Another month, another record-setting several weeks for recovered paper pricing. Pricing for old corrugated containers (OCC) and mixed paper set records for the fifth consecutive month, with both recovered fiber grades reaching levels that are more than double what they were selling for this time last year. One source says the price hikes are “explosive,” “crazy” and “risky.”

At $172.78 per ton, OCC pricing jumped $40 to $45 in the Northeast region, $35 in the Midwest, $40 in the Southeast and Southwest regions and $30 in the Los Angeles/San Francisco region, according to the March 6 PPW Yellow Sheet from Boston-based research firm RISI. (London-based Euromoney Institutional Investor PLC, the international online information and events group, has agreed to acquire 100 percent of the equity of RISI for $125 million.) Compared with OCC’s U.S. average pricing in March 2015 of $71.39 per ton, the March 2017 price is double that plus an additional $30 per ton and is more than double the $79.17 price in March 2016.

Mixed paper also has seen a dramatic increase in pricing. At an average U.S. price of $96.11 per ton, mixed paper is more than double the March 2016 price of $46.39 per ton. This is the highest pricing point mixed paper has seen.

Furthermore, the price spread between these secondary fiber grades in March 2017 is more than double the price spread in March 2016: In March 2016, the difference in per-ton prices for OCC and mixed paper was $32.78 domestically; in March 2017, the difference was $76.67.

A source based in the Midwest uses an analogy of helping to ignite a fire by adding oxygen using a bellows when he says, “Prices are like that: You put some air on it, and they get hotter and hotter; but, if you put too much air on a fire, it goes out. So, I am worried these high prices could extinguish the market.”

Pricing for exports of secondary fiber grades saw gains as well. Average prices for mixed paper, old newspapers (ONP) and sorted office paper (SOP) increased by $7 to $12 per ton FAS (free alongside ship, meaning the seller must deliver goods to a named port alongside a vessel designated by the buyer) from the prior month, depending on the U.S. shipping region. OCC pricing jolted up $28 to $34 per ton FAS.

In February China implemented “National Sword” or “Border-gate Sword.” This enforcement of existing laws is an “unrelenting crackdown on ‘foreign waste’ smuggling, [including a] focused crackdown for smuggling and illicit activities on solid waste, including industrial waste, e-waste, household waste and plastic waste,” says Steve Wong of Hong Kong-based Fukutomi Co. Ltd. in a regulatory update prepared in mid-February for the global recycling community. While National Sword is focused mostly on plastics, every container arriving at Chinese ports will be inspected, ultimately affecting shipments of recovered fiber.

“There’s going to be a backup of containers at the port, which are not getting to the mill,” the source based in the Midwest says of National Sword’s effect.

He predicts that an excess amount of OCC could be available in the domestic market as a result of these stalled containers.

In addition to potential container delays at ports within China, industry sources say higher freight rates are affecting export shipments of recovered fiber.

“Freight rates for shipping material over to China have increased, which has impacted pricing for sure,” according to a recycler based in the Southeast.

A recovered paper trader who is based in the Pacific Northwest says rail companies are healthier than steamship lines presently.

Of paper stock packers, he says, “Maintaining a healthy shipping environment is critical, and if they don’t have the opportunity to ship for two or three days, they’re bursting at the seams.”

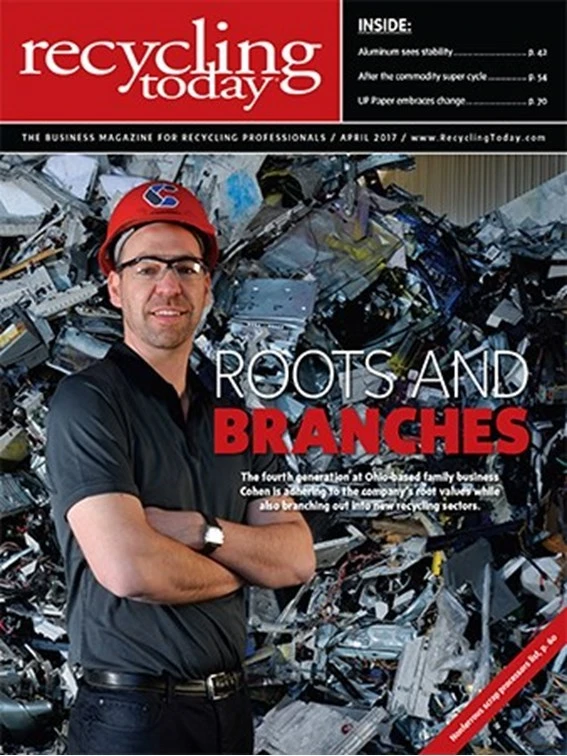

Explore the April 2017 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Greenwave Technology pares back losses in Q3

- Lindner shredders prepare Brazilian plastic for recycling

- China ups steel output, while other nations cut back

- ReElement, Posco partner to develop rare earth, magnet supply chain

- Comau to take part in EU’s Reinforce project

- Sustainable packaging: How do we get there?

- ReMA accepts Lifetime Achievement nominations

- ExxonMobil will add to chemical recycling capacity