Evening in America? Not Necessarily

There may not be any topic more important than the one addressed by Rio Tinto economist David Humphreys in our International Trading Supplement’s opening feature, "The Paradigm Shift." Although U.S. presidential candidates don’t say so directly, many of the concerns felt by U.S. employers and workers alike center on the fear that global economic power is drifting away forever.

That is not to say, necessarily, that it is evening in America. American wealth, influence and power in the world is still dominant, and opportunities and living standards for average citizens can and should remain as elevated as anywhere else in the world for the foreseeable future.

But the sheer weight of numbers (the key number being 2.3 billion—the number of people in China and India combined) is tilting economic power toward the region where markets are most fertile.

The United States, along with Western Europe and Japan, have demonstrated an impressive ability to generate and circulate wealth beyond their proportionate populations.

The macro-economic movement toward globalization, however, is bringing other segments of the world’s population into higher economic strata. And smart money, most of it controlled by people in the United States, Western Europe and Japan, is being invested to stake a claim on the new frontiers of China and India.

News departments that just a decade ago may have covered events in China from their Tokyo bureaus may now wonder how they ever got along without a Shanghai bureau. Their investment is dwarfed by the plants, offices and equipment being put in place by manufacturing, technology and service firms.

Many observers do not see China’s and India’s gains as losses for the people of North America and other developed regions. Certainly, people and companies in nations such as Denmark and the Netherlands have retained wealth and influence without residing in the center of global economic power.

These nations have thrived despite the fact that commodity prices and business conditions were often determined across the ocean in the United States. Increasingly, Americans are wondering whether they are now in the role of following commodity prices and business conditions established across a different ocean.

Will the people of the United States, a nation that has considered itself as sitting at the helm of economic power for several generations, similarly adjust if they adopt a trading and banking support role for the 2.3 billion people of East and South Asia?

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

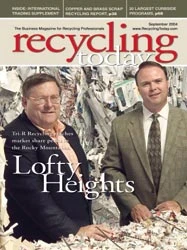

Explore the September 2004 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Hindalco to invest in copper, aluminum business in India

- Recycled steel price crosses $500 per ton threshold

- Smithers report looks at PCR plastic’s near-term prospects

- Plastics association quantifies US-EU trade dispute impacts

- Nucor expects slimmer profits in early 2025

- CP Group announces new senior vice president

- APR publishes Design Guide in French

- AmSty recorded first sales of PolyRenew Styrene in 2024