WM reports improved 2016 profits

Houston-based Waste Management Inc. (WM) has announced fourth quarter and year-end 2016 revenue and net income figures that were higher than the comparable figures from 2015.

WM says its revenue in the fourth quarter of 2016 was $3.46 billion, up by 6.4 percent from the $3.25 billion taken in during the same quarter in 2015. Net income for the quarter was $335 million, or 75 cents per diluted share, up by 22.7 percent from net income of $273 million in the fourth quarter of 2015, when WM earned 61 cents per diluted share.

Among the factors the company cites for its improved fourth quarter profitability is that “average recycling commodity prices at the company’s recycling facilities were approximately 31.6 percent higher in the fourth quarter of 2016 compared with the prior-year period.”

For all of 2016, WM says, average recycling commodity prices at the company’s recycling facilities compared with 2015 were approximately 8.6 percent higher and volumes increased by 0.8 percent. “These revenue increases, combined with reduced operating costs at the company’s recycling facilities, drove almost a 9-cent increase in the company’s earnings per diluted share,” the company says.

Regarding its overall 2016 year-end results, WM has reported revenue of $13.6 billion, up by 4.6 percent compared with the $13 billion realized in 2015. Earnings per diluted share were $2.65 for 2016, an increase of 60.6 percent compared with $1.65 earned in 2015.

Jim Fish, president and CEO of WM, says of the company’s most recent quarter and near-term future, “The fourth quarter saw internal revenue growth from each of yield and total company volume achieve 2 percent or greater. This is the first time we have achieved this result in over a decade. This revenue growth drove significant increases in net cash provided by operating activities and free cash flow. We will maintain our focus on driving core price, growing high margin volumes and controlling costs, positioning us for strong earnings and cash generation in 2017.”

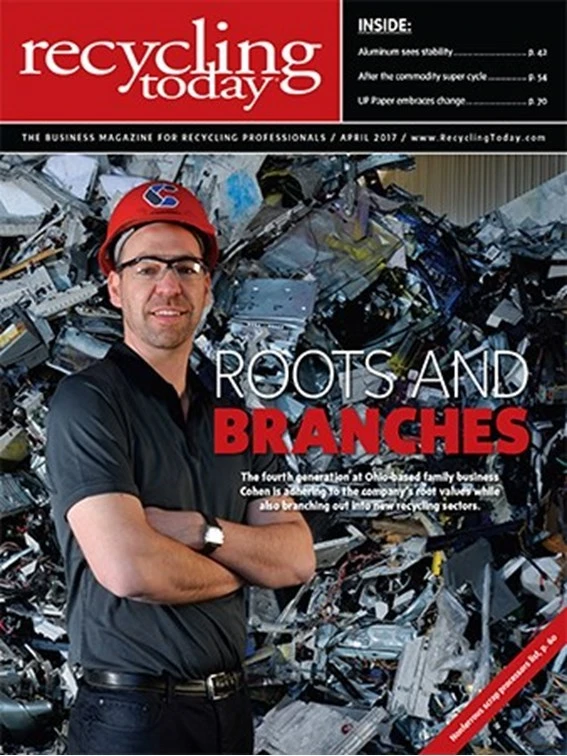

Explore the April 2017 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- BMW Group, Encory launch 'direct recycling’ of batteries

- Loom Carbon, RTI International partner to scale textile recycling technology

- Goodwill Industries of West Michigan, American Glass Mosaics partner to divert glass from landfill

- CARI forms federal advocacy partnership

- Monthly packaging papers shipments down in November

- STEEL Act aims to enhance trade enforcement to prevent dumping of steel in the US

- San Francisco schools introduce compostable lunch trays

- Aduro graduates from Shell GameChanger program