Scrap recycling can be a difficult way to make a living for many reasons, but one of the more frustrating ones is that a company’s desire to increase its output is not a decision that lies entirely within its own hands.

During most monthly or quarterly stretches in the previous seven years, even scrap facility operators who seem to be doing everything right—providing outstanding customer service and setting scale prices at the optimal point—have been unable to return to volume levels reached from 2006 through the first half of 2008.

Unless factories are humming and peddlers are motivated by attractive pricing, a recycler can do little to entice additional scrap into even the most well-run facility.

That reality has been the major reason why Recycling Today’s updated list of the 20 Largest Ferrous Scrap Processors in North America, which is based on 2015 data, largely features lower volume figures for the companies ranked compared with versions of the list published in 2014, 2012 or earlier.

DOUBLE-DIGIT DECLINE

Based on overall economic measures, 2015 was not a recessionary year or one that for retailers, some manufacturers or other industry sectors was particularly different from 2013. In fact, passenger vehicle sales in the United States in 2015, at nearly 17.5 million, set a new record.

Unhappy outliers to that trend, however, included the plunging value of mineral and metal commodities and the dire circumstances of the North American steel industry. (See the article “Crisis Level.”)

Both of these outliers combined to squeeze flows of ferrous and nonferrous scrap heading into recycling facilities. The peddlers and scavengers in particular who bring obsolete scrap into smaller yards increasingly have been less motivated to do so as the value of both copper and steel dropped throughout 2015.

The outcome for scrap recyclers, even the largest and most well-established, is reflected by an average drop of 12 percent in ferrous scrap volumes by those that reported 2013 and 2015 figures.

Recyclers contacted by Recycling Today as well as the financial reports prepared by publicly traded scrap companies strike a nearly unanimous chord. Scrap flows declined as the year progressed in 2015 and prices continued to fall.

Summarizing North American metals recycling activity in its 2015 fiscal year (which ended June 30, 2015), Sims Metal Management pointed to intake volumes that were down by 15.8 percent. In their presentation to shareholders, Sims CEO Galdino Claro and Chief Financial Officer Fred Knechtel commented, “During the third quarter [running from Jan. 1, 2015, to March 31, 2015], the 24 percent drop in ferrous scrap prices and the severe winter weather led to reduced group volumes of 18 percent versus the prior quarter and 17 percent versus the prior year.”

Family-owned recycling companies largely did not report holding onto volumes with greater success. Behr Iron & Metal in the Midwest and Newell Recycling LLC in the Southeast reported volumes down by more than 30 percent in 2015 compared with 2013.

If, as John F. Kennedy said, a rising tide lifts all boats, an ebbing tide seems to be leaving all recyclers scrambling to keep their processing machinery fed.

FERROUS MALFUNCTIONS?

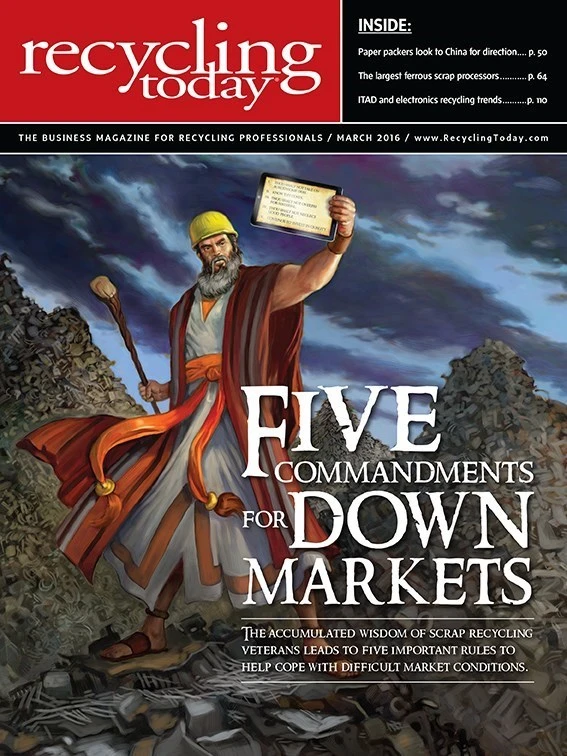

One recycler contacted for the March issue cover story on coping with a difficult market (See “Five Commandments for Down Markets.”) says a lower price environment, if it is relatively stable, is not inherently harmful to operators.

Albert Cozzi, an owner of Bellwood, Illinois-based Cozzi Recycling and a decades-long veteran of the scrap industry, offers context for his reasoning.

“If you look back at scrap trading ranges, from 2004 until 2014 No. 1 heavy melting steel (HMS) grades of scrap traded in a range of $350 to $450 per ton, with short periods slightly below and other periods substantially above these levels,” he says.

“From the 1950s to 1974, [ferrous] scrap traded in a range of $30 to $40 per ton. Prior to that, from 1974 until 2003, a period of 30 years, scrap basically traded between a range of $80 to $120 per ton, with a few runups to $140,” says Cozzi.

“Remember the outcry when scrap hit $140 per ton, and I predicted bundles would hit $200 per ton?” asks Cozzi, referring to comments he made at an industry conference in the late 1990s, when ferrous pricing had not yet hit that benchmark.

He continues, “Whether the price was $40 per ton or $140 per ton, people made money, and the industry was healthy” from the 1950s into the current millennium. “Now it looks like the new range will be between $175 and $225. But somehow when the prices were over $300 per ton in 2014 and early 2015, very few companies were profitable.”

Cozzi says he sees reasons beyond smaller prices for reduced profits operators may be experiencing currently: “Certainly some of that is attributed to softening markets, where orders are tougher to come by, grading is tougher and spreads are diminished because of narrowing margins on upgrades. But that is only a small part of the bigger issue of a lack of discipline in pricing and everyone chasing that last ton.”

He also points his finger at the steelmaking ownership composition of some of America’s largest tonnage ferrous scrap processors. “Another phenomenon affecting the profitability of the scrap industry currently is the advent of steel-mill-owned scrap companies,” Cozzi says. “It has long been my perception that steel mills are more concerned in the control of the ferrous units. They run their equipment to maximize production rather than profitability and rarely analyze how their behavior affects the rest of the market or their costs for material,” he says.

If the steelmakers that also appear on the current list of North America’s Largest Ferrous Scrap Processors are enjoying the current market, however, it is not necessarily reflected in their earnings reports.

In the comments accompanying its year-end and fourth quarter 2015 financial results, Steel Dynamics Inc. (SDI), Fort Wayne, Indiana, owner of No. 3 ranked OmniSource, says, “The company’s metals recycling operations recorded an adjusted fourth quarter 2015 operating loss of $16 million (excluding noncash goodwill and asset impairment charges), compared to third quarter 2015 operating income of $463,000. Based on lower domestic steel mill production utilization and traditional year-end steel mill scrap inventory reduction, fourth quarter 2015 ferrous scrap shipments declined 12 percent.”

SDI also says its steelmaking side did not benefit from lower scrap prices: “Average steel product pricing [in the fourth quarter of 2015] declined more than consumed raw material scrap costs, resulting in slight steel metal spread compression. The fourth quarter 2015 average product selling price for the company’s steel operations decreased $51 to $614 per ton [while] the average ferrous scrap cost per ton melted decreased $47 to $205 per ton.”

No matter how a ferrous scrap company is structured, the 2015 and early 2016 market has not made securing supply an easy task.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Explore the March 2016 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Lego creates miniature tire recycling market

- Lux Research webinar examines chemical recycling timetables

- Plastics producer tracks pulse of wire recycling market

- Republic Services, Blue Polymers open Indianapolis recycling complex

- Altilium produces EV battery cells using recycled materials

- Brightmark enters subsidiaries of Indiana recycling facility into Chapter 11

- Freepoint Eco-Systems receives $50M loan for plastics recycling facility

- PET thermoform recycling the focus of new NAPCOR white paper