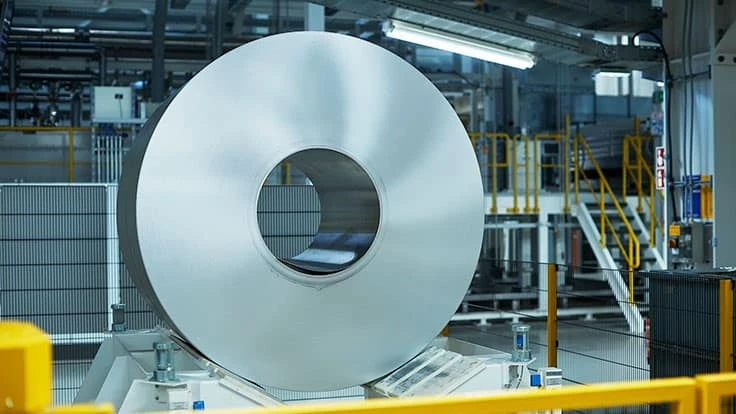

Photo courtesy of Norsk Hydro.

The London Metal Exchange (LME) and several aluminum producers have placed an increasing emphasis on distinguishing some metal as being low carbon, but whether such metal trades at a premium is not yet certain, according to participants in a recent online panel discussion.

Speaking at an LME Asia Week online roundtable in late May, Ben Jones of United Kingdom-based consultancy CRU said abundant low-carbon aluminum is on the global market today, but not yet enough buyers “willing to pay for green materials” to create a price premium for it.

Regarding copper, Jones said there is less of an “overhang” of existing low-carbon material, but that product also still needs “a lot of demand-pull” for low-carbon red metal to command a higher price in the global market.

Jones, though, also said, “We shouldn’t discount the possibility of tipping points” when it comes to low-carbon metals moving into price premium territory. Continued attention to a low-carbon agenda, the circular economy and carbon border tariffs could create “a cost of access for high carbon material,” said the consultant. The carbon border tariff in particular “really could be a driver” toward a price premium.

So, too, could the behavior of capital markets, said Jones, an observation also made by Richard Piechocki, head of sustainable trade and commodities with Netherlands-based Rabobank. Proof of sustainability is becoming “a baseline” that clients must achieve “to be good enough to be financed,” said the Dutch banker.

“We think [the lending industry] will reach a tipping point where sustainability will become the norm,” stated Piechocki, saying proof of low-carbon efforts will essentially be “a license to be financed” and that banks “won’t finance” activities considered outside of environmental, social and governance (ESG) guidelines.

“The coal industry could be the canary in the coal mine there,” said Jones of the finance industry’s role in the future of low-carbon metals. Banks and equity investors are “tuned in to these issues,” Jones said, adding “they have the potential to catalyze change. There is the real possibility for change in the future.”

In the same panel discussion, Deeksha Vats, chief sustainability officer of India-based Aditya Birla Group (which includes aluminum producers Novelis and Hindalco in its portfolio), said “collaboration and teamwork with all stakeholders in the value chain, from suppliers on one end to consumers on the other end” will continue to promote demand and transparency in the low-carbon metals sector.

Vats also touted United States-based Novelis as the world’s “highest user of recycled aluminum,” saying 62 percent of its metallic feedstock is aluminum scrap.

Fellow panelist Sun Lihui, of the China Chamber of Commerce of Metals (CCCMC), said that organization and many of its 6,500 member companies are working on translating global sustainability and ESG standards for the Chinese market while also developing its own standards. Sun said the CCCMC also is “working with the LME on a Responsible Procurement Policy.”

The discussion’s moderator, Hugo Brodie, the LME’s vice president of sustainability, said an LME effort is underway “to provide metal markets participants and our brands the option of greater transparency” via the ability of sustainability and ESG documents to be loaded onto its LMEselect online platform. That service will be introduced this summer, he said.

Latest from Recycling Today

- BMW Group, Encory launch 'direct recycling’ of batteries

- Loom Carbon, RTI International partner to scale textile recycling technology

- Goodwill Industries of West Michigan, American Glass Mosaics partner to divert glass from landfill

- CARI forms federal advocacy partnership

- Monthly packaging papers shipments down in November

- STEEL Act aims to enhance trade enforcement to prevent dumping of steel in the US

- San Francisco schools introduce compostable lunch trays

- Aduro graduates from Shell GameChanger program