For the last few years, China has been scaling back its imports of recovered paper and said it would ultimately stop imports by 2021.

By the first week of July, China reaffirmed its plans to stop importing materials it considers “solid wastes,” including recovered paper, in 2021. According to a report from the Bureau of International Recycling (BIR), Brussels, China’s Ministry of Ecology and Environment (MEE) will no longer accept and approve import applications for solid waste starting next year. The MEE considers the new regulations to be “in line with the policies applied since 2017 to reduce the import of ‘foreign waste.’” (For more on these regulations, visit our Newsworthy department.)

Paper and board producers in China seemingly have been preparing for the ban, in part by building or buying recovered fiber pulping facilities overseas so they can ship pulp, which has not been deemed a “waste” material.

“It’s not like the need for fiber will go away in China,” a broker based in the Midwest says, noting that China likely will start importing more finished products and pulp next year to meet its needs.

“There have been huge investments in recycled pulp facilities in the U.S. and other countries,” a broker on the West Coast says. “That will take up some of the slack that will be lost with no baled OCC (old corrugated containers) allowed to China, but we will see just how much that satisfies the need for demand.”

Recyclers and brokers say overall demand for recovered paper has been down this summer in export and domestic markets.

“Export markets have been reasonably quiet,” the broker based on the West Coast says, though orders are being placed. “Taiwan has been buying recovered paper; India has been a buyer. It’s not been feverish by any means—just steady buying.”

“The U.S. had a good economic growth rate—containerboard demand was solid. But now because of the pandemic, everything has gone upside down.” – a broker based in the Midwest

In July, many domestic paper mills remained fully stocked. This was reflected in domestic prices for most recovered paper grades in the July buying period. The U.S. average price of OCC dropped 26 percent from June to $54 per ton in July, and mixed paper held steady at $11 per ton, according to Fastmarkets RISI’s PPI Pulp & Paper Week July 7 report.

Although recovered paper couldn’t move fast enough to mills in the spring, a recycler based in the South says demand had slowed quite a bit by June and July. He says mills also are demanding higher quality from suppliers.

“Price is almost secondary; it’s more about movement now,” the recycler based in the South says.

The broker based in the Midwest says the recovered paper market has been very soft this summer, adding that he thinks prices could take another dip next month.

“Everything is related to how our economy will pick up,” he says. “For scrap paper markets to do better, we need the economy to pick up, and we need consumers to be buying things—things need to be shipped in boxes. The U.S. had a good economic growth rate—containerboard demand was solid. But now because of the pandemic, everything has gone upside down.”

“Price is almost secondary; it’s more about movement now.” – a recycler based in the South

Transportation for recovered paper shipments also has proven difficult to arrange for many recyclers and brokers this summer. The broker on the West Coast describes shipping schedules as “kind of screwy,” adding that bookings have been off by six to eight weeks in some cases.

“There have been some issues because some sailings have been skipped,” he says. “If a vessel skips a port and doesn’t make its normal run, that throws everything out of whack.”

The broker based in the Midwest adds that freight is one of the biggest problems in the recycling industry right now. He says part of the issue is tied to COVID-19, noting that potential new drivers were unable to get licensed during mandated shutdowns earlier this year.

He adds, “On top of that, when everything was shut down and nobody was moving merchandise, there were some freight companies that shut down and some that got rid of drivers. Now, they are making more with less.”

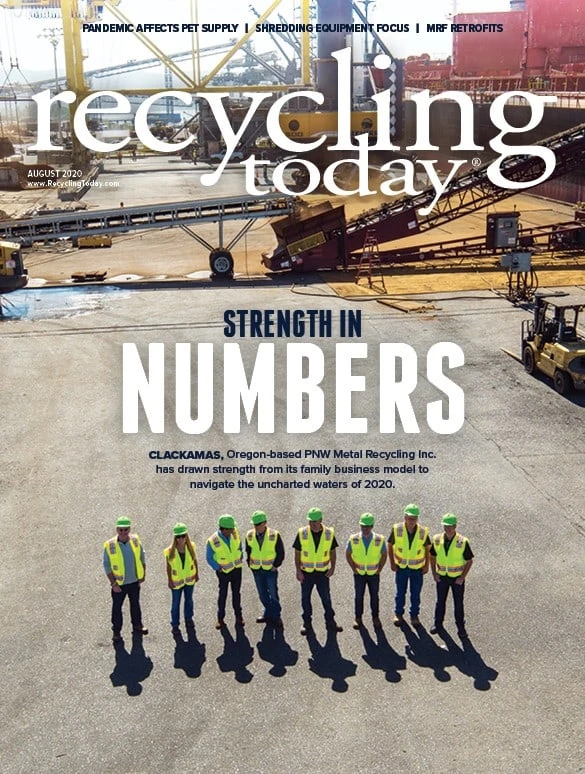

Explore the August 2020 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Alberta Ag-Plastic pilot program continues, expands with renewed funding

- ReMA urges open intra-North American scrap trade

- Axium awarded by regional organization

- China to introduce steel export quotas

- Thyssenkrupp idles capacity in Europe

- Phoenix Technologies closes Ohio rPET facility

- EPA selects 2 governments in Pennsylvania to receive recycling, waste grants

- NWRA Florida Chapter announces 2025 Legislative Champion Awards