Photo by Brian Taylor.

The calendar flipping to June has not slowed down the momentum in either the steel or ferrous scrap markets in the United States, with busheling prices and steel output rising in the first week of this month.

Metals industry information service provider Davis Index says mill buying in the Midwest and East Coast regions has settled with prompt grade busheling rising by from $50 to $60 per ton in the early June buying period, while obsolete grades have fetched $50 per ton more compared with May.

Similar price gains were seen in the Southeast, Davis Index reports, with some mills and foundries in that quadrant of the country paying $66 per ton more for shredded scrap in June compared with May.

Buyers and sellers contacted by the information service company say they do not anticipate the market cooling off in July, instead estimating stable prices or increases in the $20 per ton range.

Demand for ferrous scrap within the United States also is steady to rising, based on steel mill output figures gathered by the Washington-based American Iron and Steel Institute (AISI).

AISI says in the week ending on June 5, steel mill output of 1.84 million tons rose by 0.2 percent compared with the week before. The week’s mill capability utilization (capacity) rate was 82.3 percent, marking the second straight week it has been above 80 percent, attaining a level it was unable to reach throughout several months of COVID-19-related economic sluggishness.

Year to date through June 5, the more than 39.5 million tons of steel made in the U.S. represents a 12.1 percent increase from the 35.3 million tons produced through June 5, 2020.

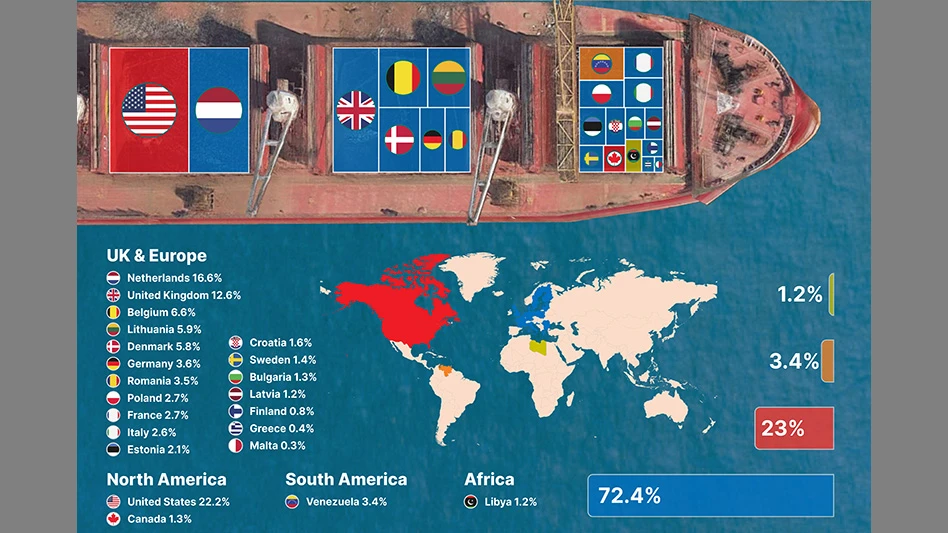

Overseas demand for ferrous scrap also remains a factor, though Davis Index reports the Turkish market—the largest for ferrous scrap exports off the U.S. East Coast—has been scaling back its demand. The news service also says demand from the Indian subcontinent is receding, with buyers from there and from East Asia possibly taking a “wait and see” attitude in case prices fall 30 days from now.

Steel and ferrous scrap prices have been rising steadily—and at times rapidly—in the last eight months. Mill buying transaction prices collected by the Raw Material Data Aggregation Service (RMDAS) of Pittsburgh-based Management Science Associates (MSA) shows prompt scrap rose nearly 84 percent in value from $313 per ton in November 2020 to $575 per ton in May of this year.

Although obsolete scrap grades are currently trading some $120 to $140 per ton less than prompt grades, they also have gained value the past several months. Shredded scrap, according to RMDAS figures, has risen by 50.7 percent from $298 per ton in November 2020 to $449 per ton this May. The No. 1 heavy melting steel (HMS) grade has gained $162 in value (a 60 percent rise) in that same time frame.

Latest from Recycling Today

- Recycling Today Media Group's battery recycling conference relocates in 2025

- IP amends DS Smith takeover bid

- Cleveland-Cliffs adds board member

- Blizzard interrupts collection routes

- Biden officially blocks Nippon Steel’s acquisition of US Steel

- Highland Sanitation awarded solid waste and recycling contract in Wanamingo, Minnesota

- Ecobat gathers support for California permit renewal

- RecyclX platform designed to provide materials transparency