China’s era of sustained industrial sector growth began shortly after then-Chairman Deng Xiaoping began introducing economic reforms in the early and mid-1980s. By the 1990s, China’s industrial growth entailed, in part, importing massive amounts of secondary commodities, including scrap metal, paper and plastic.

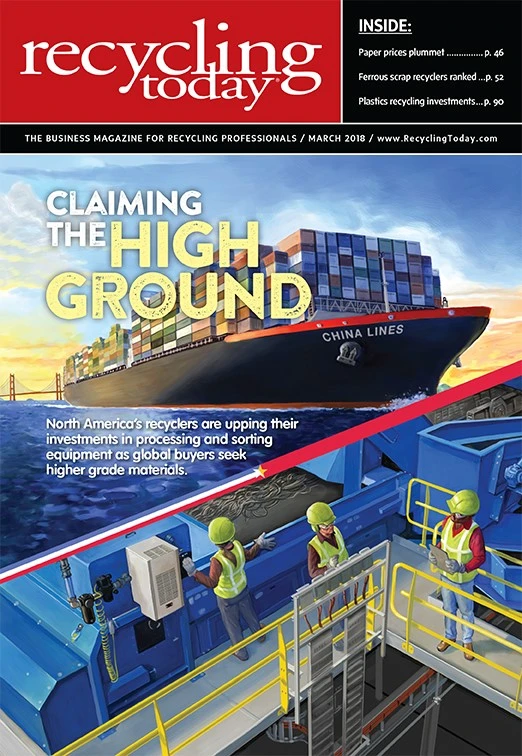

Scrap processors and traders who have been in the business for 20 years, and thus can be considered industry veterans, have only known a global market where Chinese companies were the leading overseas buyers. For many of these same traders and processors, making freight arrangements often has amounted to finding the most cost-effective container route to China.

China’s seemingly “no strings attached” welcoming attitude toward imported scrap changed perceptibly in 2013 with Operation Green Fence. That action, led by a coalition of Chinese central government agencies, was designed to enforce frequently ignored quality standards for imported materials, with a sharp focus on mixed plastics and mixed paper.

In 2017, the National Sword campaign and several follow-up actions brought further restrictions, this time including contaminant limits that are tougher than the global standards and outright bans on certain scrap materials.

For traders and scrap processors, the landscape appears to have changed abruptly and permanently. While trade negotiators from North America and Europe are questioning China’s newly declared restrictions, the Chinese government has positioned the scrap material bans as an internal environmental matter.

In 2018 and beyond, recyclers undoubtedly will watch for any changes on the policy front. At the same time, however, they also are researching and making capital investments designed to adjust to the new reality, which involves finding new ways to prepare certain grades of scrap.

High-effort copper harvests

Copper has been among the raw materials most needed for the industrial and infrastructure buildup in China for at least the past three decades.

The pursuit of red metal units by Chinese copper and brass producers soon led to a massive scrap importing and processing sector that deployed manual labor to harvest furnace-ready copper from such materials as mixed motors, baled wire and cable and mixed shredded metal “heavies.”

“We’ve already made some strategic upgrades in our chopping operation, and we are always looking to improve and expand our capabilities and facility when it makes sense.” – Mitchell Goldberg, Northeast Metal Traders

For processors in developed nations with high labor costs, it was a welcome development. One veteran scrap trader recalls calling on scrap yards throughout the eastern United States in the late 1980s and inevitably finding a stockpile of motors toward the back portion of nearly every yard. “At that time, you could buy them for 5 cents per pound and sell them to a Chinese buyer for 10 cents per pound,” the trader comments.

Michael Friedman of Louisville, Kentucky-based Sustainable Management Corp. says in that same era he “worked many years trying to solidify a firm market in China for electric motors.” He adds, “We generally bought motors for 3 cents per pound and sold them for 6 cents.”

However, that margin didn’t last long, he says, as sellers in the U.S. began demanding better prices from the flood of competing China-bound buyers.

Nonetheless, mixed motors became synonymous with shipment to China, as U.S. and European processors were happy to avoid the labor costs and potential environmental issues that came along with processing motors by separating the copper from the iron and steel castings.

Wire and cable scrap, on the other hand, has been treated with automated equipment since the 1970s. China’s entry into the market for this material involved making the economics work for processing lower grade (less copper within) wire and thus outbidding U.S. wire chopping line operators for it.

Each of these two processing-intensive grades have joined postconsumer mixed plastics and paper on China’s restricted list in 2018. Shipments of the two copper-bearing materials are still being allowed in 2018 but in import quota amounts greatly reduced from previous years.

The response from Chinese buyers is forming still. Some appear poised to set up processing operations in neighboring Asian nations. Another possibility is a renewed interest in higher grade materials, such as clean No. 1 or No. 2 copper. This provides an incentive for North American scrap companies to invest in new processing equipment.

“We’ve already seen a good number of companies taking the plunge,” Mitchell Goldberg of Philadelphia-based Northeast Metal Traders says of such investments. “We’ve already made some strategic upgrades in our chopping operation, and we are always looking to improve and expand our capabilities and facility when it makes sense,” he adds.

Lane Gaddy, president of W. Silver Recycling, El Paso, Texas, says his company also has critical reasons to broaden its ability to process red-metal-bearing scrap, “especially in low-grade industrial items that cannot be refused through commercial commitments.” In such cases, he adds, “We foresee mechanical separation being the most logical path.”

Restoring mixed motor processing capacity in developed nations may involve more caution, but change appears to be afoot. “The last lot of motors I traded stayed domestically,” Friedman says. “With more powerful shredders and superfine eddy current sorters, I believe much of the motor business has returned to the U.S.”

To what extent auto shredding plant operators will devote part of their capacities to shredding motors is not yet determined. David Dodds of United Kingdom-based Sackers Recycling says his company is operating under the premise that China’s import landscape has changed permanently.

“We will be investing in our own plants to cope with the recycling of the Category 7 scrap that China no longer wants,” Dodds remarks. Mixed motors fall within Category 7 in China’s tiered scrap import system.

He continues, “There is very little information coming out of China, so we have taken the stance to process our own material.” According to Dodds, this has included research into a mixed motor processing system.

While China’s restrictions on these two grades of copper-bearing scrap have had a ripple effect on the global metals recycling sector, its more comprehensive ban on some types of plastic and paper scrap has created considerable chaos.

“We will be investing in our own plants to cope with the recycling of the Category 7 scrap that China no longer wants.” – David Dodds, Sackers Recycling

All mixed up

Operation Green Fence in 2013 caused some discomfort and changes to the scrap metal sector, but the major impact occurred within the material recovery facility (MRF) sector. For more than a decade, operators of many of these plants had become accustomed to allowing outthrow and contaminant levels on export shipments to drift upward, as Chinese buyers desperate for sufficient volume offered relatively few quality complaints.

Changing attitudes in China perhaps can be ascribed partially to protectionism (and stimulating China’s domestic recycling activities), but the issue as described by China’s government is laden with references to “foreign garbage,” usually pointing to substandard mixed paper and mixed plastic shipments.

Plastic scrap, in particular, has been demonized, in part by a 2016 documentary called “Plastic China” that reportedly enjoyed wide viewership in China, perhaps even at the highest levels of government.

The 82-minute documentary focuses on one woman and her 11-year-old daughter who work at and live next to a sizable plastic scrap sorting operation where “foreign garbage” (as referred to by the documentarians) is sorted by hand.

Media reports in China indicate the documentary struck a nerve in the nation, perhaps even all the way up to the level of current Chairman Xi Jinping. Without question, as China introduced its new scrap import restrictions in 2017, in the plastics sector the restrictions were harsh and immediate.

By the spring of 2017, thousands of containers of plastic scrap were being refused entry into Chinese ports. Some 5,000 containers were reportedly stuck in drayage in Hong Kong alone by April 2017.

According to John Paul Mackens of freight forwarder Kuehne + Nagel, who gave a presentation at the 2017 Paper & Plastics Recycling Conference Europe in November, Europe sent 89 percent of its outbound plastic scrap to Chinese ports in 2016. In September 2017, Mackens said, just 46 percent went to Chinese ports, with Malaysia receiving 12.6 percent, Hong Kong receiving 10.7 percent and Vietnam getting 9.5 percent.

As of early 2018, plastic scrap stockpiles reportedly are building at material recovery facilities (MRFs) throughout the United States.

Of the two dozen scrap materials that faced outright import prohibitions in China, eight were forms of plastic scrap and just one was a mixed paper grade. (The others were metallic slags and residues and used clothing or textile shipments.)

For MRF operators and other paper and plastics recyclers, the adjustments needed have been swift, and likely are permanent (in the plastics sector). In the current situation, it can be hard to spot the opportunities within the challenge.

“We have scaled down plastics we take in,” states Kathy DeLano, vice president of sales at Dallas-based Texas Recycling. “Many items we have eliminated from accepting altogether. Too many plastics now have either no market or such a low value [that] it is not cost-effective to handle them.”

Shannon Dwire, president of Sioux Falls, South Dakota-based Millennium Recycling, says, “I think it naturally makes you more respectful of your domestic partners, and you work harder to strengthen those relationships. You watch quality and solidify your commitments to make sure you have a product that is wanted and even preferred over other suppliers.”

“You watch quality and solidify your commitments to make sure you have a product that is wanted and even preferred over other suppliers.” – Shannon Dwire, Millennium Recycling

For MRF operators, that can mean accepting commingled, residential materials and separating or sorting them to a level where they appear not to have been part of a commingled collection program at all.

In the wake of Operation Green Fence in 2013, technology suppliers to the MRF sector enjoyed a boom in new automated and optical sorting investments. While such suppliers are privately owned and do not report sales figures, this decade’s flurry of sales and installation announcements points to ongoing investments by MRF owners.

Municipal collection and hauling contracts on the MRF side and industrial service arrangements on the scrap metal side can make it difficult for recyclers in the U.S. to simply refuse newly restricted materials. The sustainability movement among manufacturers and consumer products companies provides another incentive for recyclers to find solutions.

However, with the North American recycling sector largely in corporate rather than government hands, profit-and-loss considerations will play a major role in how processors respond to the new landscape.

Volumetric decisions

Among the truisms espoused by veteran recyclers is that “scrap is bought, not sold.” Considered from this viewpoint, recycling only makes sense if material has been procured at a price where it can be processed, transported and sold with a profit margin intact.

For recyclers examining the post-China restrictions landscape, that means investing in processing capacity not merely because material is available, but because it can be worthwhile to handle it.

In the wire processing sector, Jeffrey Mallin of Kansas City, Missouri-based Mallin Cos. expresses little doubt that more material will stay onshore, but he also points to the need for pragmatic investing. “We have already installed equipment that further refines some of the products that used to go overseas, but [it is] nowhere near the capacity of what is out in the marketplace available to process or buy,” he comments.

Fellow wire processor Todd Safran of Chicago’s Safran Metals expresses a similar sentiment. “Depending on what exactly transpires, we have to determine what we should be handling and see if some of these [formerly] China-bound items are no longer viable to recycle,” he says.

Among the factors to watch, Safran says, is how many Chinese companies set up operations in neighboring Asian countries. “China may no longer remain an option for some of these materials in question, but other markets may become available that otherwise were not in play, and we expect to look at all available opportunities,” Safran says.

Even with such caution noted, North American investments in wire chopping, beyond the ones mentioned earlier by Mallin, Goldberg and Gaddy, have taken place in 2017 and 2018.

Buffalo, New York-based Wendt Corp., which distributes wire processing equipment made by France’s MTB Recycling, has announced three new sales and installations in the June 2017 to January 2018 time frame.

In 2017, Sims Metal Management began installing an MTB Cable Box system at its Fairless, Pennsylvania, location. MTB indicates the Cable Box is “designed to process up to 3 tons per hour of materials, including difficult-to-process materials, such as shredder wire, aluminum conductor steel-reinforced (ACSR) wires, armor-clad (BX) cable, underground residential distribution (URD) cables, Category 5 cables, tubing encapsulated cables (TEC), ‘jelly’ cables and zorba fines.”

The following month, another Cable Box sale was announced, this one to Medford, New York-based Gershow Recycling. In January 2018, Wendt Corp. and MTB announced a Cable Box sale to Sterling, Virginia-based Potomac Metals.

“I think it’s a wake-up call that we must have facilities that make things capable of using these materials to succeed.” – Ron Sherga, EcoStrate

“The demand for insulated copper wire has weakened, and several buyers have priced themselves out of the market due to oversupply,” David Zwisky, a vice president with Potomac Metals, said when the sale was announced. “We look forward to getting up and running, because with this machine and the type of material we will be processing, we will have a very clean product that should be able to reach any mill’s specs while helping to increase our margins.”

In the MRF sector, suppliers of screening and sorting equipment and systems have announced a steady succession of sales to recycling companies that, because of contract commitments, will continue to accept a high volume of material and must then sort it thoroughly.

Ron Sherga of Arlington, Texas-based EcoStrate is among the companies that could be poised to benefit from China’s import restrictions. EcoStrate, the 2017 Institute of Scrap Recycling Industries (ISRI) Design for Recycling award winner, takes in mixed and traditionally “difficult-to-recycle” plastic scrap and converts it to street signs, park benches and other manufactured items.

In early 2018, Sherga says he is enjoying access to additional material, which he had predicted would be the case. “EcoStrate has always expected a reshoring shift, and our EcoStrate model focused on pursuing large markets with sustainable profit margins without material subsidies,” he continues. “Our manufacturing capabilities are already falling far short of the demands we are seeing. This China effect has added to that demand and interest.”

While he is glad EcoStrate is benefitting from the changes, Sherga indicates he would rather see a larger trend of America finding additional ways to process and consume its own scrap materials.

“I think it’s a wake-up call that we must have facilities that make things capable of using these materials to succeed,” Sherga says. “Export plays a role and always will, but many companies got lazy and still lack resources or don’t fully understand scrap markets, and their struggles will get worse.”

To spin China’s import restrictions as a positive for U.S. recyclers can seem far-fetched as companies struggle to react in early 2018. When or if a longer-term reaction of pursuing opportunities takes shape in the ensuing months is likely to influence recycling company strategies throughout the rest of 2018 and into 2019.

Explore the March 2018 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Ferrous price hikes may be poised to pause

- BIR prepares for Spanish exhibition

- Copper exempted from latest round of tariffs

- Interchange Recycling's EPR stewardship plan approved in Yukon

- Making the case for polycoated paper recovery

- Novolex, Pactiv Evergreen finalize merger

- In memoriam: Danny Rifkin

- BIR adds to communications team