A late-July report from the RaboResearch department of Netherlands-based Rabobank points to setbacks in establishing plastic packaging circularity in the U.S. and Europe, but it concludes that recycling will grow.

The report says despite good intentions, many companies have had to adjust their sustainability goals and packaging strategies by pushing their recycled-content target dates further into the future.

The report calls some of these target dates “ambitious,” such as those set for 2025 and 2030, amid challenges like insufficient scrap supply, inadequate collection networks and the slow issuance of U.S. Food and Drug Administration letters of no objection for food-contact recycled plastic.

Also recognizing the ambitious nature of 2025 targets is the Walpole, New Hampshire-based U.S. Plastics Pact, which helps Ellen MacArthur Foundation signatories meet their commitments.

“We’ll focus on increasing our use of recycled plastic, making our packaging lighter and scaling alternative formats, materials and business models.” – Pablo Costa, global head of packaging, Unilever

In June, the group released its Roadmap 2.0, outlining steps to create a circular economy for plastic packaging by 2030 rather than 2025.

For companies working toward these goals, 2023 sustainability reports have reflected the mix of progress and setbacks alluded to by the RaboResearch report.

For example, Mars Inc.’s July report notes that while it has designed 61 percent of its packaging for recyclability, it used only 1.5 percent postconsumer resin (PCR) in its packaging, well short of its 30 percent goal for 2025.

“We are investing millions of dollars to improve the recyclability of our packaging, increase the amount of food-safe, recycled content and to reduce the use of virgin plastic,” the report says.

Similarly, PepsiCo reported in June that it would fall short of its 2025 goal to produce 100 percent-recyclable packaging. Additionally, the company, which set a goal to use 50 percent PCR by 2030, used 10 percent last year, up from 7 percent in 2022.

The company also aims to reduce virgin resin use by 20 percent by 2030 but reports a 6 percent increase in 2023.

Challenges PepsiCo has faced in its pursuit of recycling goals reportedly include inadequate recycling infrastructure, low recycling rates and limited supply of high-quality PCR.

Another example is Unilever, which reported a 22 percent increase in recycled resin use in its global plastic packaging portfolio. Global Head of Packaging Pablo Costa says the company was “firmly on track” to meet its 25 percent goal by 2025. It is prioritizing reducing virgin plastic use by 30 percent in 2026 and by 40 percent in 2028, among other goals.

“We’ve now set a clear, interim goal to help build on our progress, improve transparency and strengthen accountability,” Costa writes in an April 30 post on the Unilever website. “Here, we’ll focus on increasing our use of recycled plastic, making our packaging lighter and scaling alternative formats, materials and business models.”

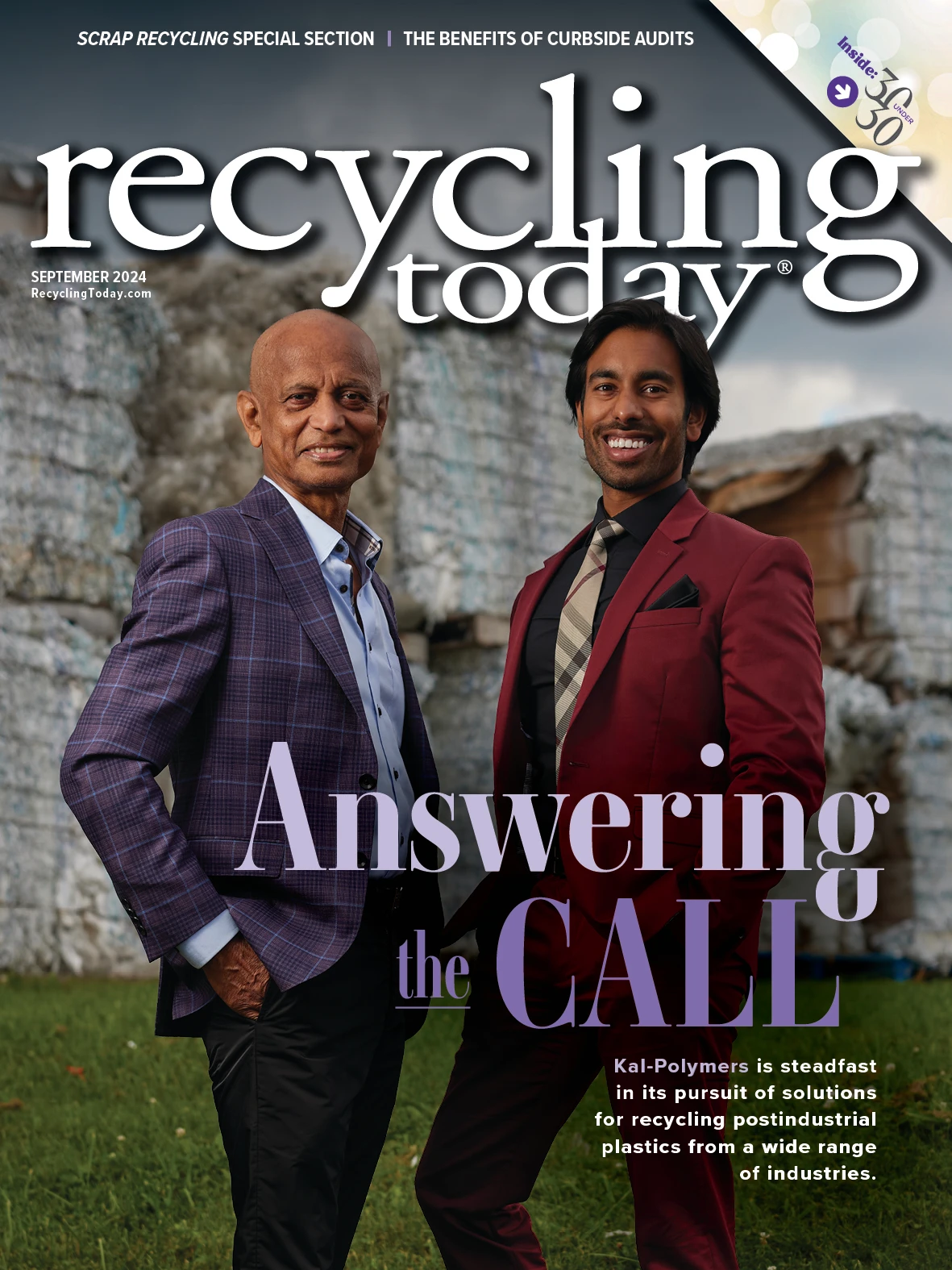

Explore the September 2024 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- China to introduce steel export quotas

- Thyssenkrupp idles capacity in Europe

- Phoenix Technologies closes Ohio rPET facility

- EPA selects 2 governments in Pennsylvania to receive recycling, waste grants

- NWRA Florida Chapter announces 2025 Legislative Champion Awards

- Goldman Sachs Research: Copper prices to decline in 2026

- Tomra opens London RVM showroom

- Ball Corp. makes European investment