Recycling plastic scrap to make and sell new pellets is a familiar business model, but an original equipment manufacturer (OEM) that reprocesses other companies’ scrap in-house to make material for its own products takes the concept of circularity to another business level.

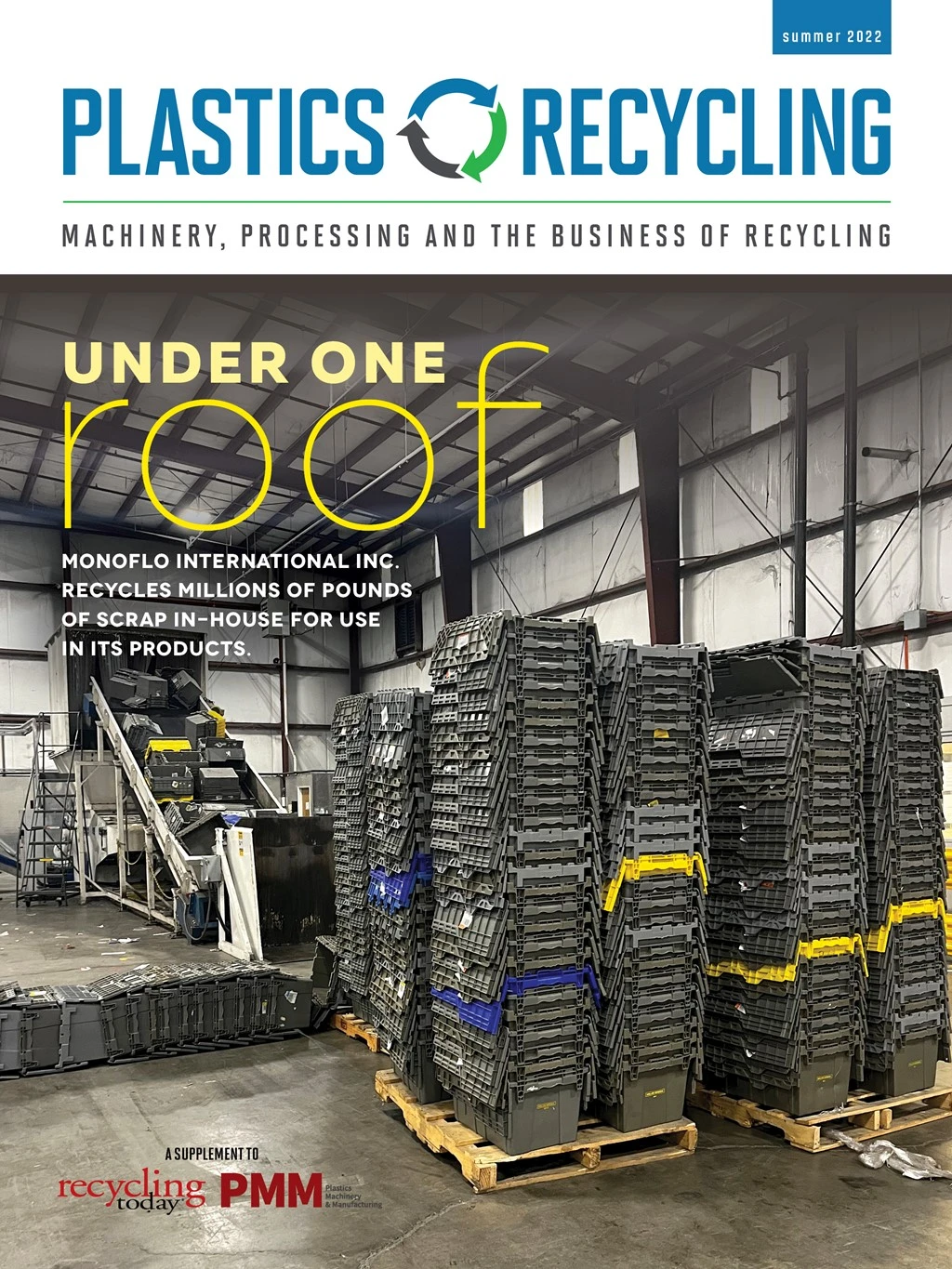

Monoflo International Inc., a Winchester, Virginia-based manufacturer of reusable transport packaging products, such as bulk containers, pallets and totes, recycles about 3 million pounds of scrap every month and mixes all of it with virgin resin to manufacture its own products.

Can recycling and manufacturing new products under the same roof be a successful business model? It has worked for Monoflo for more than 10 years. Annual sales growth of 10 percent to 30 percent is normal for the company.

“Recycled material is not more expensive when you are reprocessing it yourself,” says Ben Waterman, Monoflo business development manager. “But today, that delta is starting to shrink. It always makes good sense economically, but it makes more sense sustainabilitywise. So regardless of the economic benefit, there truly is a benefit for the environment.

“But there is still an economic value, especially for our customers,” Waterman continues. “Instead of throwing something into a landfill when it is broken, it has residual cash value. They can bring it back and we can recycle it.”

The process

Monoflo scours the country for high-density polyethylene (HDPE) and polypropylene (PP) rigid scrap, including its own products as well as competitors’ products that have reached the end of their useful lives. The company does not buy film or postconsumer scrap.

“Our machines are dialed in for rigid material,” Waterman says. “That’s a choice we have made so we can dial in the process.”

The material is shipped to Monoflo’s Virginia plant or to a smaller plant in Ottawa, Kansas, where it is shredded and contaminants are removed before it is extruded and pelletized.

The Winchester facility uses two shredders, one from Weima America Inc., Fort Mill, South Carolina, and one from Vecoplan LLC, Archdale, North Carolina. The shredders have a capacity of about 3,000 pounds per hour.

The next step is to remove metal before the regrind goes through a wash system from Herbold USA, North Smithfield, Rhode Island, to remove paper, adhesives and other contaminants.

The washed material again is checked for metal, then extruded using one of three extruders from Austria-based Erema. The strands of new resin are chopped into pellets, which are then fed into the company’s silo system.

Monoflo has capacity to reprocess about 5,000 pounds per hour in Virginia and 1,000 pounds per hour in the Kansas facility. The plants run 24/7.

Material waiting to be reprocessed is neatly stacked or stored in containers inside the processing area. Waterman says Monoflo also is adept at bringing material directly from the delivery truck to the shredder.

Highly automated

The company started making products for the logistics industry in the mid-1980s, but it was not until 2010 that planning for in-house reprocessing started. It took a few years to perfect the highly automated system, which launched with a capacity of about 1,000 pounds per hour at startup in 2012.

The Wittmann Group, Torrington, Connecticut, which already was supplying robots and material-handling equipment to the Virginia plant, designed the conveying system. Four Wittmann M7 control systems manage material handling in the main plant, including unloading virgin resin, moving reprocessed resin to silos and moving virgin and reprocessed material to wherever it is needed in the facility. Resin moves through overhead pneumatic pipes.

Approximately 8 percent of the total resin Monoflo uses is its own material that has been recycled in-house. The other 92 percent is virgin resin, which is delivered primarily by railcars. “There is not enough recycled material on the market,” Waterman says. “We are in a tough place for that.”

Some products can use up to 50 percent recycled material, depending on the customer’s requirements and Monoflo’s analysis of the best mix for a particular application, while some products are made with 100-percent-virgin resin. All products are tested by a third party for weight load, capacity and design.

Monoflo products serve four markets:

- distribution, which includes attached-lid totes, pallets and bulk containers, for which Monoflo is the market leader in containers to get products to retail locations;

- manufacturing and automotive, which includes bulk boxes, pallets and containers used in manufacturing and automotive plants;

- automation, which includes customized products used in e-commerce applications; and

- food and bakery, which includes reusable, easy-to-clean containers and trays designed to replace wood and paper products.

Monoflo’s customers include CVS, Ford and Target.

Technological investments

The company has a history of aggressively investing in technology to drive higher quality, faster cycle times and lower costs for customers.

The processing area of the Virginia plant houses 40 injection molding machines from JSW of Japan and KraussMaffei of Germany, and Monoflo has plans to increase the machine fleet by about 25 percent this year.

The plant uses extensive automation, with robots from KraussMaffei, Wittmann and Rochester Hills, Michigan-based Fanuc.

A notable automation project is a quick mold-change system for straight-wall containers. The automation reduced mold change time from two hours to less than 10 minutes. It was built by KraussMaffei and Swiss company Stäubli.

The system starts with molds being built in the same size base. A mold is moved out of the molding machine onto a cartridge table, which then shuttles to one side to place the new mold into the machine opening. Automated disconnects and connections for the new mold complete the process.

The system was designed because a customer needed 500 to 1,000 units of a particular container, which meant these molds had to be changed frequently.

Monoflo currently has two injection molding machines using the quick-change system, and Waterman says that could be expanded.

Innovative solutions

Monoflo works in markets that traditionally have used standardized designs, but it has seen success with innovating many of its products. “Anybody can make a bakery tray; it is not rocket science,” Waterman says. “But what we put into the bakery tray is huge.”

Monoflo implants radio frequency identification (RFID) tags into trays that provide full traceability.

“If there is a recall, they know exactly where the product was made and where it went,” he explains. “It is cloud-based and real-time information. We have done about 2 million of those trays.”

Monoflo’s largest bulk container is 4 feet by 3.8 feet and contains about 118 pounds of plastic. “We redesigned the container to use less material and last longer,” Waterman says. “By taking 20 pounds of material out and getting a higher-performing container, some of our large OEM customers that go through tens of thousands of these things realize great savings.”

Monoflo has a scrap rate well below 2 percent, but all its scrap and rejects are recycled. “Everything that we manufacture here—color changes, short shots, anything—we can take and recycle. Zero goes to the landfill.”

In addition to in-mold RFID, Monoflo offers rapid prototyping, barcoding, sequential numbering, custom colors and logo application.

The recycling and manufacturing areas of the plant are noticeably clean and free of clutter. Waterman says the recycling area of the plant is shut down several times a month for extensive cleaning.

Monoflo also uses an enterprise resource planning (ERP) system from IQMS, now DelmiaWorks, headquartered in Waltham, Massachusetts.

Training from Paulson Training Programs, Chester, Connecticut, are used in conjunction with the Plastic Injection Molding Academy (PIMA) Monoflo launched last year. PIMA recruits people through area high schools and community colleges, gives them a job and puts them through two years of training.

“After a couple years, they are fully certified and hopefully they stay in with us,” Waterman says. Six people are enrolled in PIMA currently, which also has been opened to current employees who want to advance.

A unique benefit for employees is the Monoflo concert series. The company books up-and-coming bands into a downtown venue and gives employees VIP passes, which include free food and beverages. Community members also can buy tickets. “It’s great for retention,” Waterman says.

Explore the Summer 2022 Plastics Recycling Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Orion ramping up Rocky Mountain Steel rail line

- Proposed bill would provide ‘regulatory clarity’ for chemical recycling

- Alberta Ag-Plastic pilot program continues, expands with renewed funding

- ReMA urges open intra-North American scrap trade

- Axium awarded by regional organization

- Update: China to introduce steel export quotas

- Thyssenkrupp idles capacity in Europe

- Phoenix Technologies closes Ohio rPET facility