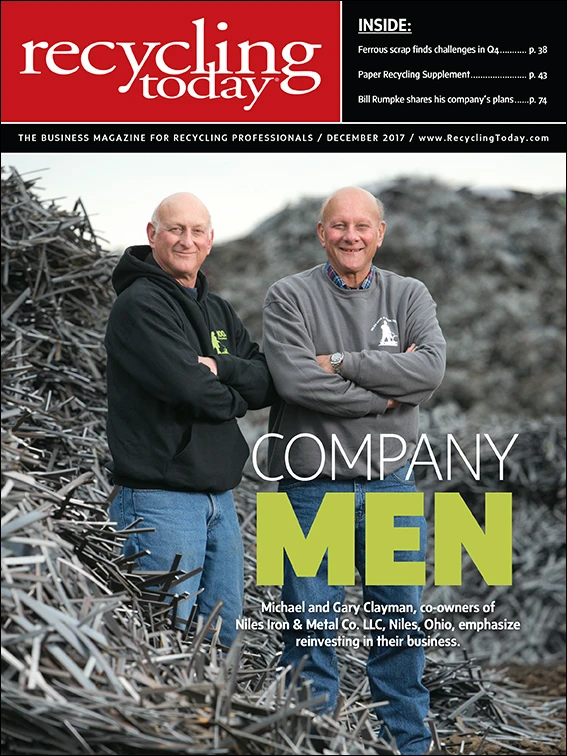

Niles Iron & Metal Co. LLC (NIMCO), which operates two scrap yards in Niles, Ohio, celebrated its 100th anniversary in 2017. Gary Clayman, who owns and operates the company with his brother Michael, says NIMCO owes its longevity to the Clayman family’s “old-school” approach to running the business, which prioritizes reinvesting in the company while running debt-free and with a dedicated staff.

“The company’s health and our long-term goals have always come first in our decision-making process,” Gary says.

Reinvesting in the business is crucial, he says. “We invest money to improve our operational efficiencies to keep us competitive and to maintain our bottom line.”

But NIMCO doesn’t take on debt to do so. “We are very determined to maintain the financial strength of the company.” By doing so, NIMCO is overcapitalized rather than undercapitalized, allowing it to pay vendors promptly, which Gary says is one of the company’s many selling features.

However, for a time that wasn’t the case.

Entering and exiting a joint venture

In 2008, NIMCO became part of a joint venture with Scholz AG of Essingen, Germany, and Liberty Iron & Metal Holdings of Phoenix. Scholz and Liberty took equity positions in NIMCO as well as in Mercer Co., with operations in Sharon, Pennsylvania, and Girard, Ohio, forming LNM Holdings LLC. Gary and Michael also maintained equity positions with LNM Holdings LLC.

However, LNM Holdings’ majority partners became financially distressed in 2015, Gary says, prompting him and Michael to withdraw from the partnership and buy back the assets of their original company.

Gary says the joint venture was attractive initially because the brothers wanted to have a younger and more diverse management staff in place so they could entertain retiring when the time came.

Instead, Michael and Gary found themselves buying back ownership of the company eight years later.

Michael says the experience “re-emphasized our philosophy of running a debt-free company,” teaching the brothers that “our father’s approach to

To better position NIMCO for the future, Gary says he and Michael are concentrating more now than in the past on developing a younger, self-sufficient management team.

Michael says, “We realize that one of our most important responsibilities is to pass our father’s approach to the next generation.”

NIMCO added Gary Chandler as

Rounding out the company’s leadership team is Gary’s son-in-law, Matthew Smith, who serves as vice president of ferrous operations. Smith has been with NIMCO since 2005.

Dedicated to the business

Apart from the short period of the joint venture, the Clayman family has been running NIMCO since its founding by Hyman Clayman and his son Morris in 1917.

The company’s first location was on East Federal Street in Niles, which is part of the Youngstown-Warren-Boardman, Ohio, metropolitan area. In 1950 the current 2-acre facility at 45 W. Federal St. became the corporate office and now services as NIMCO’s nonferrous yard.

“At the nonferrous site, the predominant commodity handled is aluminum of all types and grades,” Gary says, “but we also handle material such as copper, brass, stainless steel and precious metals.”

Hyman died in 1942, which is when Morris and his only son, Bill, father to Gary, Joel and Michael, partnered to run the business until Morris’ death in 1964.

Gary, who attended Oberlin College, joined his father at NIMCO in 1973.

His brothers, Joel and Michael, were added to the partnership in 1981 and 1982, respectively.

Michael, an Ohio University graduate, majored in finance.

Gary says he and his brothers were intrigued by the business from an early age, with their parents encouraging them to spend their weekends and summers working in the family business.

He says he always knew he’d work in the family business. “It was always my goal,” Gary says. “I grew up in it. I never considered anything else.”

NIMCO added a second yard in 1981. That 57-acre location on Main Street in Niles, roughly 1 mile from the company’s first location, serves as its ferrous yard. NIMCO also handles scrap paper—primarily old corrugated containers (OCC) and newspapers—from commercial accounts at this site, selling the material to paper mills throughout North America. The company has handled scrap paper for more than 80 years, with Gary saying, “We have always been a full-service provider to our customers from the beginning.”

Bill, Gary, Joel

The Clayman family’s dedication to its business extends to the people who work for NIMCO and the company’s customers.

NIMCO employs approximately 50 people on a full-time basis. “Many employees have been with the firm

He says the company has achieved that by running with highly skilled employees who get the job done and are willing to work overtime when necessary. When things slow down, NIMCO just goes back to 40-hour workweeks for its employees. “We have no excess people to lay off,” Gary says, adding that he and Michael take their obligations to their employees seriously.

“The company’s health and our long-term goals have always come first in our decision-making process.” – Gary Clayman, co-president, Niles Iron & Metal Co. LLC

NIMCO also prioritizes customer service, taking pride in its responsiveness to the needs of its customers and suppliers. “An employee always answers the phone—not a machine—and we react quickly to requests for service,” Gary says. “Our trucks make pickups and deliveries per our customers’ requested schedules or as needed.”

He continues, “Our business philosophy revolves around attentive customer service and prompt payment. This financial strength coupled with the flexibility to adapt to the needs of our customers is paramount to our success.”

Honing its focus

Ferrous scrap accounts for much of the material NIMCO handles. The company’s ferrous yard specializes in prompt industrial scrap, preparing it to

The company’s focus on

NIMCO serves industrial clients within a 100-mile radius of its yards and retail customers from within a 50-mile radius, but Gary says the steel mills the company serves can be as far as 700 miles away. The company handles 200,000 gross tons of scrap annually and can ship as much as 25,000 gross tons per month.

“In addition, we provide brokerage services to many regional dealers,” he says, adding that NIMCO has the ability to get them orders they cannot get themselves.

Gary says 70 percent of NIMCO’s ferrous scrap sales are mill direct to domestic consumers, while 15 percent to 20 percent of the nonferrous scrap the company prepares is sold to the export market.

Transporting material from the company’s yards to consuming destinations has not been an issue for NIMCO as it has been for many recyclers in other parts of the country in the last quarter, he says. “Eighty to 95 percent of our material is shipped by truck,” Gary says, adding that the company is in a “good lane” that isn’t feeling the effects of the hurricanes on trucking demand and availability. NIMCO operates its own trucks but also uses a number of common carriers. He says the company offers these carriers prompt payment and gets them in and out of its yards quickly; this helps to ensure their continued business with NIMCO. “You service them, and

The company uses a variety of equipment to move and process material at its two yards, including a 1,000-ton stationary Lindemann shear, supplied by Metso, with U.S. headquarters in San Antonio; a TG 2229 ferrous scrap baler and an HRB-8 nonferrous baler, both manufactured by Harris, Cordele, Georgia; and another high-speed baler for scrap paper. NIMCO also uses eight hydraulic material handlers, an equilibrium crane, several heavy-lifting cranes, loaders, forklifts and skid-steer loaders. Gary says several large liquid oxygen vessels support the company’s torching operation. “We also own a fleet of trucks and specialized equipment, such as a portable logger/baler, portable car crushers, roll-off trailers and lugger trucks, along with hundreds of trailers and boxes for customer service.”

From 85 percent to 90 percent of the company’s business is with commercial and industrial accounts, while retail accounts for 10 to 15 percent. “We’re always looking at options to grow the retail business, but the population base has shrunk in the Mahoning Valley,” Gary says.

NIMCO strives to get its retail customers in and out of its yards quickly, he says. The company’s yards are primarily paved and open on Saturdays for the added convenience of retail customers.

Taking the wider view

“Market conditions in our region have improved from the depths of the 2015 contraction in steelmaking,” Gary says.

He has a positive outlook for 2018, citing economic acceleration and potential deregulation and the effect it could have on business by removing laws that have been “restricting industry

He’s also encouraged by the go-ahead President Trump gave to the Keystone Pipeline, and points to stronger oil prices as an additional benefit. “The oil price stabilization has helped demand from the many pipe manufacturers in our area,” Gary says. “Capital goods orders seem to have improved, allowing for greater demand for all of our products along with improved pricing levels.”

However, uncertainty regarding China’s scrap import policies is a source of concern. “As China restricts imports of secondary materials and proposes new regulations, there will be some dislocation in

But he adds that he’s hopeful it will not become a major issue. “We’ve had no problem moving certain grades of material. We just moved five to seven loads of electric motors last week,” he says, referring to the first week of November.

One thing is certain, however, and that is the

“We’re trying to get more squeak out of the pig and to get

The

While the company’s Main Street yard has plenty of room to accommodate an auto shredder, it’s not an investment Gary says he’s interested in making. “There are way too many around, certainly in our area,” he says. “Suppliers to shredder operators are in a better position than the shredder operator.”

While Gary says he and Michael are interested in growing NIMCO further, they would prefer to do so organically rather than through acquisitions.

Michael says, “Properly managed growth has proved out over the last 100 years and should hold true into the next century.”

Explore the December 2017 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- BMW Group, Encory launch 'direct recycling’ of batteries

- Loom Carbon, RTI International partner to scale textile recycling technology

- Goodwill Industries of West Michigan, American Glass Mosaics partner to divert glass from landfill

- CARI forms federal advocacy partnership

- Monthly packaging papers shipments down in November

- STEEL Act aims to enhance trade enforcement to prevent dumping of steel in the US

- San Francisco schools introduce compostable lunch trays

- Aduro graduates from Shell GameChanger program