When Tigard, Oregon-based chemical recycler Agilyx Corp. formed Cyclyx International Inc. in 2020, the purpose of the subsidiary was to help develop new supply chains to collect and reprocess larger volumes of postuse plastics than current systems could support.

At the time, Agilyx said the Cyclyx platform was developed to be an industry consortium comprised of partners across the value chain that would enable the company to have a greater impact with plastic recycling solutions across many more industry sectors.

“As a company striving to increase global plastic recovery, we have found that the data generated over our history can be used as a key tool to greatly expand and accelerate the recycling of postuse plastics,” then-Agilyx CEO Joe Vaillancourt said when Cyclyx was formed. “We initially developed Cyclyx to help source plastic feedstocks appropriate for facilities we are currently developing on three different continents. We quickly discovered that our process was greatly needed by others in the advanced recycling as well as mechanical recycling industries. As a result, we have created Cyclyx so that Agilyx and many other companies can work together to help bridge that gap.”

Fast forward to this year, and the Portsmouth, New Hampshire-based subsidiary has grown exponentially, establishing a collection foothold in Houston while developing a network of 44 partners that include AstroTurf, PepsiCo and Union Pacific.

As part of a joint venture with global petrochemical companies ExxonMobil and LyondellBasell, both with headquarters in Houston, Cyclyx is poised to open its first Circularity Center, or CCC1, in the Houston area in 2025, which will have the capacity to produce hundreds of millions of pounds of plastic feedstock per year for its advanced and mechanical recycling partners.

The material Cyclyx is procuring for its facility is coming from postconsumer, postcommercial and postindustrial sources, as well as from its own 10to90 recycling program, where Houston-area residents have been encouraged to bring plastic items of all types to various collection sites since 2022.

The company has continued to increase its offerings. In 2022, it commissioned the Cyclyx Circularity Lab in Portsmouth, which allows it qualify a broader range of qualities of plastic scrap—and significantly greater quantities of it—for potential use at CCC1.

In 2023, it launched Cyclyx Brokerage Services to address plastic streams it has sourced but that are not appropriate for processing at CCC1 based on the needs of its specific offtake partners.

Houston, we have plastic

Diverting plastic from landfills has been Cyclyx’s focus since its inception, and its 10to90 initiative has served as its engine.

The name “10to90” refers to the company’s goal of increasing the recyclability of plastic from 10 percent to 90 percent, and since 2022, it has challenged corporations, retailers, communities, schools and residents to get involved through takeback programs, education, rewards and engagement tools sponsored by consortium members.

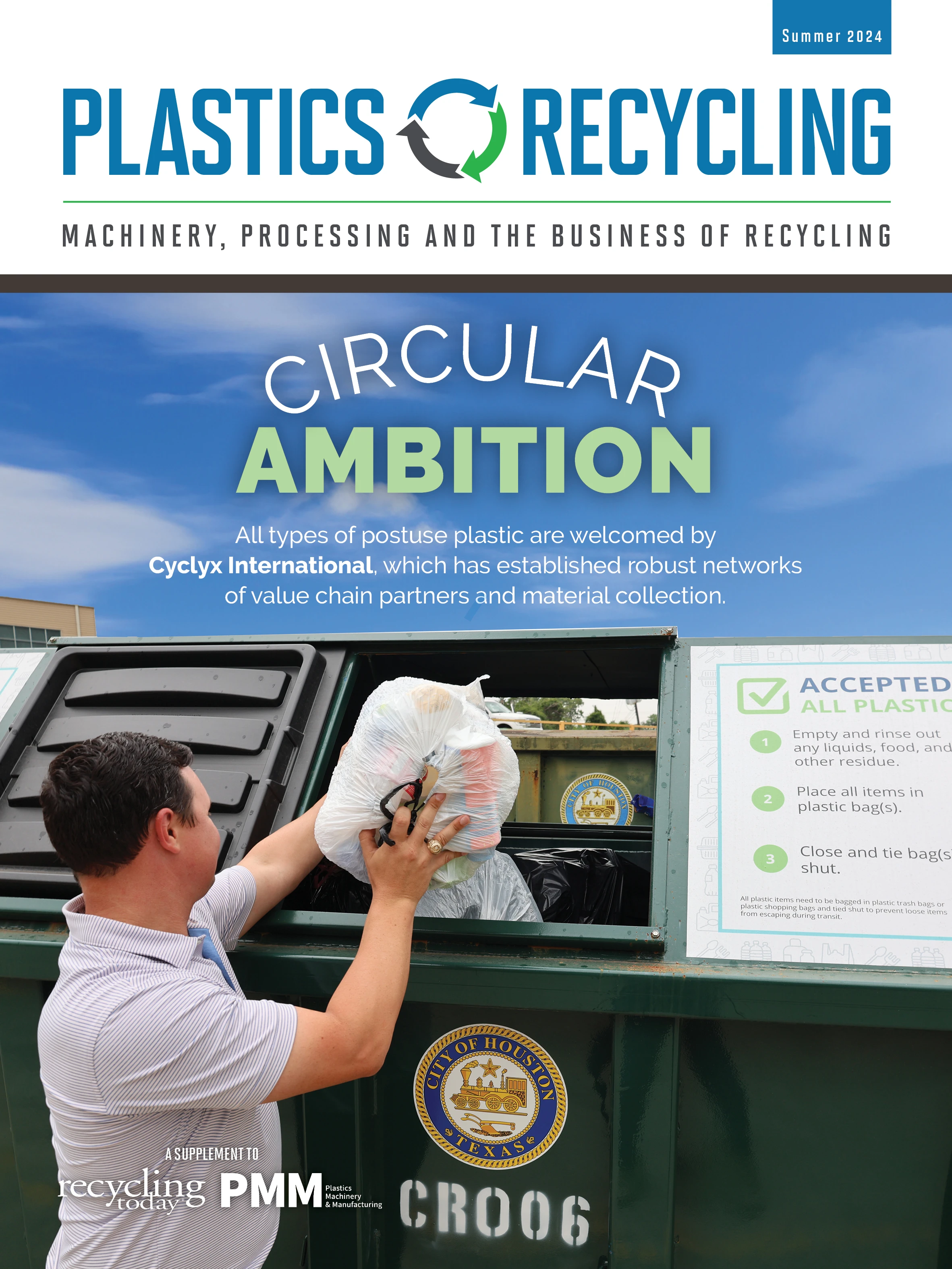

In December 2022, Cyclyx started its first 10to90 All-Plastic Bag It & Bring It takeback program in Kingwood—a neighborhood in northeast Houston—in collaboration with the Houston Recycling Collaboration (HRC), receiving a strong response from the community of more than 81,000 residents. In its first weekend, the Kingwood site collected 3,900 pounds of plastic scrap.

Bag It & Bring It has since expanded to include eight sites in Houston, plus a pilot program in the Houston Independent School District. The program accepts Nos. 1-7 plastics, including straws, takeout containers, dry cleaner bags, bubble wrap and polystyrene foam, as well as unnumbered plastics, such as chip bags, baby bottles, CDs and plastic wrap.

In an April news release, Houston Solid Waste Director Mark Wilfalk says the public response from the initial 10to90 collection effort was overwhelmingly positive.

“Broadening our collection efforts will provide Houstonians with more opportunities to divert these additional plastics from our waste stream,” he says.

Since 2022, Cyclyx says it has collected more than 440,000 pounds of plastic, which is tested at its circularity lab to determine recyclability. The material collected from 10to90 sites in Houston is being inventoried until CCC1 opens.

“Based on what is currently collected for recycling in the area, approximately 70 percent of the plastic collected through the 10to90 programs would have gone to landfill,” Cyclyx says. “We are proud to be able to put this plastic waste on a recycling pathway.”

The company adds that its 10to90 format allows municipalities to integrate it into their existing collection processes for a more “accessible, simplified process” that leads to increased community participation.

“We are always interested in having conversations with municipalities that would like to explore how a 10to90 program can be deployed in their communities,” Cyclyx says. “We anticipate continued growth over the next year with the opening of more collection sites and the introduction of new Cyclyx consortium members.”

Cyclyx President of Postconsumer Programs Robert Dishman says the platform offers municipalities benefits such as the creation of a simplified collection process; the ability to integrate Cyclyx’s collections into any current agreement with recycling partners; and the ability to introduce a replicable all-plastic collection model that will enable the legacy collection infrastructure to include more plastic types.

“This will reduce the amount of plastic destined for the landfill, which will benefit our communities, the environment and the circular economy,” he says.

New digs

Anticipation is high for CCC1, which will use the plastic scrap collected through 10to90 programming and other sources to produce sorted, custom-blended feedstock for its partners in the advanced and mechanical recycling sectors. Throughout its process, Cyclyx says it adheres to ISCC Plus standards to ensure the delivery of traceable, certified feedstocks through CCC1.

The company says the facility, located at the Houston Tradeport, will be able to produce 300 million pounds of feedstock per year and is expected to begin operations by mid-2025. By comparison, Cyclyx says a typical material recovery facility (MRF) produces anywhere from 10 million to 30 million pounds per year of recycled plastic.

The facility will be housed in an existing 525,000-square-foot warehouse in Houston, which Cyclyx is retrofitting to meet its design. The company notes that procurement of equipment is underway, with deliveries of equipment slated for the third quarter of this year.

“We have completed the necessary engineering work and are ready to begin construction,” Cyclyx says, adding that contractors were to begin mobilizing to the site for the in-building civil work in June, followed by the installation and commissioning of the processing equipment.

December 2022 in Houston’s Kingwood community

and has since expanded to eight locations. More than

440,000 pounds of plastic have been collected as

of mid-May.

Additionally, Cyclyx is renovating the building’s office space and is constructing an on-site circularity lab.

In December 2023, Cyclyx announced that partners ExxonMobil and LyondellBasell would invest $135 million to fund operating activities and construction costs for the new facility, which will create more than 100 jobs, with additional positions created off-site related to CCC development, including in logistics and collection programs.

“This milestone is evidence of the real progress we are making to increase the circularity of plastic waste as a resource,” Vaillancourt, now CEO of Cyclyx, said when announcing the investment agreement. “The first-of-its-kind CCC in Houston will serve as a blueprint, which we can replicate across the U.S. to progress our long-term goal of increasing the recycling options for plastic waste. Cyclyx is proud to be an innovator and enabler for unlocking plastic’s potential.”

Repeatable action

Cyclyx’s facility plans don’t end with CCC1. The company believes the design is repeatable and already is in the final stages of selecting a second location. Combined, the company says the two facilities could have the capacity to produce up to 600 million pounds of feedstock per year.

“The production capacity of CCC2 will be dependent on the location, but we anticipate it will be comparable to that of CCC1,” Cyclyx says.

Meanwhile, it continues to collect material in Houston, which started with the Kingwood Recycling Center. Since 2022, Cyclyx has added locations such as the North Main Neighborhood Depository/Recycling Center, the Westpark Consumer Recycling Center and, since April, depository/ recycling centers in the neighborhoods of Sommermeyer, Kirkpatrick, Sunbeam, Southwest and Central Street.

The company continues to add partners to its consortium from across the value chain, too.

This year, new members include TrinityRail and the Vinyl Institute. In 2023, it added 10 partners, including Savage, Vinmar International, Evergreen, Newpark Resources Inc., Freepoint Eco-Systems, the Galveston Island Park Board of Trustees, Teknor Apex, AstroTurf, CheckSammy and Again Technologies.

“We look to all our consortium members as integral and valuable stakeholders in the value chain of plastics that help make what we do possible through collaboration,” Cyclyx says. “It is encouraging to see companies come together with shared goals and values for a plastic circular economy. For example, the support we receive from the city of Houston and from ExxonMobil and LyondellBasell in their sponsorship of our 10to90 programs in Houston has been instrumental in the success of the programs.”

The author is associate editor of Recycling Today and can be reached at cvoloschuk@gie.net.

Explore the Summer 2024 Plastics Recycling Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Orion ramping up Rocky Mountain Steel rail line

- Proposed bill would provide ‘regulatory clarity’ for chemical recycling

- Alberta Ag-Plastic pilot program continues, expands with renewed funding

- ReMA urges open intra-North American scrap trade

- Axium awarded by regional organization

- Update: China to introduce steel export quotas

- Thyssenkrupp idles capacity in Europe

- Phoenix Technologies closes Ohio rPET facility