Aluminum continues to display positive signals moving into the spring. After struggling through the last several years of massive overcapacity and low prices, primary and secondary aluminum markets have seen positive movement. The turnaround took hold in the middle of 2016 and has continued into the first quarter of 2017.

A number of market observers say they feel the improvement should last for at least the middle two quarters of 2017, despite concerns that a return to oversupply on the global market could curb recovery.

A combination of improving national economies and a substantial reduction in stocks in London Metal Exchange (LME) warehouses has been driving the primary and secondary aluminum markets.

Ed Meir, an independent analyst based in New York City with the consulting and research firm INTL FCStone, says since January 2014 LME stocks have dropped from 5.5 million metric tons to 2 million metric tons, which has helped provide some underlying strength to aluminum.

Regarding the U.S. economy, the Institute for Supply Management (ISM) Purchasing Managers Index (PMI) for domestic manufacturing hit 57.7 in February, its highest level in nearly three years. According to this index, the U.S. economy has been growing for more than 90 consecutive months.

Improved flow

Many recyclers say they have a bullish outlook on aluminum. Several dealers say the flow of aluminum scrap throughout the supply chain has increased noticeably, with the A360 cast alloy grade generating the most enthusiasm.

“Secondary smelters are aggressive with prices,” one large scrap metal broker says. “And it looks like they are having to pay more [for aluminum scrap].”

Along with better prices, the broker says new scrap supply seems to be stronger and demand seems healthy for the next several months at least. A recent increase in the flow of aluminum scrap to recycling yards has eased one of the biggest concerns many recyclers have been expressing during the extended market downturn of the past several years.

“The uptick in price and demand has resulted in more aluminum coming across our scales,” another scrap metal recycler comments. “We are more bullish now than we have been in a long time.”

The improved outlook is not limited to North America. In its annual report, Norsk Hydro, the European-based aluminum producer with operations in more than 40 countries, says it is forecasting aluminum demand to grow by 3 percent to 5 percent in 2017. The company adds that it expects China’s aluminum demand to rise 4 percent to 6 percent in 2017 relative to 2016 and its primary aluminum production to increase by a similar percentage.

A report by Harbor Aluminum, Austin, Texas, concurs with Norsk Hydro’s forecast, saying that during the first quarter of 2017, secondary aluminum markets in the U.S. saw a pronounced improvement. “Obsolete scrap tightness seems to have eased marginally [the last week of February]. Apparently, higher prices have increased the availability. Nevertheless, our [perspective] indicates that some secondary smelters are offering high prices for items such as turning, old cast, old steel, twitch, etc.,” the Harbor Aluminum report reads.

Meir says he expects to see a bullish global market for the next several months. “I think aluminum should be trading between $1,750 to $2,000 over the next two quarters,” he adds.

However, hedging his longer-term outlook on aluminum, Meir says prices could drop to the $1,600 level by the end of the year. “The aluminum rally could fall apart by the end of the year,” he says. “Prices could drop quite a bit.”

The reason Meir hedges revolves around the state of China’s aluminum industry going forward.

Addressing the oversupply issue

With China continuing to produce more aluminum than it can consume domestically, aluminum producers in many other parts of the world are becoming increasingly vocal about the need to aggressively rein in China’s production.

During the BMO Capital Markets Global Metals & Mining Conference, held Feb. 26 to March 1, 2017, in Hollywood, Florida, Roy Harvey, CEO of the U.S.-based aluminum company Alcoa Corp., noted the disparity between aluminum production in China and production outside that country. “From a smelting standpoint, it’s a bit of mixed story. When you think about everything outside of China, we are producing less than we consume, about 1.5 million tons. When you think about productive capacity inside of China, the fact is there are more smelters operating than they, in fact, need.”

Harvey continued, “Now, there’s a lot going on in the market to try and correct that, between WTO (World Trade Organization) cases and announcements from the Ministry of Environmental Protection in China. But when you put it all together, our expectation is that China will be in surplus by about 2 million tons, and when you combine that all together, we expect the markets will be in a small surplus of about 300,000 tons to 400,000 tons.

Complaints that China is shipping aluminum to the United States at unfair prices are starting to be addressed more aggressively. In early 2017, the Obama administration filed a complaint against Chinese aluminum subsidies with the World Trade Organization. The complaint accused Beijing of artificially expanding its global market share with cheap state-directed loans and subsidized energy.

In its complaint, the U.S. Trade Representative’s office contended that China’s capacity to produce aluminum more than quadrupled between 2007 and 2015, while global prices fell about 46 percent.

Following this complaint, in March, the Arlington, Virginia-based Aluminum Association’s Trade Enforcement Working Group filed anti-dumping and countervailing duty petitions, charging that unfairly traded imports of certain aluminum foil from China were causing material injury to the domestic aluminum industry.

Continuing the aggressive move to rein in China’s aluminum production, a recent letter submitted by three aluminum associations—The Aluminum Association, the Montreal-based Aluminium Association of Canada and Brussels-based European Aluminium—in advance of the upcoming G-20 summit, to be held in Hamburg, Germany, in July, called for the creation of a global forum to address global aluminum overcapacity. This is the first time that a global coalition of aluminum producers has called for such an effort to address Chinese overcapacity in the marketplace.

In its letter, the associations focused on the sharp increase in aluminum production in China and the impact it is having on global markets. In 2000, the letter states, “China supplied 10 percent of the world’s primary aluminum. Today, Chinese manufacturers have increased their output by five, supplying 53 percent of all aluminum produced globally and spurring increasing overcapacity in the downstream aluminum sector. Additionally, by 2020 Chinese aluminum capacity is expected to grow by a further 24 percent.”

The letter continues, “China’s state-sponsored support is contributing to an unsustainable structural overcapacity that will impact growth and contribute to heightened instability until it is addressed. Both the massive increase in production and the excess capacity have had a downward effect on the prices, generating significant economic and employment losses for our respective producers and economies. This excess capacity threatens the competitiveness of both upstream and downstream aluminum producers.”

Clearing the air in China

For many aluminum market observers, China’s actions and policies are key factors that will drive aluminum through the second half of this year.

One widely discussed issue has been the pressure the Chinese central government has been under to reduce air pollution in the country. China’s central government, along with its environmental agency officials, have been discussing a plan to cut manufacturing operations in 28 urban areas of the country to reduce air pollution. Ultimately, this move could reduce the country’s aluminum production by as much as 30 percent.

According to several published reports, China’s Ministry of Environmental Protection ordered the country’s aluminum industry to temporarily close 30 percent of its smelters in four Chinese provinces. The cuts would take place during the “heating season,” which translates into the months of November through March.

With the 2016-2017 heating season having ended, it is likely the real cuts will take place during the fourth quarter of 2017 and first quarter of 2018.

One market analyst says the Chinese government is walking a fine line between curbing its pollution problem and forcing the shutdown of many aluminum smelters, ultimately laying off people.

One widely discussed issue has been the pressure the Chinese central government has been under to reduce air pollution in the country. China’s central government, along with its environmental agency officials, have been discussing a plan to cut manufacturing operations in 28 urban areas of the country to reduce air pollution.

Another source says more efficient aluminum smelters could lobby local government officials to allow them to continue operating, which could displace shuttered smelting plants.

Speculators, anticipating significant cuts in aluminum (and alumina) production in China, helped boost prices by 12 percent over the first two months of 2017, bringing prices to $1,900 per metric ton, a 21-month high.

Recent production figures from China showed aluminum output climbing by 16 percent over the first two months of 2017 relative to January and February of 2016.

According to the London-based International Aluminium Institute, for the first two months of 2017, China produced close to 5.5 million metric tons of aluminum, more than 50 percent of all the aluminum produced in the world during that time.

The increase in aluminum production in China was primarily because of higher prices for the metal. However, what has been disconcerting for many aluminum producers outside of China is that the significant increase in aluminum production was not met with a commensurate increase in domestic demand. Rather, according to several reports, there has been an increase in the movement of aluminum to warehouses in the country. The Shanghai Metals Market news service reported inventories of aluminum ingot in China climbing to the 1 million metric ton mark in early March 2017, the ninth straight week of aluminum inventory increases.

Caution flags

Meir says signals about the longer-term health of aluminum markets may be clearer by the end of 2017. If the Chinese government fully implements cutbacks in aluminum production to rein in pollution, China’s production of aluminum could decline significantly. However, he says the central government will be put in a tricky position because cuts in aluminum production will result in higher unemployment, which could further hamper an already slowing Chinese economy.

Additionally, a bulwark of the country’s economy has been its real estate market. This sector uses a significant amount of aluminum. Meir says the Chinese construction sector, which already has been slowing down, could further decelerate late in 2017, which could result in declining domestic demand for aluminum.

Looking further into the future, the aluminum scrap market could be contending not only with a higher percentage of global aluminum coming out of China but also with more aluminum scrap being generated by Chinese sources. China also is putting a major emphasis on becoming more self-sufficient regarding its raw material needs. And, from various reports over the past several months, the country is on its way to reaching that goal.

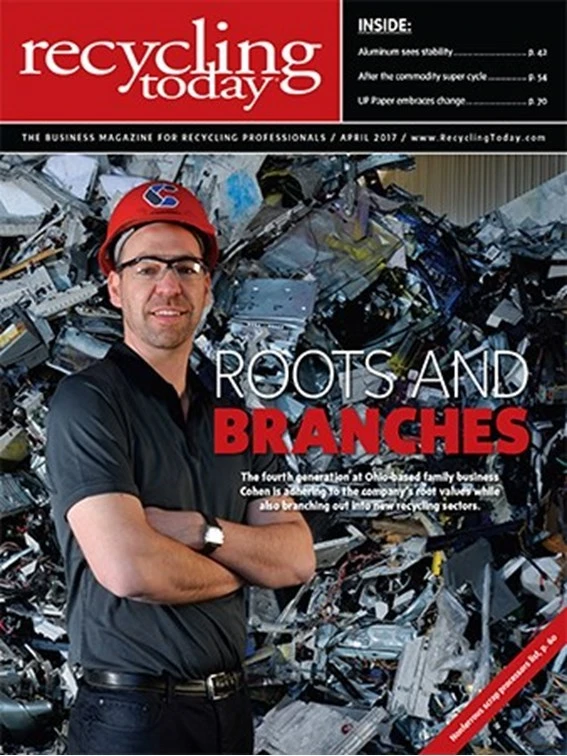

Explore the April 2017 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- BMW Group, Encory launch 'direct recycling’ of batteries

- Loom Carbon, RTI International partner to scale textile recycling technology

- Goodwill Industries of West Michigan, American Glass Mosaics partner to divert glass from landfill

- CARI forms federal advocacy partnership

- Monthly packaging papers shipments down in November

- STEEL Act aims to enhance trade enforcement to prevent dumping of steel in the US

- San Francisco schools introduce compostable lunch trays

- Aduro graduates from Shell GameChanger program