The following article is based on a presentation given by Nathan Fruchter at the Bureau of International Recycling (BIR) World Recycling Convention in Hong Kong in late May 2017. Fruchter has been a metals trader for more than three decades and currently leads Idoru Trading Corp., an independent scrap trading company based in the state of New York in the United States.

Five years ago, I met a junior scrap trader at a BIR conference in Rome. He made a good impression and seemed very knowledgeable about the ferrous scrap market. We engaged in a very nice conversation and he started to ask me all kinds of questions about what our industry was like before he started working in this business. I could not help but notice how he repeatedly commented to me things like:

- What do you mean ferrous scrap was not shipped in containers in those days?;

- I can’t believe you actually shipped a bulk cargo from Rotterdam to Korea; that makes no sense;

- I never heard of anyone shipping a U.S. East Coast cargo to Spain; and

- How did you export Russian scrap from the Soviet Union?

And then a light went on. It dawned on me that todays’ younger generation of traders, dealers and processors may have no clue what our trade was like 30 to 40 years ago. That gave me the idea to create this presentation. For some of you this will be a walk down memory lane. For others, it will be enlightening.

Some 34 years ago I walked into the New York City offices of Marc Rich & Co., one of the largest international commodities trading companies at the time, to interview for a job in its ferrous scrap department. I had no idea what ferrous scrap was, but a week later I was already on my first business trip, climbing on top of a pile of steel turnings in the port of Providence, Rhode Island, measuring the temperature of the cargo, to ensure it was not too hot to be loaded into a ship heading to Spain. And that is how I got started in ferrous scrap trading.

OLD SCHOOL COMMUNICATION

With communication being an integral part of every business, let’s consider how has that changed our industry over the years.

In 1984, it seemed like all communication went via Telex. There was no Internet, SMS, cellphones, Twitter or Facebook. None of that existed. Even fax machines were a very rare sight in those days.

In the Telex system, every letter (or character) cost money, so we had to write our offer in a condensed format, made up of abbreviated words. Today, when we send out an offer via email to our overseas clients, we spell it all out. We literally spoon feed them all the information and leave nothing to the imagination.

In 1984, when you sent out a Telex to book a deal, it took two to three days of back and forth Telexes and an occasional phone call during the night from your agent or client to try and overcome a few hurdles in order to make progress.

Today, you send an email out before you leave the office, and by the time you get home you already have a first email reply, to which you respond right away. During dinner, a second email comes back with further comments to which you reply, unless your family has a strict “no cellphone at the dinner table” policy. And by the time you finish your dinner, the deal is confirmed. Despite the fact that communication has advanced so much and is supposed to make our lives easier, we basically work much harder and more intensely today.

And, by the way, there was no electronic filing in those days. All Telexes were filled manually, so one copy was filed in each of these four file cabinet folders: shipping, sales, operations and archives.

FOLLOWING THE MONEY

I would say the development of the market price indicator (MPI) has changed the industry greatly. Today when you have a conversation with your colleagues, suppliers or buyers, you ask that ever-irritating question of “Where’s the market at?” or “Where’s today’s price?” The indicating number you will get is either a Turkish C&F (cost and freight) price for HMS (heavy melting steel) 80/20 in bulk or, if you’re an Asian buyer, a Taiwan C&F CY (Chinese yuan) price for HMS 80/20 in containers. But this was not always the case.

Back in the 1980s, we had a Korean C&F price for HMS No. 1 in bulk ex U.S. Also, we had a Turkish FOBST (free on board stowed and trimmed) Rotterdam price for shredded, and we had an Indian C&F price for shredded in Swiss francs.

Why were the Turks buying FOBST Rotterdam and the Indians in Swiss francs? In those days, the Turkish government gave out 30 percent rebates to companies that chartered Turkish flag vessels. As a result, Turkish steel mills chartered their own ships to enjoy these rebates.

The Indians were buying their scrap through the MSTC (Metal Scrap Trade Corporation) and always needed 180 days financing. The Swiss franc interest rate in those days was lower than the U.S. dollar’s. The Indians also enjoyed some special Indian rupee clearing terms with some of the East Bloc countries. As a result, they bought their cargoes in Swiss francs.

In the 1990s, we still had a Korean C&F price for HMS 1 in bulk ex U.S. But the Turkish price for shredded was then quoted on a C&F basis because the Turkish government did away with the 30 percent rebates, hence there was no more incentive to charter Turkish flag vessels. And the Indians dropped their MSTC buying setup. Individual mills stepped forward to buy their own cargoes and make their own financing arrangements. As a result, they switched to a U.S. dollar pricing system.

Come the 2000s, we still had a Korean C&F price for 80/20 in bulk, but slowly we started to see a CFR CY price for HMS 80/20 in containers. The Turkish C&F price was still there, and we started also to see the emergence of a CFR CY Taiwan price for HMS 80/20 in containers.

Fast forward to the 2010s and the Koreans have switched their container buying to non-U.S. sources. As a result, the two main MPI’s today are, like I said before, the Turkish C&F price for HMS 80/20 in bulk or, if you’re an Asian buyer, a Taiwan CFR CY price for HMS 80/20 in containers.

CHANGING FLOW PATTERNS

In my years in the business we have seen the rise of new export markets and the fall of old ones. In the '80s the U.S. exported scrap to Mexico, Spain, Italy, Greece, Turkey, India, South Korea and Japan.

In the '90s, Brazil joined the ranks of U.S. buyers, but Spain and Italy kind of dropped off that list. Other newcomers were, Indonesia, Malaysia, Singapore and Thailand.

Brazil’s imports were short lived and few by the 2000s, but Ecuador and Peru started buying U.S. scrap. Turkey and India were still going strong, and China, of course, came into the market with a vengeance. Most sellers flocked to become AQSIQ (General Administration of Quality Supervision, Inspection and Quarantine) registered, so they could ship to China. (I for one did not. I had no interest in being just another numbered supplier to a Chinese buyer when I was on a first name basis with my existing buyers.)

Today, our main buyers are Turkey, Mexico, India, Taiwan, Vietnam and, to a smaller extent, South Korea, Thailand, Ecuador and Bangladesh, to name just a few.

Geopolitics also has played a role in scrap flows. I was fortunate to witness the two most significant political event that changed our industry dramatically. These were the fall of the Berlin Wall in November of 1989 and the breakup of the Soviet Union in December of 1991.

Many of us remember when President Ronald Reagan gave his speech in front of the Brandenburg Gate, in June of 1987, when he said these famous words, “Mr. Gorbachev, tear down this wall.” Two years later on Nov. 9, 1989, the Berlin wall came down. West German scrap merchants did not waste any time. They all ran to East Germany trying to find a location that would generate scrap for exports, as East Germany had never exported any scrap. And, boy, was there a lot of scrap located on East German territory.

This event also gave Germany another deep sea port to export large bulk cargoes in the form of Rostock. For the next 10 years the scrap was just flowing out of East Germany. But the rest of the Communist Bloc countries were also bursting with scrap, and on Dec. 26, 1991, when the Soviet Union broke up, the entire map of scrap supplying countries underwent a dramatic change.

Suddenly, scrap was exported via the Baltic Sea from Estonia, Latvia, Lithuania and Russia and via the Black Sea from Ukraine, Russia and Georgia. We even saw scrap exports from as far north as the Barents Sea from Murmansk and Arkhangelsk. All these countries became important sources to the Turkish, Egyptian, Spanish and Italian mills.

Far eastern Russia had its own awakening, with exports from Vladivostok, Nakhodka, Magadan, Petropavlovsk, to name just a few. South Korean traders were flocking to these ports to set up all kinds of joint ventures with Russian processors. As a result, far east Russian scrap became a vital source of scrap to the Korean mills, which accounts for some drop in U.S. bulk exports to Korea over the years. The other reason Korea imports less U.S. bulk scrap is because they buy a lot of non-U.S. origin scrap in containers (as well as bulk) from Japan.

Natural disasters also can affect the scrap market. On Jan. 17, 1995, while living in London, I was awoken by a phone call at 2 a.m. It was my boss in New York, who said, “Nathan, I’m sorry to wake you in the middle of the night, but there was just a massive earthquake in Japan, you’ll see it on the news in the morning. Can you please make sure to go long. And I mean very long! Suck up every single ton of scrap that you can buy across Europe. Don’t leave a single ton behind. By the time New York opens, make sure to be 500,000 tons long.”

The damage this Kobe earthquake created was frightening. Japan needed a lot of steel to rebuild. Prices skyrocketed.

Fast forward to March 11, 2011. We all remember the devastating footage on TV of the carnage left behind by the Tohoku earthquake and tsunami. Again, I expected prices to skyrocket. But that was not the case this time. Prices merely continued sideways, a few dollars up, a few dollars down. I pondered for some time why the market did not react the same way, with a massive earthquake in the same country. The difference this time was that the tsunami devastated a lot of coastal areas of Japan, where wood was used for construction. The steel requirement was not as big as in 1995.

I cannot tell you how many times during the summer months I have heard German scrap dealers whining about the low water levels on the River Rhine because it has not rained in weeks. As a result, the barges cannot take a full load, driving the freight cost per ton up, making the price of scrap more expensive.

The opposite effect in the winter will also drive prices up. All you need is a good snowstorm along the U.S. East Coast, affecting ports in Massachusetts, Rhode Island, New York and New Jersey. Add some freezing temperatures and you have the makings of equipment breakdowns, stoppages, freeze-overs, slippery roads—enough to slow down the movement of scrap, send some shivers down the spines of some steel mills fearing they won’t get enough scrap, and a little bidding war breaks out, sending prices up.

SMALL CARGOES, BIG CHANGES

Without hesitation, the most significant event we saw in our industry in recent years was the start of container shipments for ferrous scrap. Ferrous scrap was always a bulk commodity. I think the Indian trader who started these container shipments really deserves a lifetime achievement award!

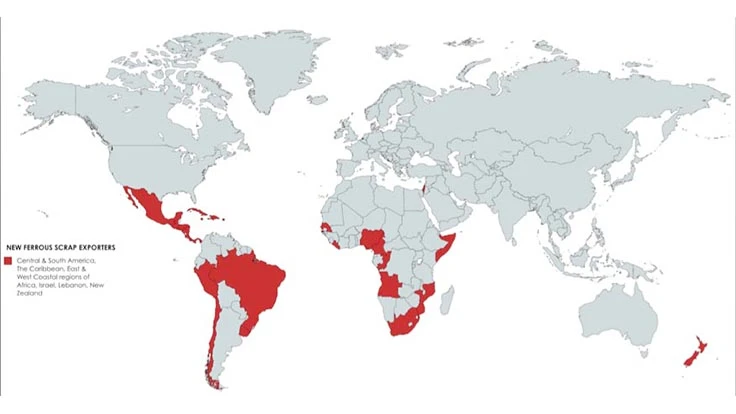

Container shipping opened up dozens of new places to global markets—places that had no access to a deep sea berth and could only dream of exporting. Well, their dream came through when containers were introduced. Central and South America, the Caribbean, and practically all African coastal areas became scrap export areas. But these smaller sized shipments also made life easier for the steel mills, who suddenly were not forced to buy bulk cargoes but were able to buy much smaller shipments, tying up less money.

What’s next? I am very confident that the next big thing will be LME (London Metal Exchange) futures trading. It’s already gaining some traction and it’s a matter of time until more people join the bandwagon. I for one see many advantages in it. It will help our industry move away from this scrap image, and define us more as a commodity sector, which it really is. We are not scrap traders. We really are recycled metals traders, and its time people also saw the industry this way.

Nathan Fruchter is the founder of Idoru Trading Corp., an independent ferrous scrap metal trading company that has expanded to include other recycled products. He started his career at Marc Rich & Co. in New York in 1984, He was later sent to London to build Glencore’s European ferrous scrap operations, developing trans-shipment terminals for the group in Rotterdam, Amsterdam and Antwerp, Belgium, and Gdansk, Poland. He also is the principal of Global Recycling Consult. a New York-based consulting firm assisting companies seeking help and services in the ferrous scrap and related sectors. Fruchter has a B.A. in economics and political science from Yeshiva University. He can be contacted at nfruchter@me.com.

Latest from Recycling Today

- Aqua Metals secures $1.5M loan, reports operational strides

- AF&PA urges veto of NY bill

- Aluminum Association includes recycling among 2025 policy priorities

- AISI applauds waterways spending bill

- Lux Research questions hydrogen’s transportation role

- Sonoco selling thermoformed, flexible packaging business to Toppan for $1.8B

- ReMA offers Superfund informational reports

- Hyster-Yale commits to US production