A ferrous scrap market that has been steady throughout most of 2017 experienced some boosts in pricing in the early August buying period, sparked not only by steady domestic mill buying but also by increased overseas interest.

The Midwest pricing indices formulated by American Metal Market (AMM) showed price increases in the $10-per-ton range in August, but the real volatility occurred in export transactions.

Purchases

The steel industry in the U.S. has played its role in the 2017 ferrous market with

The trend has been for output to rise through most of 2017. In the week ending Aug. 5, 2017, domestic steel production was 1.76 million tons, while mills operated at a capacity rate of 75.6 percent. That 75.6 percent capacity rate helped boost the year-to-date average.

Those weekly figures also compare favorably with

On the supply side, a recycler in the Midwest says overall his second quarter “was a little softer” compared with the first quarter. In the tried and true fashion, however, as scale prices were rising in August, he says, “Material seems to be coming out of the woodwork, as usual.”

Wider industry and economic trends could yet spoil the 2017 party, including

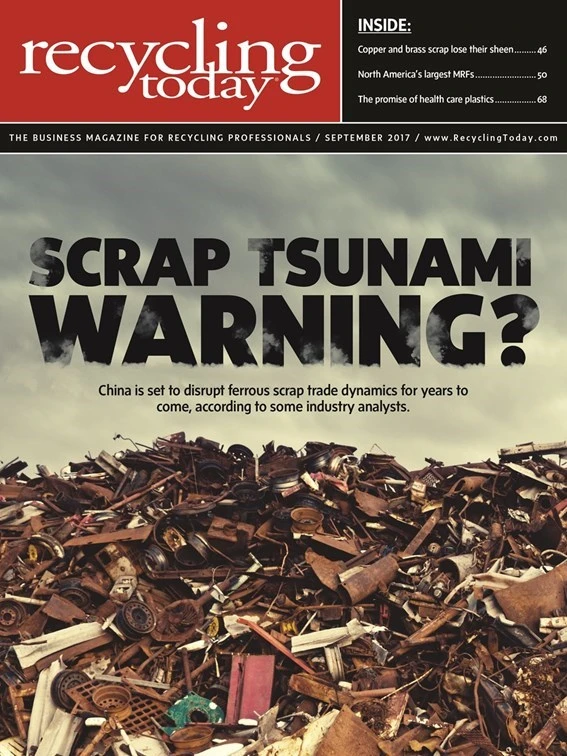

To what extent China will become a net exporter of ferrous scrap is not a subject of

India-based journalist V.K. Shrivastava says Chinese scrap was marketed to mill buyers in neighboring nations, such as South Korea and Taiwan, in the spring of 2017, in what could mark a shift from China as a net importer to a net exporter of ferrous scrap.

The near-term prospects for China’s steel industry remain critical to scrap pricing for supply and demand reasons. If China’s steel sector slows, it would not only consume less scrap but likely would speed up China’s status as a scrap exporter.

Various Chinese ministries have long made statements of concern pertaining to overcapacity in the steel industry, and reports from China indicate

Statistics from within China, however, do not point to cutbacks in overall steel output in that nation. Reuters reported in mid-August that China’s own statistics bureau recorded 74 million metric tons of steel output in July 2017, the second consecutive month the nation has posted a new monthly record.

Industry analysts reached by Reuters said the shutdown of the induction furnace mills might have had the unintended consequence of remaining steelmakers stepping into the breach to produce more rebar and other types of steel made by the idled mills.

In the Western Hemisphere, Mexico and Brazil, the two largest volume steelmakers in Latin America, each posted double-digit percentage steel output gains in the first half of 2017.

Figures collected and distributed by the Brussels-based World Steel Association (WorldSteel) show that while the U.S. managed just a 1.3 percent rise in output in the first half of 2017 compared with 2016, Mexico’s output climbed by 11.2 percent, and Brazil’s production by 12.4 percent.

Brazil produced more than 16.7 million metric tons of steel from January through June 2017, up

Sponsored Content

Redefining Wire Processing Standards

In nonferrous wire and cable processing, SWEED balances proven performance with ongoing innovation. From standard systems to tailored solutions, we focus on efficient recovery and practical design. By continually refining our equipment and introducing new technology, we quietly shape the industry—one advancement at a time.

Argentina, Latin America’s third-largest steelmaking nation, also boosted its output beyond the 1.3 percent rise of the U.S., though its 3.2 percent gain in output did not come close to matching Brazil or Mexico’s double-digit gains.

According to an analysis posted on the Hellenic Shipping News website, the growth in steel output in Brazil and Mexico occurred despite Latin America importing 13 percent more Chinese steel by volume in the first half of 2017 compared with the first six months of 2016.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Explore the September 2017 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Call2Recycle Canada launches program in Alberta

- The history of SAS Forks: Celebrating 50 years

- SAS Forks partners with NED at Green Recycling in Houston, Texas

- DRKhorse’s RCC series at Gorick Construction in Endicott, New York

- Balar Equipment to operate under Enviro-Clean Equipment name

- Li-Cycle reports 2024 financials

- Wisconsin Aluminum Foundry acquires Anderson Global

- PureCycle, Landbell Group working to advance PP recycling in Europe