Aluminum scrap and copper scrap, the two most widely handled nonferrous scrap metals, have taken different paths in late summer.

While markets for aluminum scrap and primary aluminum have held up fairly well over the past several quarters, prices have lagged throughout most of this decade. The steep glut of material on the global market dampened steadily increasing aluminum demand.

However, following significant cuts in capacity by many aluminum producers, aluminum prices have been strengthening through most of this year. Bullish market observers point to a steadily improving U.S. economy as well as to expanding end markets for aluminum as factors contributing to this strengthening.

Preliminary estimates from the Aluminum Association, Arlington, Virginia, support this optimism. Aluminum demand in the United States and Canada reached 12,548 million pounds during the first six months of 2014, a 2.5 percent increase from the same time last year, according to the Aluminum Association. Meanwhile, for the first half of this year, apparent consumption by domestic markets reached 10,714 million pounds, a 4.1 percent increase from the same time last year.

The improvement in the North American economy has not carried over to other parts of the world, however. The Aluminum Association notes that the export of aluminum ingot and mill products from the U.S. and Canada totaled 1,833 million pounds over the first six months, a drop of 5.8 percent from the first half of 2013.

On the scrap side, the U.S. Geological Survey (USGS), Department of Interior, reports that the recovery of aluminum scrap increased by nearly 3 percent to 3,255 million pounds over the first five months of 2014.

Reflecting softer demand for secondary aluminum offshore, the USGS reports that aluminum scrap exports over the first five months of this year dropped 7.9 percent to 1,497 million pounds compared with the same period in 2013.

Although aluminum scrap prices have held up fairly well over the past several quarters, that strength may be coming to an end, at least for a short time. A number of sources say aluminum scrap markets may have “gotten ahead of themselves” and could see some modest price corrections toward slightly lower levels.

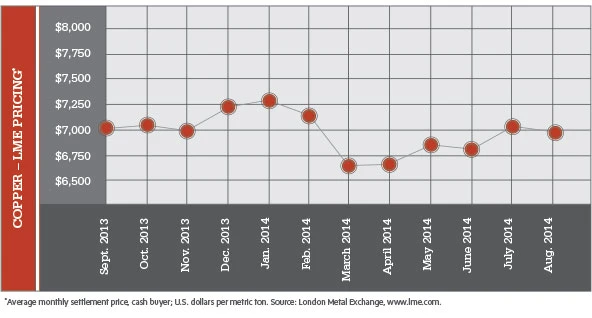

Copper scrap markets have been sluggish throughout the last 12 months. Despite a couple of unsustained moves to the upside, copper scrap prices have trended downward through most of this year.

One source of trepidation in the copper market is China. Buying patterns have come under greater scrutiny and questionable financing of copper (as well as of aluminum) at Chinese ports created negative pressure on the market.

Additionally, one of China’s largest power grid firms is being audited for questionable business practices. The power grid sector consumes roughly half of all the copper used in China, and the investigation could negatively affect copper demand as expansion projects slow.

Despite this news, the mood is optimistic when it comes to copper. A key factor has been the steadily improving U.S. economy, which is starting to trickle down to scrap dealers, who are seeing increased generation related to stronger manufacturing.

Explore the October 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Sonoco selling thermoformed, flexible packaging business to Toppan for $1.8B

- ReMA offers Superfund informational reports

- Hyster-Yale commits to US production

- STG selects SolarPanelRecycling.com as exclusive recycling partner

- Toyota receives $4.5M to support a circular domestic supply chain for EV batteries

- Greyparrot reports 2024 recycling trends

- Republic Services opens Colorado hauling facility

- ABTC awarded $144M DOE grant