The summer market for ferrous scrap remained in the doldrums through mid-August, with only rare glimpses of a pricing rebound seen so far this year.

As measured by mill transaction pricing collected by the Raw Material Data Aggregation Service (RMDAS) of Pittsburgh-based MSA Inc. and intelligence gathered by Davis Index, July prices for benchmark grades were stable in the best cases and dropped further in others.

Ferrous scrap sellers and those holding inventory did not receive better news in August. Davis Index reported prices for benchmark grades, including No. 1 busheling, shredded scrap and heavy melting steel (HMS), as largely unchanged in terms of domestic mill buying.

The August export market for HMS grades fared little better, with West Coast shippers witnessing a $5-per-metric-ton drop in value, and those on the East Coast watching prices drop by about $10 per metric ton compared with July.

“Export has been a godsend for scrap dealers as the prices have held steady for most of the summer.” – Scrap processor in the western U.S.

The impact of China’s steel mills churning out product its own builders and manufacturers cannot consume is being felt in the Turkish export market this year, according to Davis Index.

“Most Turkish mills are uninterested in ferrous cargo purchases due to falling prices for imported billet from China,” Davis Index writes, adding that the end market of Turkish semifinished and finished steel was “sluggish,” with no improved sales prospects in sight.

On the supply side, two processors who help manage multilocation scrap companies say U.S. supply and demand are balanced and don’t believe prices will rise soon.

“Going forward, there seems to be a bearish tone to the market as there are several planned maintenance outages across a number of consumers in September and October,” a processor based in the Midwest says, adding that future steel demand seems questionable.

A processor with yards in the western U.S. says the market is balanced, but not in a favorable fashion.

“Supply is not plentiful; it has steadily reduced as seen in total quantities sold and shipped,” he says.

Although tight supply often sparks a rebound, the western processor says, “The difference is that demand is also down. In that context, supply is in balance. If you look at most scrap yards, there is not a surplus of scrap inventories.”

Export pricing and demand are not booming, though the western processor says sellers and shippers near ports are benefiting from purchases being made.

“Export has been a godsend for scrap dealers as the prices have held steady for most of the summer,” he says. “That has prevented U.S. prices from falling further in a market of weak demand but limited supply.”

He says Pacific Coast companies that can access bulk cargo export markets would “rather load a boat for export than railcars for domestic sales. The export price has supported those bulk export sales versus the freight cost to ship it inland to domestic consumers.”

In late January, Cleveland-Cliffs Chair and CEO Lourenco Goncalves talked about price discovery, saying that, “Going forward, and assuming a fair scrap marketplace—free from artificial, provoked and hard-to-explain moves—with scrap demand growing and scrap supply shrinking, there is no good reason for scrap prices to go down.”

Additional details as to what Cliffs observed were not forthcoming. In August, however, a move by the Ohio electric arc furnace (EAF) mill operated by Australia-based BlueScope brought price discovery back to the fore.

The Midwest-based processor says the mill, which for several years had issued a monthly announcement declaring what it intended to pay for grades of scrap, did not do so in August.

“They have seemingly gone away from a blanket price announcement and let their supply base know that they will no longer be distributing blanket price direction but rather contacting their supply base to discuss prices monthly,” the processor says, adding that the announcements previously served as a sort of market direction indicator.

Earlier this decade, BlueScope joined Nucor Corp., Steel Dynamics Inc., Gerdau, CMC, Evraz and Cleveland-Cliffs as steel producers who own scrap yard networks. Radius Recycling also owns one EAF mill and, this summer, Wisconsin-based Charter Steel bought an Ohio scrap processing company.

When or if the vertical reach of steel producers into their supply chains has begun to affect what has long been considered one of the economy’s truly supply-and-demand-based indicators remains an open question.

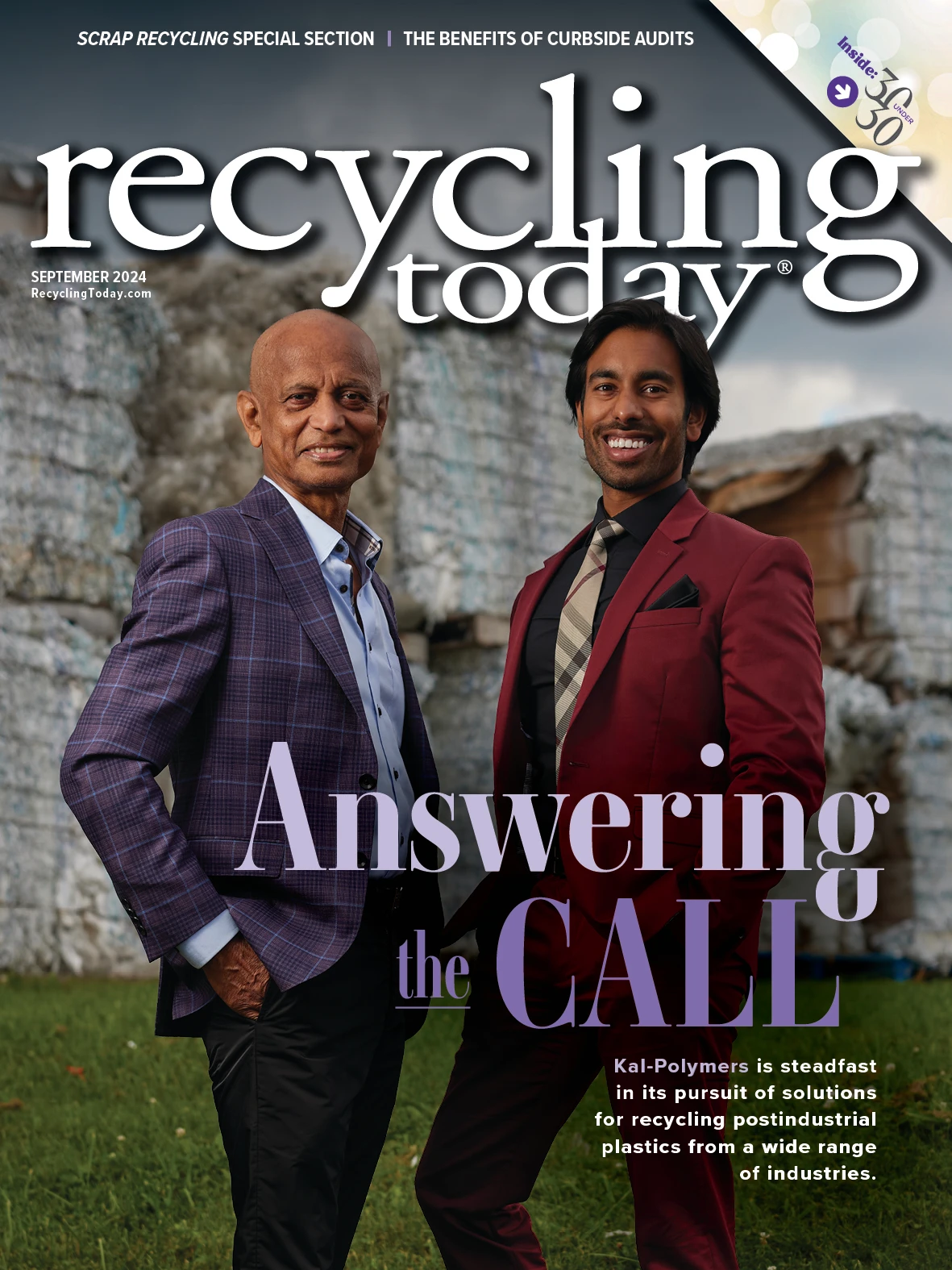

Explore the September 2024 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Orion ramping up Rocky Mountain Steel rail line

- Proposed bill would provide ‘regulatory clarity’ for chemical recycling

- Alberta Ag-Plastic pilot program continues, expands with renewed funding

- ReMA urges open intra-North American scrap trade

- Axium awarded by regional organization

- Update: China to introduce steel export quotas

- Thyssenkrupp idles capacity in Europe

- Phoenix Technologies closes Ohio rPET facility