Graph courtesy of the Aluminum Association

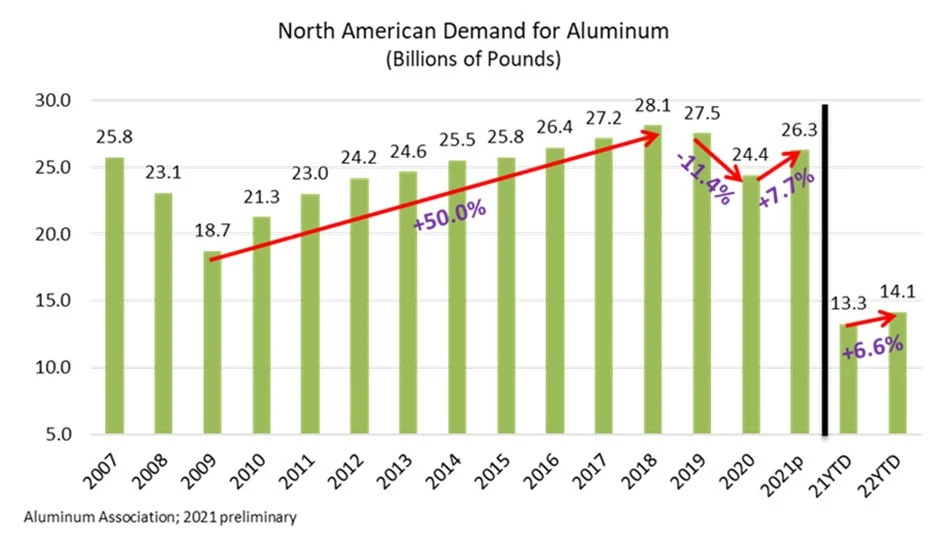

The Aluminum Association, Arlington, Virginia, says preliminary estimates show demand grew 6.6 percent for the aluminum industry in the U.S. and Canada through the first half of 2022 following estimated growth of nearly 8 percent year-over-year in 2021 and growing demand levels estimated during the first quarter.

Since 2021, the Aluminum Association says its member companies, including Hydro, Novelis and Rio Tinto, have announced more than $3.7 billion in investments in domestic manufacturing operations, including new, U.S.-based greenfield facilities for the first time in decades. Other companies, such as Mana Capital Partners and Ball and Steel Dynamics Inc., have announced additional aluminum investments in the U.S. in recent months totaling more than $4 billion.

Related: Alcoa warns of aluminum overcapacity

“We are seeing strong demand and truly unprecedented levels of investment in the U.S. aluminum industry today,” says Charles Johnson, president and CEO of the Aluminum Association. “America is one of the best places in the world to make aluminum, and our industry is putting its money where its mouth is to ensure a strong, vibrant domestic industry for years to come.”

The Aluminum Association points to a number of key takeaways from its monthly “Aluminum Situation” report:

- Aluminum demand in the U.S. and Canada (shipments by domestic producers plus imports) totaled an estimated 14.1 billion pounds through June, 6.6 percent more than in the same period in 2021.

- Nearly all major semifabricated, or mill, product categories saw increased year-over-year demand growth in the first half of 2022, led by sheet and plate products (12.5 percent) and electrical wire and cable (9.2 percent). In total, mill product demand grew 9.1 percent year-over-year through June 2022.

- Aluminum exports (excluding scrap) to foreign countries declined 18 percent from the year-ago level.

- Imported aluminum and aluminum products into North America (U.S. and Canada) have grown 35.7 percent year-to-date through the second quarter, reaching 4.7 billion pounds. While growing, the year-to-date import levels remain below the level of imports seen over the same period as recently as 2019.

According to the association’s quarterly "Sheet & Plate End Use Report,” growth in the containers and packaging segment has helped drive some of the increase in overall aluminum demand. Domestic producer shipments in this segment grew 13.1 percent year to date through June 2022.

Related: CMI publishes beverage can recycling primer, road map

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Latest from Recycling Today

- Toppoint Holdings expands chassis fleet

- Lego creates miniature tire recycling market

- Lux Research webinar examines chemical recycling timetables

- Plastics producer tracks pulse of wire recycling market

- Republic Services, Blue Polymers open Indianapolis recycling complex

- Altilium produces EV battery cells using recycled materials

- Brightmark enters subsidiaries of Indiana recycling facility into Chapter 11

- Freepoint Eco-Systems receives $50M loan for plastics recycling facility