The scrap recycling industry is experiencing a veritable "golden age." Prices for material are high, demand is strong, and buyers, especially in Asia, are displaying a huge and growing appetite for many recyclables.

Despite these positives, a major issue is concerning many recyclers. The lack of containers and space on oceangoing vessels is creating nightmare scenarios for many recyclers. Words such as "bad," "critical," "dreadful" and "horrendous" are being used by some exporters to describe the situation.

During the past several months, export demand has skyrocketed. Not only recyclable commodities, but grains and other raw materials, are being shipped via container to overseas destinations, increasing the demand for containers and room on oceangoing vessels.

The export of raw materials and goods from the United States has surged recently partly because of the soft U.S. dollar. This has increased demand for containers, which has had the secondary effect of increasing container pricing.

Additionally, fuel costs continue to increase, adding to the overall expense of moving material from the United States to foreign markets.

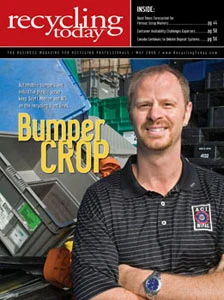

"Exports are booming," says Scott Krohn, with Orient Overseas Container Line (OOCL), based in Hong Kong. "Even with costs so high, we are not empty."

Bookings for containers have skyrocketed. However, for many shippers of recyclables, including scrap metal and scrap paper, the strong demand for containers often results in shippers of secondary materials falling down to the bottom of the order pile in favor of transporting higher-value goods.

Although they could book more orders with overseas consumers, many scrap exporters are finding it challenging to obtain the containers they need to ship their materials overseas.

CHANGE OF COURSEWhere have the containers gone?

Many shipping lines, seeing a better business environment outside of the United States, are opting to reposition more of their containers along their Europe-to-Asia routes.

Adding to the hurdles recyclers must face to get their material overseas, there also are indications that many ships that typically moved between the United States and Asia have been redirected to shipping lanes that run between Europe and Asia.

Shailesh Vyas, president of Bay Bridge Enterprises LLC, a scrap metal recycling company headquartered in Chesapeake, Va., says he has seen his company’s container shipments decline from more than 1,000 containers per month in 2007 to approximately 350 containers per month as of mid-April. Vyas adds that not long ago his company was shipping more than 1,300 containers per month to consumers in India.

Bay Bridge is no small operator, either. The company is a part of a large, billion-dollar India-based business conglomerate, which theoretically should give it some sway with the shipping lines.

Vyas says container availability is as bad as many people make it out to be. He estimates that while imports to the U.S. have declined by 40 percent to 45 percent, exports have increased, adding to the disparity of containers available for export shipments.

Additionally, the cost to ship material via containerized vessel has skyrocketed. "Last year I could ship a container for around $550; now I am paying around $1,200 per container," Vyas says.

To compensate for the lack of space and the higher costs associated with oceangoing shipments, Bay Bridge has made a number of strategic moves. For instance, the company is focusing more of its business in the less-constricted Europe-to-Asia shipping lanes. This transportation corridor offers a better cost structure for the company. Also, Bay Bridge is looking to redirect more of its ferrous scrap to domestic sources, shipping only shredded scrap via ocean liner, primarily to India and the Indian subcontinent.

Vyas says Bay Bridge is flexible and willing to ship to other regions of the world, including Pakistan and Bangladesh, but still continues to be plagued with limited container availability.

GOOD NEWS, BAD NEWSAfter years of reports noting that the United States was in a growing trade imbalance, with more containers entering the country than leaving, the decline in the U.S. dollar has resulted in a stronger export environment. The difference between the U.S. dollar and many foreign currencies is making it more lucrative for overseas firms to buy U.S. products. This has resulted in a boom in exports from the United States.

One exporter notes that in the past, roughly 2.5 containers came into the United States for each outgoing container. That imbalance has declined to two to one, he says, as a result of the reduced flow of containers with new consumer goods coming into the country.

Additionally, the weight disparity between inbound containers, which often are filled with finished products, and outgoing vessels full of ferrous scrap material—which can weigh nearly three times as much—is shrinking the space available on outgoing vessels, as some container lines opt to book lighter containers. One exporter says shipping lines "prefer volume to weight. They make more money with lighter loads."

Additionally, with the increase in container orders, shipping lines are looking to place containers with higher-value cargo, leaving shipments of most recyclables, including scrap paper and scrap metal, toward the bottom of the list.

OOCL’s Krohn is optimistic, however. While acknowledging that the current situation is difficult, he notes some relief could be coming. Mid-May through October is the peak season for imports into the United States, as retailers stock up in anticipation of Christmas sales. With the influx of containers, the situation should ease a bit. It may not bring the total relief some are seeking, but Krohn says he feels it will help to ease the situation.

While some companies may point an accusatory finger at shipping lines, which have raised their rates significantly, Krohn says these companies have been withstanding sharply higher fuel costs for quite some time and must offset them.

While some exporters have grumbled that shipping lines are just dictating the price and availability for shippers, Edward Zaninelli, vice president of Transpacific Westbound Trade with OOCL, says that in the past container lines have ended up subsidizing the cost for fuel for shippers. However, with fuel prices soaring, it is no longer feasible to do this. The result is the sticker shock many exporters are now experiencing.

Additionally, the movement toward a "green" approach to business has meant that shipping lines have had to make changes in the type of fuel they use, which has added costs.

While the shipping situation is difficult throughout the country, some regions are experiencing additional challenges. The West Coast, while feeling the pinch, is not suffering as much as other regions, especially the inland Midwest, in light of the large number of shipping lines that use the ports of Los Angeles, Long Beach and Oakland.

Steve Gilbert with Global Recycling Inc., a scrap recycler based in New York State, concurs that problems are far greater on the East Coast than on the West Coast.

THE MIDWESTERN BLUESAs challenging as the market is on the East Coast, for some companies the Midwest poses the greatest challenge of all. With such demand for containers and higher fuel costs, vendors that seek containers for intermodal shipments or IPI (inland port intermodal) shipments are finding minimal availability.

Gilbert says he feels there will be modest improvements by the end of the second quarter of this year. "There are no short-term solutions," he notes.

Gilbert says Global Recycling saw the problem of oceangoing shipments exacerbating six months ago and made adjustments to lessen the negative impact on its business.

Bay Bridge’s Vyas says it is important to work more closely with the ship lines in this new environment.

In the short term, several companies, including Bay Bridge, are looking at increasing their breakbulk shipments.

While ferrous scrap has been shipped in breakbulk vessels traditionally, more recyclers have sought to move material by container. This method has been more common on the West Coast, through it is growing on the East Coast.

Several scrap metal recyclers also are in the process of loading breakbulk shipments of ferrous scrap from Northeastern ports.

However, Gilbert says this method also has its problems. If a company is short of scrap to fill a vessel, a jump in ferrous prices, such as the one seen during April, could be extremely damaging to its bottom line. With market volatility the norm these days, more companies are opting to play it safe.

However, with containers in short supply, breakbulk shipments may be the only way to meet the orders that have been coming into the United States.

A recent report in the Wall Street Journal notes that along with the container shortage, equipment such as wheels and frames on container-carrying trucks also is in short supply. Without these, it is impossible to move the containers.

The author is senior and Internet editor for Recycling Today and can be contacted at dsandoval@gie.net.

Explore the May 2008 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Nucor receives West Virginia funding assist

- Ferrous market ends 2024 in familiar rut

- Aqua Metals secures $1.5M loan, reports operational strides

- AF&PA urges veto of NY bill

- Aluminum Association includes recycling among 2025 policy priorities

- AISI applauds waterways spending bill

- Lux Research questions hydrogen’s transportation role

- Sonoco selling thermoformed, flexible packaging business to Toppan for $1.8B