

Although the company has traditionally focused on selling to domestic consumers, Lorbec’s willingness to adapt to change means it now puts together more trans-oceanic shipments. "We have recently made a key hire so we can directly sell to China, which helps us be competitive," says Warren.

That change in circumstances is evident in shipping costs. "We can ship to Europe or the Far East a lot more affordably than we can ship to the Midwestern U.S.," Jay comments. "We can ship a container to China for $1,800 and one to Europe for as little as $800, but it can cost us $2,500 to send a truckload to Kentucky."

Navigating currency fluctuations, sky-high commodity prices and counter-intuitive shipping rates are among the challenges facing Jay and Warren Goldstein as they prepare to keep Lorbec competitive.

Another is industry consolidation, which can take the form of rapidly growing American Iron & Metal in its own province, or wider industry trends Lorbec also has to monitor.

"There are huge players in the U.S. and around the world trying to pool together and stay profitable," says Warren.

"Consolidation is taking place both in the scrap industry and among primary metals producers," says Jay. "Definitely, the metal industry has changed, and you’ve got to go with the flow and change with the changes."

ALWAYS LEARNINGIn its first 31 years, Lorbec has been willing to change with the industry, which is one of the lessons Jay says he has tried to pass on to his son Warren.

"A lot of the changes that are going on I have to get used to and I have to show him how things worked previously," says Jay. "I guess it’s a learning curve for him, but he picks things up pretty quickly and he does a good job in trading through all the changes."

"The way I do things is based on the good intentions that my father has instilled in me," says Warren. "Jay has run a modest business based on honesty, fairness and veracity. That is why we are still here today. Jay has always stayed away from the spotlight and has kept Lorbec going for the last 32 years. Lorbec has been around for as long as I have been alive. I hope that what I have learned from my father will help me continue Lorbec Metals Ltd. for another 32 years or until my sons or daughter are ready to take over."

Warren adds, "Not just me, but our customers also look to my father for market information. He’s often on the phone with younger people in the industry."

Sharing knowledge is essential for Lorbec within its own office and as it serves its customers, both father and son agree.

"Things used to change in a day or a week—today it’s minute by minute," Jay says. "Lorbec can survive. We concentrate on serving our customers and fulfilling our contract, even if the markets change behind us. If we do that, we’ll not only survive, but keep looking for opportunities to grow as well."

The author is editor in chief of Recycling Today and can be contacted at btaylor@gie.net.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Explore the April 2008 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Athens Services terminates contract with San Marino, California

- Partners develop specialty response vehicles for LIB fires

- Sonoco cites OCC shortage for price hike in Europe

- British Steel mill’s future up in the air

- Tomra applies GAINnext AI technology to upgrade wrought aluminum scrap

- Redwood Materials partners with Isuzu Commercial Truck

- The push for more supply

- ReMA PSI Chapter adds 7 members