Plastic recycling has made considerable strides in the United States in the past 20 years, but the overall recycling rate for plastic remains below that of metal and paper.

Plastic recycling has made considerable strides in the United States in the past 20 years, but the overall recycling rate for plastic remains below that of metal and paper.

Polymers and plastics are much younger materials than metals or paper and thus can be expected to be behind in the evolution of technology, collection supply chains and processing capacity.

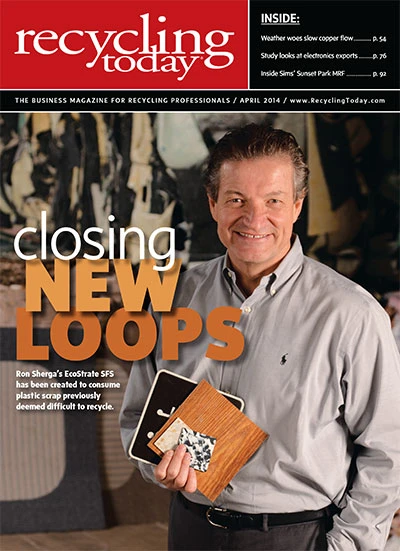

Among the people taking steps to speed up that evolutionary time frame is Ron Sherga, founder and board chairman of EcoStrate SFS LLC, Arlington, Texas.

Sherga enjoyed decades of plastics and recycling industry experience before taking the major step of founding EcoStrate in 2012. The company has set out to establish new manufacturing processes and facilities that will consume types of plastic scrap that commonly head to a landfill rather than being recycled.

Casting out demons

The progress that plastics recycling has enjoyed in the past two decades has allowed some types of plastic scrap—such as No. 1 PET (polyethylene terephthalate) bottles—to become commonly collected and traded and to rise in value.

Likewise, sustainability efforts by large corporations have helped increase recycling of computers and telecom equipment, exterior automotive components and some types of carpeting.

Despite a more active market and increased attention from large companies, a diverse and sizable stream of plastic goods and packaging is unlikely to be recycled, especially if it is to stay within the U.S.

Sherga sees this wide-ranging and complex stream as an opportunity. “My focus from day one has been to obtain polymer-based materials that have no option in the U.S. other than landfilling or being burned,” he says.

Not only are these materials obtainable, but recycling them can provide several benefits. “They have the biggest pain point and often are such an issue they make viable recycling processes uneconomical,” Sherga says. “They are the key excuses for the demonizing of plastics because they do not have any markets.”

Sherga says he did not start EcoStrate thinking he was the first to try to tackle this problem. “After many years of watching dozens of companies create complex systems to recycle products and mixed materials, I felt that there were very few systems that worked well or worked economically,” he comments.

“With that in mind, I decided to do the opposite of almost all existing processes and create EcoStrate,” says Sherga. “Initial testing proved so encouraging that I invested in equipment, materials and legal support for intellectual property. So far, my vision has proven to be correct, and we are creating materials for sale at small commercial levels for certification and validation of performance.”

Among the products EcoStrate is making using its as yet proprietary process are street signs, flooring and building panels. “We create substrates and provide a great base material for lamination and painting or finishing,” Sherga says. “We recognize broader applications exist; but, as a new firm, we’ve had to operate within a limited budget and focus on markets we can enter the fastest.”

According to Sherga, EcoStrate’s process accepts a broad range of plastic manufacturing scrap and end-of-life material. “We are able to use numerous materials and end-of-life products, quite often in the form they exist as they enter our system. Little or no preprocessing or traditional size reduction is needed, and we don’t add chemicals.”

He continues, “We are currently focused on textile, packaging and electronic scrap. A unique capability we have is our ability to take in materials in various forms: hard plastics, fiber, films and dusts. We are very broad in regard to this.”

Regarding the EcoStrate process, Sherga says, “Let me say that we repurpose some equipment and are using other equipment in ways not done before,” he comments. “We also have designed equipment of a proprietary nature as part of our next step.”

Ultimately, however, Sherga adds, “We want to share this, after we’ve recovered our investment.”

Bumps in the road

As EcoStrate has fine-tuned its manufacturing process and broadened its range of finished products, it also has encountered the hurdles that must be jumped by a company with a new business model.

Sherga says access to some end markets for EcoStrate products has not been instant. “The paths to many applications have had barriers created by the current players to restrict new materials and new players,” he remarks. Sherga notes, for example, that many state departments of transportation only have specifications for aluminum street and highway signs.

|

Geography quiz For the past year, EcoStrate SFS LLC, Arlington, Texas, has been modifying and expanding its proprietary manufacturing process from a location near Philadelphia. However, according to Ron Sherga, founder and board chairman of the company, the EcoStrate business model has been designed to spread all around the globe. The problem of plastic scrap being landfilled, dumped or incinerated “is bigger than EcoStrate,” says Sherga. “We want to share this—we don’t want to ‘black box’ something. If our process will solve pollution problems and let people recover waste in developing nations, we want to help.” The question facing EcoStrate may not be when to expand internationally but which particular nation presents the best first opportunity? The process EcoStrate offers may be ideal in developing nations, Sherga says, because it is not dependent on a multilink supply chain. “We are not creating pellets or bales, we’re creating a true end product,” he remarks. Thus, end products such as road signs or flooring can be made directly from the obsolete product scrap that is the current cause of disposal and recycling headaches in developing nations. Sherga says the EcoStrate process can accept a broad range of plastic scrap as feedstock, including the engineered plastics used in computer and consumer electronics products and textiles that often go unrecycled in developing nations. “Our solutions are based on supply and end markets that exist on every continent,” Sherga says. |

“If states embrace us, we can use their excess materials to make highway signs for them,” says Sherga. “In California we can use their carpet and other forms of scrap that have been banned from the landfill. But these same states are so accepting of aluminum that they don’t have a protocol for us to submit our substrate material.”

State governments with well-thought-out recycling policies can be part of the solution to increase the recycling rate for carpet, electronic scrap and plastic overall, Sherga says. “I think more mandates and, hopefully, the right incentives to meet them will be created for the recycling industry. I’d like to see more people involved that have business experience in helping to create strategies that can positively affect collection and then recycling into end products,” he adds.

Many of the other emerging companies seeking to collect mixed plastic scrap are makers of alternative fuels. Sherga says EcoStrate can make an argument that recycling these plastics into a new product makes more sense than converting them into fuel.

“Our product can be recycled, theirs can’t—it’s eventually being burned, maybe in a more efficient energy-creating way, but it’s still being burned,” he states. “We think that is a temporary bridge.”

In terms of energy savings, Sherga says the EcoStrate process has merits of its own. “We often make more energy-efficient products from a process that, based on U.S. Environmental Protection Agency energy reports, uses less than 80 percent of the energy and water to make virgin pellets. Combined with the fact we also use feedstocks that have high levels of embedded energy used during their creation in materials and assembly, we might exceed a savings of more than 100 percent compared to virgin polymers. We capture the essence of the value many materials were endowed with during their design and assembly.”

Thinking locally and globally

Cost-effective recycling is often a matter of scale, and Sherga says the company is still calculating the ideal scale or size of an EcoStrate manufacturing plant.

The current thinking is that large plants may not be necessary. “We can be profitable at smaller levels than many recycling or waste-to-energy entities,” he says. “Our manufacturing process is not overly capital intensive, and we can acquire the materials we need in almost any urban area.”

The company is currently working from one manufacturing plant near Philadelphia, but Sherga says he and his colleagues are exploring expansion opportunities in other parts of the country.

“It’s likely that we’ll move to a technology partner’s facility soon for scaling up and improvements,” he says.

Although the EcoStrate process is currently proprietary, keeping it that way is not the long-term plan. “We are happy to look for regional partners, and Texas and California are logical places to go next,” he comments. Both states have several large urban centers, while California also has legislation mandating the recycling of carpet and obsolete electronics.

The availability of feedstock and the viability of EcoStrate end products also has Sherga thinking globally. “We want strategic partners who are invested in developing nations and, through their capital and resources, we are very eager to work with them to help set up facilities.”

Such partners could be “large beverage companies or consumer products groups,” says Sherga. “When you think about it, all these places around the world need flooring, they need signage, they need promotional items—why not make it from the very materials you are promoting?” (See the sidebar, “Geography Quiz,” on the opposite page.)

During 2014, Sherga will be working with key colleagues and allies to create new sales channels for products made from the EcoStrate process and to tap into additional material streams for feedstock.

EcoStrate COO and polymers industry veteran Ron Simonetti has been developing markets and materials supply chains, Sherga says, while Jim Chapman, the company’s former technology leader with experience in the signage industry and in polymer coatings, helped design prototypes and indoor signage sales channels.

Other key allies, Sherga says, have included San Francisco-based plastics recycling firm DCO International Inc., which has helped EcoStrate procure materials; recycling industry contacts Rob Starr of St. Joseph Plastic, St. Joseph, Mo., and Thomas Holland, CEO of Texas Carpet Recycling, Grapevine, Texas; and attorney Scott Hemingway, who has helped EcoStrate take the proper intellectual property and trademark steps.

EcoStrate also has a family business aspect to it, Sherga says. “Karen Sherga, my wife, has been invaluable in tracking paper work and financial performance.”

He says the challenges remain considerable for EcoStrate, but the sheer number of opportunities outweighs those challenges.

“We don’t want to reinvent the wheel, we just want to make it rounder and make it roll better,” says Sherga. “Expansion is in our immediate scope, and we never want to accept success as a finish; we see it as a starting point.”

The author is editor of Recycling Today and can be contacted at btaylor@gie.net.

Explore the April 2014 Issue

Check out more from this issue and find your next story to read.

Latest from Recycling Today

- Magnomer joins Canada Plastics Pact

- Electra names new CFO

- WM of Pennsylvania awarded RNG vehicle funding

- Nucor receives West Virginia funding assist

- Ferrous market ends 2024 in familiar rut

- Aqua Metals secures $1.5M loan, reports operational strides

- AF&PA urges veto of NY bill

- Aluminum Association includes recycling among 2025 policy priorities