Batteries have become a larger part of the way people live and as a sector within the global economy, with a predominant reason being a transition away from fossil fuels.

The growing population and roster of applications for batteries have, for scrap processors, brought an industrywide (if clichéd) strengths, weaknesses, opportunities and challenges (SWOT) matrix.

An operational threat currently exists in the volatile and flammable nature of lithium-ion batteries, a configuration used not only in electric vehicles (EVs) but also in smartphones and numerous other smaller devices. Fires in shredder yard stockpiles have become all too common.

For several years, company owners and executives have discussed to what extent recycling lithium-ion batteries from end-of-life EVs represents an opportunity.

“For several years, company owners and executives have discussed to what extent recycling lithium-ion batteries from end-of-life EVs represents an opportunity.”

Spurred on in part by government prodding and incentives, automakers and battery producers have begun to establish the infrastructure needed to process end-of-life EV batteries to extract the lithium, cobalt, nickel and other metals deemed critical to an EV-heavy future.

Whether such investments in the United States yield a return on investment depends on numerous factors, including just how many EVs Americans want to buy in the next 20 years or so.

A presenter at a recent conference on EV battery recycling mentioned another potentially troubling circumstance: EV batteries outlasting their warranties and being exported or otherwise used in ways that question how many batteries actually will flow into battery recycling plants.

Another presenter at the same conference made a statement regarding end-of-life EV batteries that will ring true to veteran metals recyclers: “Access to scrap is going to be the key to survival in the [battery recycling] supply chain.”

For an American scrap processing sector that long ago learned to relinquish downstream recycling aspects of certain automotive components (such as lead-acid batteries and catalytic converters) to other companies, that old piece of wisdom could provide the best guidance.

Specifically, large-tonnage scrap companies that have established and experimented with their own auto salvage and dismantling business units could determine the first link in the chain is the proper place to be when it comes to establishing a presence in the EV battery recycling sector.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

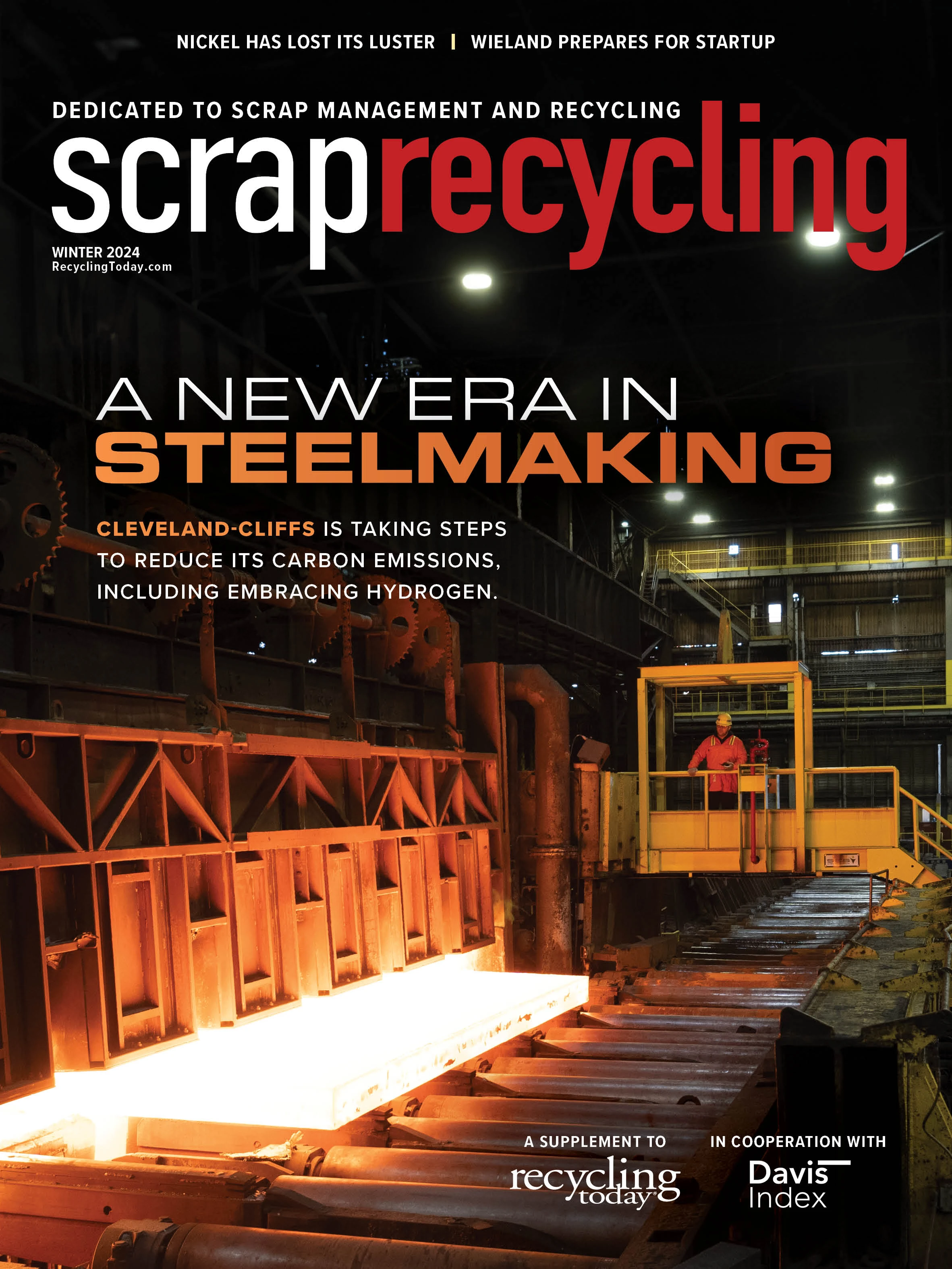

Explore the Winter 2024 Scrap Recycling Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Tomra applies GAINnext AI technology to upgrade wrought aluminum scrap

- Redwood Materials partners with Isuzu Commercial Truck

- The push for more supply

- ReMA PSI Chapter adds 7 members

- Joe Ursuy elected to NWRA Hall of Fame

- RRS adds to ownership team

- S3 Recycling Solutions acquires Electronics Recycling Solutions

- Nextek, Coveris to recycle food-grade plastic film