When the scrap recycling industry gathers for the Institute of Scrap Recycling Industries (ISRI) 2016 Convention & Exposition in early April, it will have no shortage of issues to discuss or causes for concern as its member companies attempt to be profitable in 2016.

Throughout 2015, recyclers of most materials—and especially of metals—faced the difficult task of operating in an environment of falling prices. The first quarter of 2016 has brought with it a continuation of previous concerns and the presentation of new ones, with events in all three of the world’s largest economic regions raising questions about how they will be resolved.

Often attracting the most attention is the economy of China, which clearly is facing constraints to its recent pace of robust growth. Scrap recyclers are all too familiar with how China’s economy and decisions by its government ministries can stimulate rapid changes to the demand for and pricing of secondary raw materials.

In 2016, questions focus largely on the ability of China to, on the one hand, scale back its overly generous production of steel and other basic materials and, on the other, maintain enough economic growth to consume materials such as steel, aluminum, copper and containerboard.

Europe, as of the fourth quarter of 2015, is continuing to experience slow economic growth. The biggest news story in Europe—its sudden absorption of migrants from the Middle East, Africa and central Asia—also ties into its economic outlook. Germany, in particular, will be facing the challenge of either supporting such migrants or integrating them into its workforce.

The United States is experiencing economic growth at a slightly faster pace than Europe. However, among the events likely to cause angst among business decision-makers in 2016 is that it’s a presidential election year.

“The United States is experiencing economic growth, but among the events likely to cause angst among business decision-makers in 2016 is that it’s a presidential election year.”

The campaign is still in its early stages, but thus far one party has an emerging candidate who steadfastly believes wages should rise and large companies should pay a higher percentage of their profits into the national treasury. The other party has produced a front-runner (as of this writing) who is a property developer turned reality TV star turned presidential candidate with an exceedingly unclear agenda, other than to say that immigrants are unwelcome.

No matter what their political beliefs, many investors and business managers seemed to demonstrate in 2012 that they get cold feet when tax-and-spend policies in Washington face near-term uncertainty.

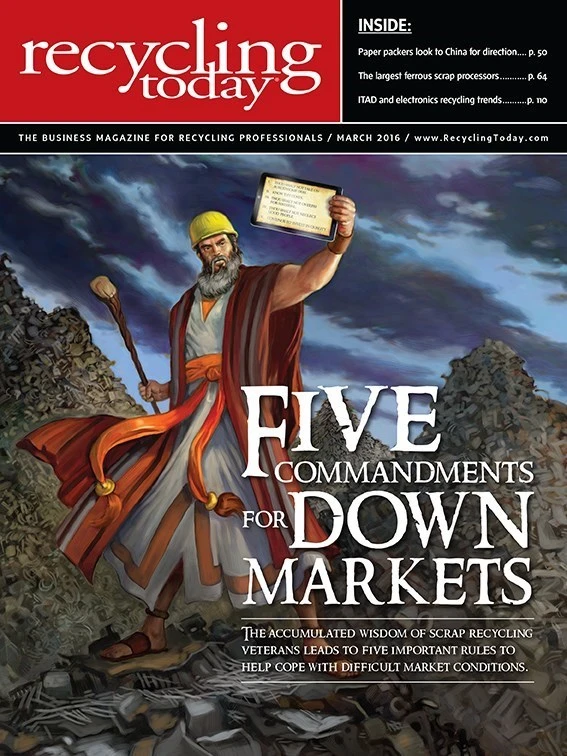

The recycling business owners and managers who will gather at the ISRI convention have been through such periods of uncertainty before. That isn’t likely to make 2016 any easier; but, as demonstrated in our cover story starting on page 36, it can help them manage through difficult situations.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Explore the March 2016 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Green Cubes unveils forklift battery line

- Rebar association points to trade turmoil

- LumiCup offers single-use plastic alternative

- European project yields recycled-content ABS

- ICM to host colocated events in Shanghai

- Astera runs into NIMBY concerns in Colorado

- ReMA opposes European efforts seeking export restrictions for recyclables

- Fresh Perspective: Raj Bagaria