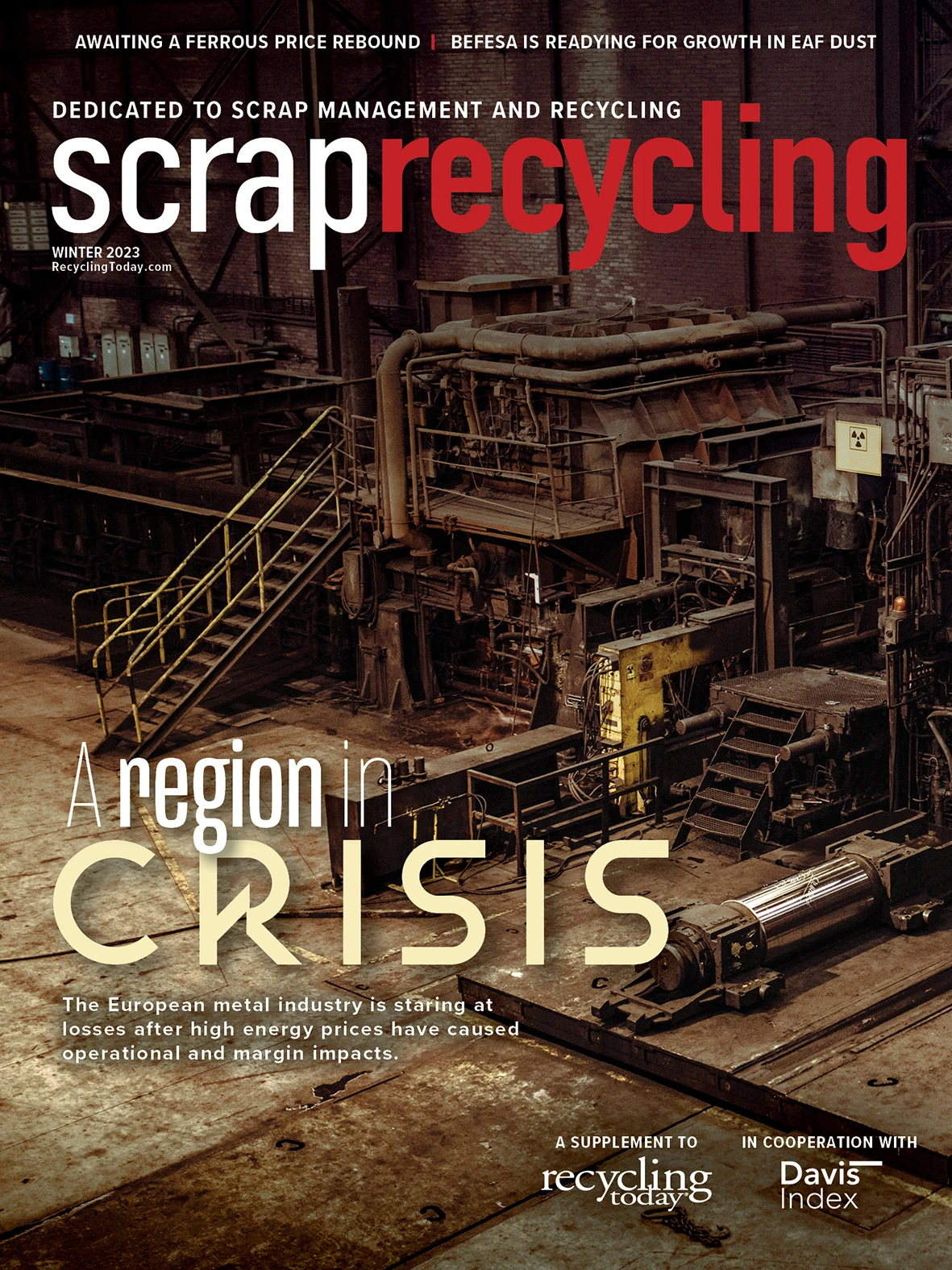

Photo courtesy of Recycling Today archives

Global vehicle recycling reached $67 billion in 2021 and, according to market research firm Imarc, could grow nearly 14.5 percent to roughly $139 billion by 2027, largely because of increasing demand for lightweight finished metals for use in electric vehicles (EVs).

E-mobility and sustainable production technologies are at the forefront with the European Union’s Green Deal, and carmakers and metals manufacturers worldwide have rolled out medium- to long-term climate goals in a bid to cut carbon emissions by 2050.

As industries gear up for net-zero carbon, the last several years have been a period of innovative collaborations and strategic business expansions.

French carmaker Renault, for example, has pledged to increase its closed-loop recycling capacity for its end-of-life vehicles to 1.2 million metric tons per year by 2030. The company also hinted at doubling its recycled steel use to 3 million metric tons annually.

BMW recently announced another round of sustainable steel supply agreements with manufacturers in North America and Asia. The company plans to cut its carbon footprint in its steel portfolio to 900,000 metric tons by 2026.

Notable partnerships include those with China’s HBIS Group, Europe’s Salzgitter AG and H2 Green Steel (H2GS), with first deliveries likely to begin in 2023. BMW also is looking to purchase almost 50 percent of its steel from steelmakers using electric arc furnaces (EAFs) and recycled steel.

Mercedes Benz received its pilot batch of fossil-free steel, totaling 20 metric tons, from Europe’s Kloeckner. That company’s trademark Nexigen product will enable the strengthening of Mercedes’ recyclable metals supply chain and reduce greenhouse gas emissions considerably by 2039. Moreover, the automobile manufacturer indicated in March 2022 that nearly 95 percent of the material it uses in its vehicles can be reused.

Ford Motor Co. has inked terms with Tata Steel Europe for its Zeremis green steel product to help achieve its carbon neutrality target by 2035.

This synergy of sorts has influenced car part makers as well. European manufacturer H2GS will partner with German auto components specialist Adient starting in 2026.

Pedal to the metals

As collaborative agreements are on the rise, it also is important to understand which metals are becoming popular in the automobile scrap recycling synergy.

Iron and steel comprise between 54 percent to 65 percent of a vehicle, according to Middletown, Ohio-based organization WorldAutoSteel, which says most of the two metals can be reused. The American Iron and Steel Institute (AISI), Washington, claims an almost 90 percent recyclability rate for steel extracted from end-of-life vehicles.

South Korean steelmaker Posco considers steel to be optimal for reducing, reusing and recycling. The company estimates roughly 4,000 metric tons of the metal can be retrieved after crushing 10,000 vehicles. Like other steel manufacturers, Posco aims to procure responsibly sourced raw material from end-of-life automobiles.

The nonferrous side

Aluminum also will emerge as a major extractive alternative in the coming decades owing to two factors: Its properties are ideal for EVs and an anticipated increase in end-of-life vehicles made from aluminum in the long term will translate to higher scrap volumes.

However, according to a University of Michigan report, aluminum is more difficult to recycle than steel. The university says its Clean Sheet Project aims to develop cost-effective methods to make lightweight metal sheets from recycled metals. The team has received a $2 million grant from various investors, including the U.S. Department of Energy’s Remade Institute, the Institute of Scrap Recycling Industries (ISRI), the Aluminum Association and Ford.

Copper and nickel are the top contenders for recycled battery materials for EVs. Major producers such as Aurubis are working on ramping up annual output of recycled copper and nickel to more than 350,000 metric tons by 2024 in a bid to meet growing demand for battery-grade material.

Headquartered in Greece, ElvalHalcor also is gradually emerging as a significant recycled nonferrous metals producer with a consolidated capacity of more than 800,000 metric tons. The company aims to leverage its position to meet growing demand worldwide for renewable metals.

The use of recycled zinc largely is dependent on the rate at which global zinc-coated galvanized steel grows. The International Zinc Association, based in Durham, North Carolina, says it expects the automobile industry to drive future needs for advanced high-strength steel (AHSS), which could lead to more tons of zinc-coated sheet and result in growing steel dust volumes—a major source for extracting zinc.

Processors to the rescue

Metals recyclers also are boosting their capacities worldwide as the long-term climate neutrality target draws nearer. Processors in North America have anticipated an almost 35 percent increased capacity requirement in the next five years. Most yards in the U.S. handle about 50 percent material from end-of-life vehicles. Moreover, annual demand for recycled raw material only has strengthened and will do so consistently.

Schnitzer Steel Industries Inc., headquartered in Portland, Oregon, achieved 20 percent more sales in its 2022 fiscal year at 1.81 million metric tons. The producer and recycler’s ferrous scrap export volume for the period was 2.81 million metric tons, a decline of 3.4 percent annually. Schnitzer says it plans to leverage the company’s competency to meet estimated volume growth in the segment owing to the U.S. government’s Buy Clean initiative.

Virginia-based Greenwave Technology says it expects scrap metal demand to soar 41 percent, or about 30 million metric tons, by 2025. The processor commissioned its second shredder in the third quarter of 2022 and has more than 12 facilities across Virginia and North Carolina as of the end of 2022.

Metals recycling remains a nascent industry in other parts of the world, though processors such as India’s Gravita have made significant progress in ramping up nonferrous volumes, especially for aluminum. The company’s newly commissioned 4,000-metric-ton recycling facility in Senegal will cater to growing orders of recycled material from automobile manufacturers in China, Vietnam and Japan.

The road ahead

The energy crisis in Europe, growing concerns of global inflation and COVID-19 have not aided the automotive industry. Ongoing supply shortfalls in semiconductor chips and other components only have exacerbated the situation. But findings from a recent Pulse Check survey by the European Association of Automotive Suppliers (CLEPA), Brussels, have revealed a more positive outlook: About 80 percent of suppliers will remain operational—21 percent have hinted at expansion—and almost 76 percent of the participants have forecasted opportunities in the parts shortage and expect to be profitable in the long term.

Industry perception is another challenge for global recycled metals specialists. The segment itself is considered “unclean” or a polluter, however, innovations in processing methods are beginning to change that. Associations including the European Recycling Industries’ Confederation (EuRIC), Brussels, have stressed the importance of recyclers and their role in closing the supply chain loop in manufacturing. Moreover, ISRI’s initiative to spread awareness of a common language for recyclables aims to reposition the segment from being associated with landfills to sustainable manufacturing.

Policy change also is needed to regularize this largely informal industry. EuRIC has called for easing ferrous scrap trade and raising Europe’s competitive advantage, while South Africa’s government plans to roll out scrap metal policies to curb theft and monitor registrations and trade.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Explore the Winter 2023 Scrap Recycling Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Athens Services terminates contract with San Marino, California

- Partners develop specialty response vehicles for LIB fires

- Sonoco cites OCC shortage for price hike in Europe

- British Steel mill’s future up in the air

- Tomra applies GAINnext AI technology to upgrade wrought aluminum scrap

- Redwood Materials partners with Isuzu Commercial Truck

- The push for more supply

- ReMA PSI Chapter adds 7 members