For the past several years, recyclers have had a front-row seat to observe the emerging influence of China’s economy, seeing up-close how it has affected commodity markets.

Recyclers are by no means unified on what the emergence of China’s manufacturing sector means for the future of North America.

If it makes them feel any better, economists and policy makers seem equally uncertain what to make of China’s rapid growth and whether to welcome its ability to provide return on invested capital or fear its ability to act as a sponge for the world’s wealth and resources.

A recent news analysis in the Financial Times of London seeks the views of strategists and economists on what China’s booming economy will mean during the ensuing years. As background material, the article offers some remarkable statistics:

• In the first half of 2003, China’s iron ore imports rose 45 percent and its

copper imports 40 percent, pushing copper prices to their 14-year high

• China’s consumption of copper in 13 years has grown from 5 percent of the

global share to 20 percent

• China now accounts for anywhere from 20 percent to 33 percent of the

world’s consumption of iron ore, alumina, zinc, copper and stainless steel

(and, presumably, similarly impressive percentages of the scrap forms of

these metals)

• Volkswagen now sells more vehicles in China than it does in Germany.

While this is marveled at by some, it is a matter of concern to Berkshire Hathaway CEO Warren Buffett. One of America’s wealthiest men, Buffett has penned an essay for Fortune magazine, while also offering the disclaimer that "my forecasting record with respect to macroeconomics is far from inspiring."

But Buffett’s investing track record should merit some attention for his view that trade deficits since 1970 have resulted in a transfer of 5 percent of U.S. wealth to other nations, and that the trend is accelerating.

"Foreign ownership of our assets will grow at about $500 billion per year at the present trade-deficit level, which means that the deficit will be adding about one percentage point annually to foreigners’ net ownership of our national wealth," Buffett writes. "We have entered the world of negative compounding—goodbye pleasure, hello pain."

Sponsored Content

Labor that Works

With 25 years of experience, Leadpoint delivers cost-effective workforce solutions tailored to your needs. We handle the recruiting, hiring, training, and onboarding to deliver stable, productive, and safety-focused teams. Our commitment to safety and quality ensures peace of mind with a reliable workforce that helps you achieve your goals.

Buffett’s proposal to compel U.S. businesses—as an aggregate entity—to use an equal number of import credits and export credits each year would likely be shot down by an array of interest groups here and in global trade courts.

But, he concludes, "Make no mistake, a solution must come." He states in closing, "From what I now see, action to halt the rapid outflow of our national wealth is called for. Just keep remembering that this is not a small problem: For example, at the rate at which the rest of the world is now making net investments in the U.S., it could annually buy and sock away nearly 4 percent of our publicly traded stocks."

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

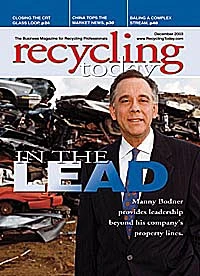

Explore the December 2003 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Steel Dynamics cites favorable conditions in Q1

- Hydro starts up construction in Spain

- Green Cubes unveils forklift battery line

- Rebar association points to trade turmoil

- LumiCup offers single-use plastic alternative

- European project yields recycled-content ABS

- ICM to host colocated events in Shanghai

- Astera runs into NIMBY concerns in Colorado